Cryptocurrency exchange Poloniex has began trading two tokens ETHS and ETHW predicting the situation that Ethereum will be chained following The Merge occasion.

Poloniex commences trading two Ethereum tough fork tokens

On the evening of August seven, Poloniex stated it had opened negotiations for two tokens ETHS and ETHW, predicting the end result of the Ethereum The Merge update occasion in September.

🎉 More fascinating information for our end users!

The new trading pairs are right here: #ETS/ USDT, #ETHW/ USDT, ETS /#USDD ETHW / USD!

Additionally, end users will love trading costs for all ETHS / ETHW trading pairs.

Trade and trade: https://t.co/WwU4ZpXsVC

Details: https://t.co/m9h0OMtNJT#Ethereum #ETH

– Exchange Poloniex (@Poloniex) August 7, 2022

As reported by Coinlive, Poloniex for the initially platform enables traders to “choose which side to stand” on the assumption that Ethereum will have a split chain following The Merge, forming a chain that continues to hold Proof-of-Work alongside the chain will transform to the use of Proof-of-Stake.

Consequently, ETHS will signify the tokens of the Proof-of-Stake chain, though ETHW will signify the Proof-of-Work chain. The complete worth of each will be one, which represents the appropriate to redeem one ETH at this time.

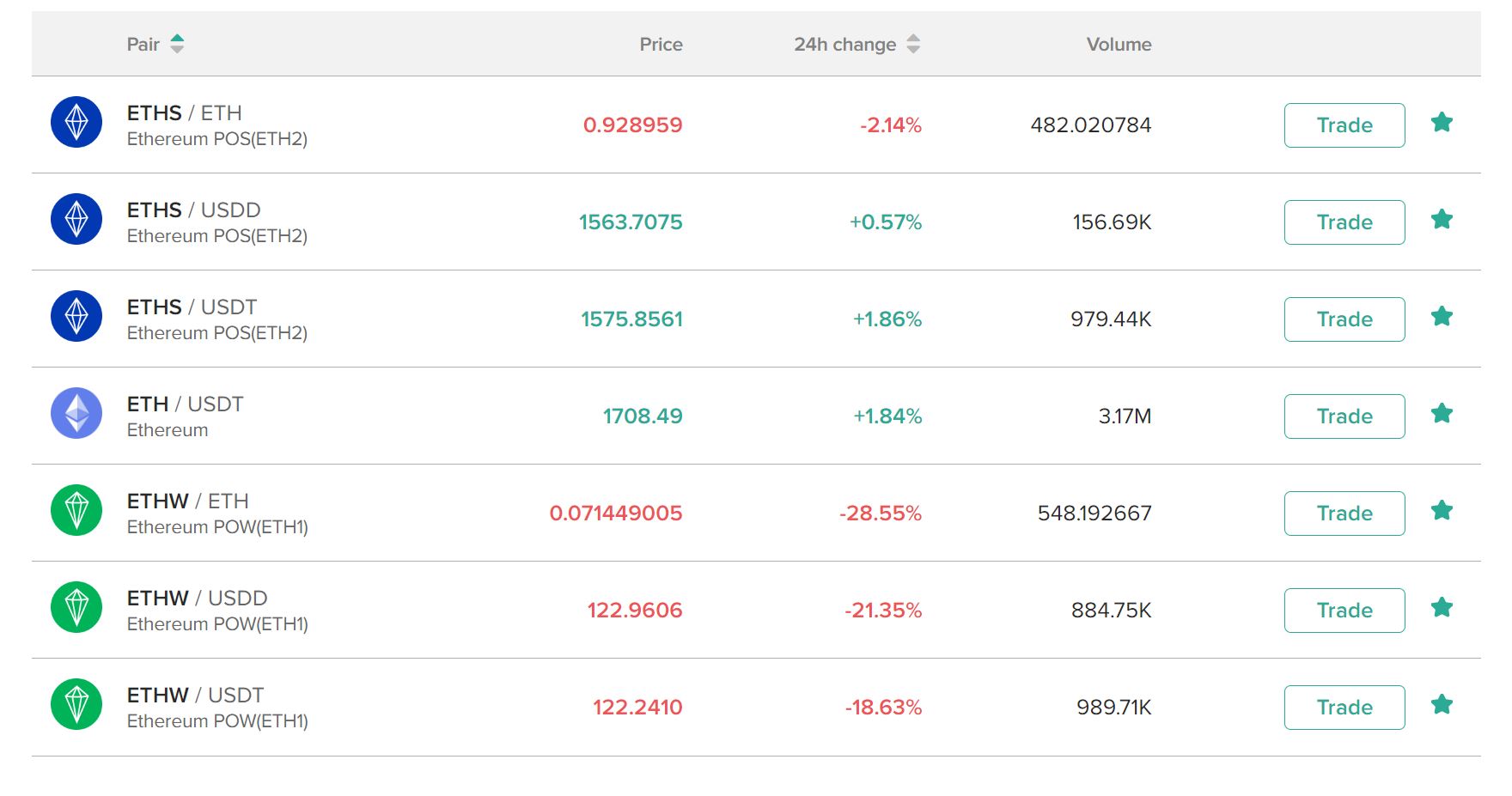

At launch, Poloniex will checklist the following trading pairs for each currencies: ETHS / ETH, ETHS / USDT, ETHS / USDD and ETHW / ETH, ETHW / USDT, ETHW / USDD. The exchange will no cost up trading for all of the over pairs.

