Polkadot (DOT) value has been falling along a descending resistance trendline due to the fact February.

The decline in DOT value has triggered a breakdown from a extended-phrase horizontal assistance place at $four.thirty. Will rates rise once more or is there far more area for decline?

Web3 Foundation launches new initiative

Polkadot growth organization, Web3 Foundation, has just announced a new system to invest a complete of 22.08 million USD and five million DOT coins all through the time period of 2024. This complete investment quantity is almost 41 million USD. .

This system aims to strengthen Polkadot’s local community-primarily based fiscal process, primarily from the platform’s Foundation. This fiscal assistance is especially directed in the direction of tasks that could substantially effect the potential of Polkadot.

Polkadot fell under extended-phrase assistance

On the weekly timeframe chart, we can see that DOT has fallen under the countertrend line due to the fact February. Recently, this trendline triggered an outcry in July.

In August, DOT broke down from the horizontal assistance place at $four.forty. This place has existed due to the fact the starting of the 12 months.

After the breakdown, Polkadot confirmed this place as assistance in September, a prevalent response following this kind of breakdowns.

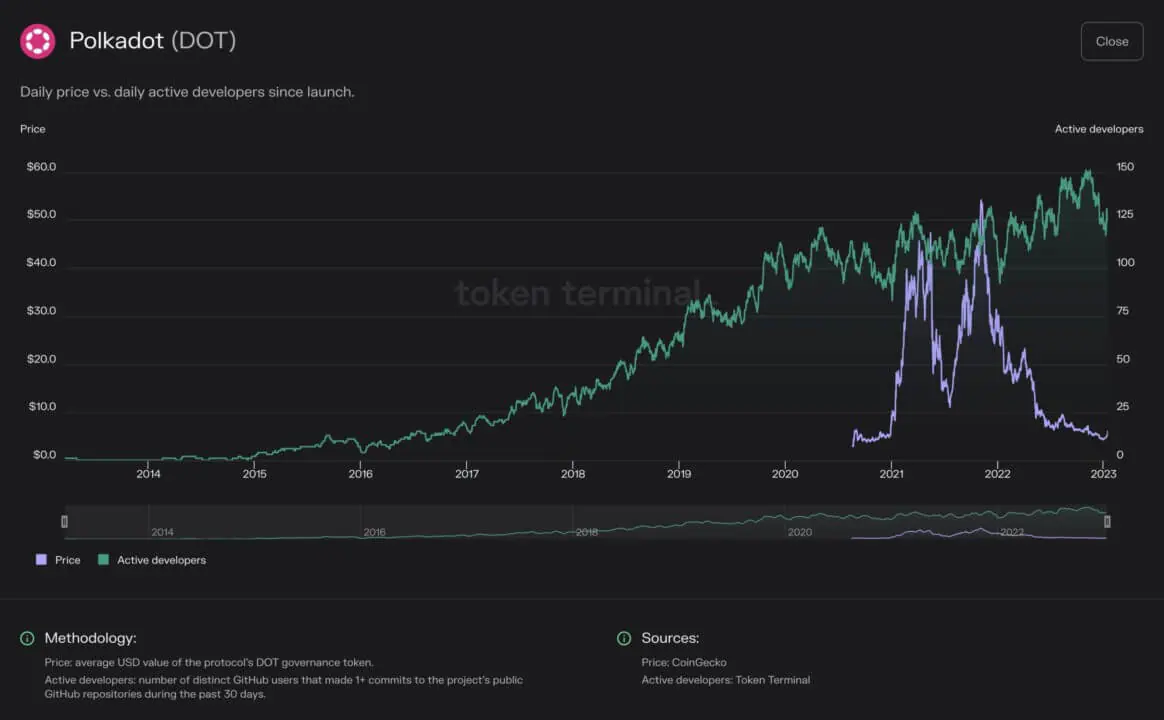

Even however the Polkadot value is falling, developers in the Polkadot ecosystem continue to be unaffected. This is clear when wanting at the quantity of each day energetic developers, which is virtually the highest ever and substantially far more than in 2021 when the value of the coin reached a record large.

One intriguing issue to note is that Polkadot has had a considerable quantity of growth action. This is primarily evident in the previous thirty days, when it ranked 2nd primarily based on the quantity of commits on GitHub.

DOT Price Prediction: Where Next?

Currently, Polkadot’s value is falling and no longer has horizontal assistance from prior value amounts. However, we can use the Fibonacci pattern to determine value zones that could be the bottom of a downtrend.

According to the Fibonacci retracement pattern, following a sharp maximize or reduce in value in a specific route, the value will normally return to a prior value degree prior to continuing in the identical route.

This model can also be applied to assess the bottom of potential value movements.

The weekly RSI also displays continued decline in Polkadot value. RSI is an indicator applied to assess no matter if the market place is overbought or oversold.

Readings over 50 and an uptrend indicate a buyer’s benefit, when numbers under 50 indicate the opposite. The RSI is at the moment under 50 and reducing, the two signaling a downtrend.

The value degree one.27 of the Fibonacci pattern is approached at $three.twenty, 15% under the latest value, when the value degree one.61 is found 50% under the latest value at $one.90. This value is close to the all-time reduced (red line) of $two.

Although DOT value predictions are not good, if the value closes the week over $four.thirty it would indicate the trend is even now good.

In that situation, the cryptocurrency could rally yet another 50% and attain the $five.60 resistance degree.

General Bitcoin News