PNUT price has dropped more than 20% in the past 24 hours, after a recent sharp increase when listed on major exchanges, reaching 2.28 USD. This decline highlights weakening momentum, as indicators such as ADX and RSI show the uptrend is fading.

However, PNUT still has the ability to recover strongly if buyers return. However, if selling pressure continues, PNUT could face a significant correction, test key support levels and potentially lose further momentum.

PNUT’s Uptrend Is Fading

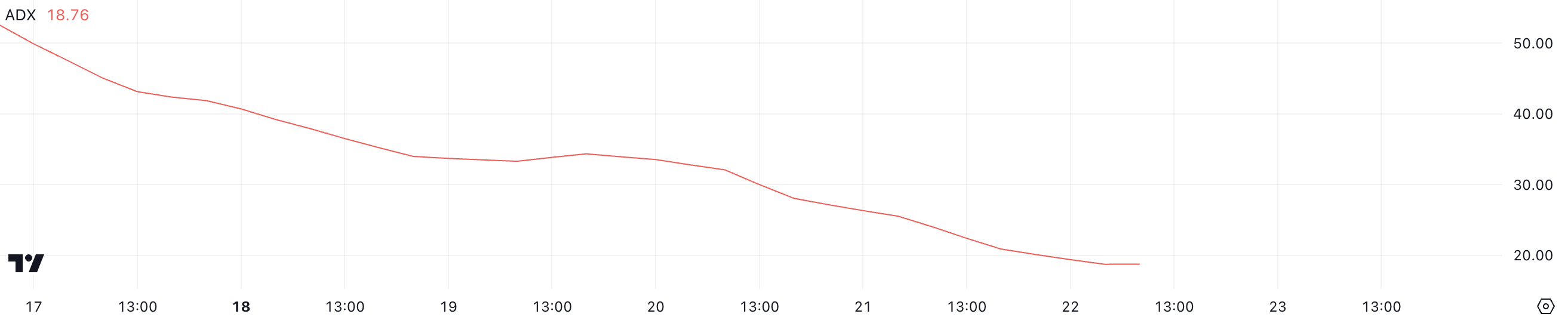

Currently, PNUT’s ADX is 18.76, down significantly from levels above 50 just a few days ago. The constant decline of ADX shows that the strength of PNUT’s uptrend is gradually weakening.

While still in an uptrend, the sharp decline in price over the past 24 hours highlights the increasing vulnerability of maintaining upward momentum. ADX shows a potential reversal.

ADX measures the strength of a trend, with values above 25 indicating a strong trend and below 20 indicating a weak or non-existent trend.

PNUT’s ADX falling below 20 reflects a weakening trend, although the current shift still leans to the upside. If this trend strength continues to weaken, PNUT may have difficulty maintaining the uptrend. That could make PNUT price vulnerable to a sharp reversal in a short period of time.

PNUT Almost Hits Oversold Point

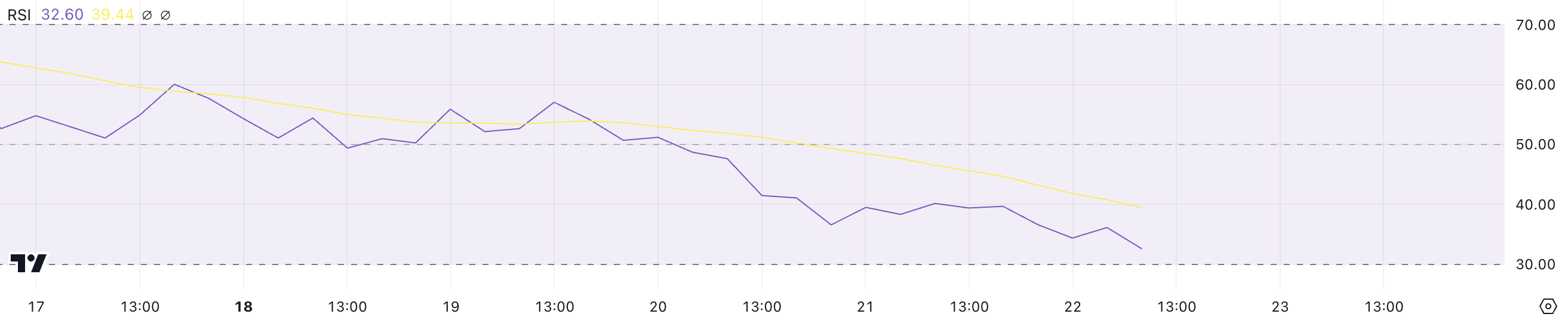

PNUT’s RSI is currently 32.6, marking its lowest level since being listed on Binance.

The Relative Strength Index (RSI) measures the speed and amplitude of price movements, with values above 70 indicating overbought conditions and below 30 signaling oversold points.

The persistent decline in PNUT’s RSI over the past few days has highlighted weakening momentum, with the asset now approaching oversold levels.

If RSI falls below 30, this could signal that PNUT is significantly undervalued in the short term. However, persistent pessimism could continue to put pressure on prices, delaying any recovery.

PNUT Price Forecast: 72% Correction Coming Soon?

If PNUT price experiences a reversal and a strong downtrend emerges, it could test support at $0.749. If this level fails to hold, the price could fall further to $0.41 and even $0.32, marking a potential correction of up to 72%. This will cause PNUT to be surpassed by other Meme Coins such as MOG, GOAT and MEW in terms of market capitalization.

This scenario would see increased bearish pressure, with traders likely to continue to abdicate following spikes in listings on major exchanges.

On the other hand, if PNUT’s uptrend regains strength, the price could rise to test the resistances at $1.87 and $2.21.

If these thresholds are overcome, PNUT could retest the old peak of $2.50. That would deliver a potential 111% gain and establish PNUT as one of the top 10 Meme Coins on the market.