At the time of creating, the ETH / ETH charge is .93, surpassing the .07 of ETHW / ETH. This demonstrates that most traders think that the probability of the visual appeal of the Proof-of-Work chain is not higher. This is also reflected in the USD worth of the two currencies, when the price tag of ETH reaches 93% of the price tag of ETH.

Prior to The Merge occasion, Poloniex will obtain the stability of all accounts containing ETHS. After Ethereum has carried out this update, if a chain split takes place, the exchange will convert ETHS to ETH working with PoS at a one: one ratio for all end users.

Meanwhile, the Ethereum chain working with Proof-of-Work with the highest hashrate will be selected by Poloniex as the “mainstream” blockchain to convert to ETHW. It can be witnessed that Poloniex has also ready for the situation in which a lot more than 1 Ethereum chain working with PoW seems.

Conversely, if the merge goes smoothly and no unit divides the Ethereum chain to keep Proof-of-Work, ETH will carry on to trade ordinarily on the exchange, two coins ETH and ETHW will be eradicated.

MEXC and Huobi think about the very same move

The MEXC exchange produced the very same announcement as Poloniex, also working with the very same ETHS and ETHW tokens.

MEXC will help the #Ethereum improve and its probable tough fork.

All MEXC $ ETH holders will get the asset forks with a one: one ratio at the finish of the update.

Details: https://t.co/nY06CPNB2O pic.twitter.com/HeFyIPuO3v

– MEXC Global (@MEXC_Global) August 5, 2022

Meanwhile, the Huobi exchange has announced that it is closely monitoring the likelihood of many Ethereum chains following The Merge occasion.

Although the statement does not help the bluffing actions of chaining mainly because it prospects to the formation of needless blockchains and confuses end users, Huobi will continue to be neutral and will checklist the coins of the chains that meet the floor needs.

🔥#Huobi has witnessed current discussions about the probable #Ethereum tough forks.

We keep an goal and neutral frame of mind in the direction of the principle of delivering protection to your assets and will make a initially move to help the tough fork following getting a standard image of users’ opinions. pic.twitter.com/yirsYxMASE

– Huobi (@HuobiGlobal) August 5, 2022

Huobi’s needs contain:

– The group behind the Ethereum fork have to notify the exchange in advance and verify the tough fork.

– The new Ethereum chain have to make certain measures towards replication attacks, stopping transactions on 1 chain from occurring with the other chain.

– The new chain will exist independently and in parallel with the other chain.

– Coins of the new chain have to have clear identification to prevent confusion.

Before the tough fork, the buyer of the new chain have to pass a public check and have to publish the evaluation report.

While it can be witnessed that Huobi will not pre-checklist prediction tokens this kind of as Poloniex, the announcement of the availability of new coins that may well seem following The Merge occasion demonstrates the inspiration to maintain up with rivals in the trading area section. .

Controversy more than the division of the chain following The Merge

Since The Merge confirmed it was staying launched on Ethereum in mid-September, there have been lots of conspiracy theories about the potential of the world’s 2nd biggest cryptocurrency blockchain.

The debate started with a series of posts from Galois Capital, a figure that emerged in the cryptocurrency neighborhood following the LUNA-UST crash. This individual raised a variety of inquiries about whether or not Ethereum chains are even now working with Proof-of-Work, which side will stablecoin tasks consider, place of exchanges, DeFi / GameFi / NFT tasks How will it flip out …

The query raised by Galois Capital is incredibly excellent, mainly because in the previous there has never ever been a undertaking to move the consensus algorithm like the following, not to mention that it is Ethereum: the blockchain is at the center of a whole lot of progress and pioneering inventions. cryptocurrency sector.

However, the viewpoint of most of the Ethereum neighborhood is that The Merge will go smoothly without the need of top to a split in the chain, mainly because this has been a extended-planned update and has acquired help from each sides. .

Currently, only 1 side has confirmed that it will launch the Ethereum chain that it maintains Proof-of-Work, known as ETHPoW. This unit is supported by Chandler Guo, a “whale” in the Chinese cryptocurrency mining neighborhood.

Additionally, the “infamous” cryptocurrency billionaire Justin Sun also announced his help for the Ethereum PoW chain. Justin Sun is at present the proprietor of the Poloniex exchange. This individual claims to contribute one million ETHW to the Ethereum Proof-of-Work neighborhood for potential advancement.

Like a whale with more than a million eths, I will make a whole lot of funds by switching to POS (POS is clearly friendlier to ETH holders) but I consider to some extent that the Ether neighborhood may well underestimate how significantly POW has contributed to Ethereum as the basic consensus mechanism.

– SE Justin Sun🌞🇬🇩 (@justinsuntron) August 6, 2022

“As the founder of a PoS blockchain, I think PoW has its merits. We may well also have underestimated Ethereum as the only clever contract platform working with PoW.

Being a whale holding a lot more than one million ETH, I will make a whole lot of funds by switching to PoS (PoS will reward a lot more ETH holders), but I consider the Ethereum neighborhood has underestimated PoW’s contribution as a important consensus protocol.

There is a chance when Ethereum switches from PoW to PoS and I consider there is almost nothing incorrect with continuing to keep an Ethereum PoW chain for the neighborhood,

Synthetic currency 68

Maybe you are interested: