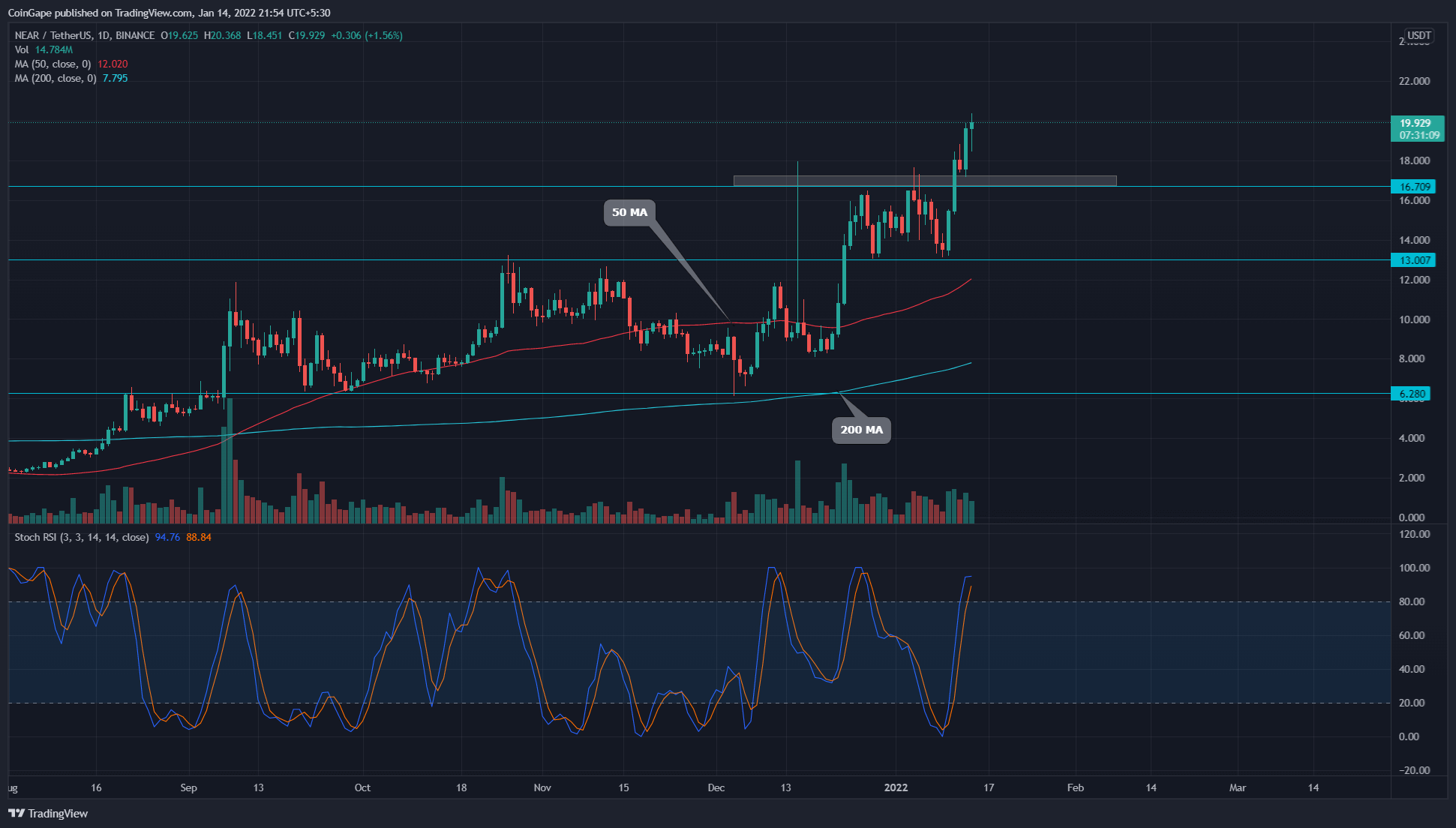

Technical chart displaying the general trend for Proximity protocol (Close to) the selling price is growing sharply. Close to selling price not too long ago broke by its earlier All-Time High resistance close to the $17 mark. The coin exhibits fantastic sustainability over the new help ($17), welcoming new ranges inside its attain.

Main technical factors:

- The selling price is Just about obtaining solid help from the twenty EMA.

- Trend-based mostly Fibonacci extension exhibits $22 and $24.five as important resistance

- The Close to coin’s intraday trading volume is $one.71 Billion, displaying a twenty% enhance.

The supply- Tradingview

The supply- Tradingview

In our earlier coverage of Proximity protocol technical evaluation, the coin selling price is retesting the $13 help. Although the selling price is beginning to move greater, provide stress is solid at $17 demand for an additional small pullback.

After the 2nd rally from the $13 degree, the technical chart exhibits a double bottom in the day-to-day timeframe chart. On January eleven, Close to selling price manufactured a decisive breakout from the $17 neckline, which was also the earlier all-time higher resistance.

The coin trades Just about over the significant MA lines (twenty, 50, one hundred and 200), indicating a solid bullish bias. These moving averages can give fantastic help through occasional pullbacks.

Furthermore, the Daily-Stochastic RSI supports a regular development in selling price action with its lines approaching the one hundred mark.

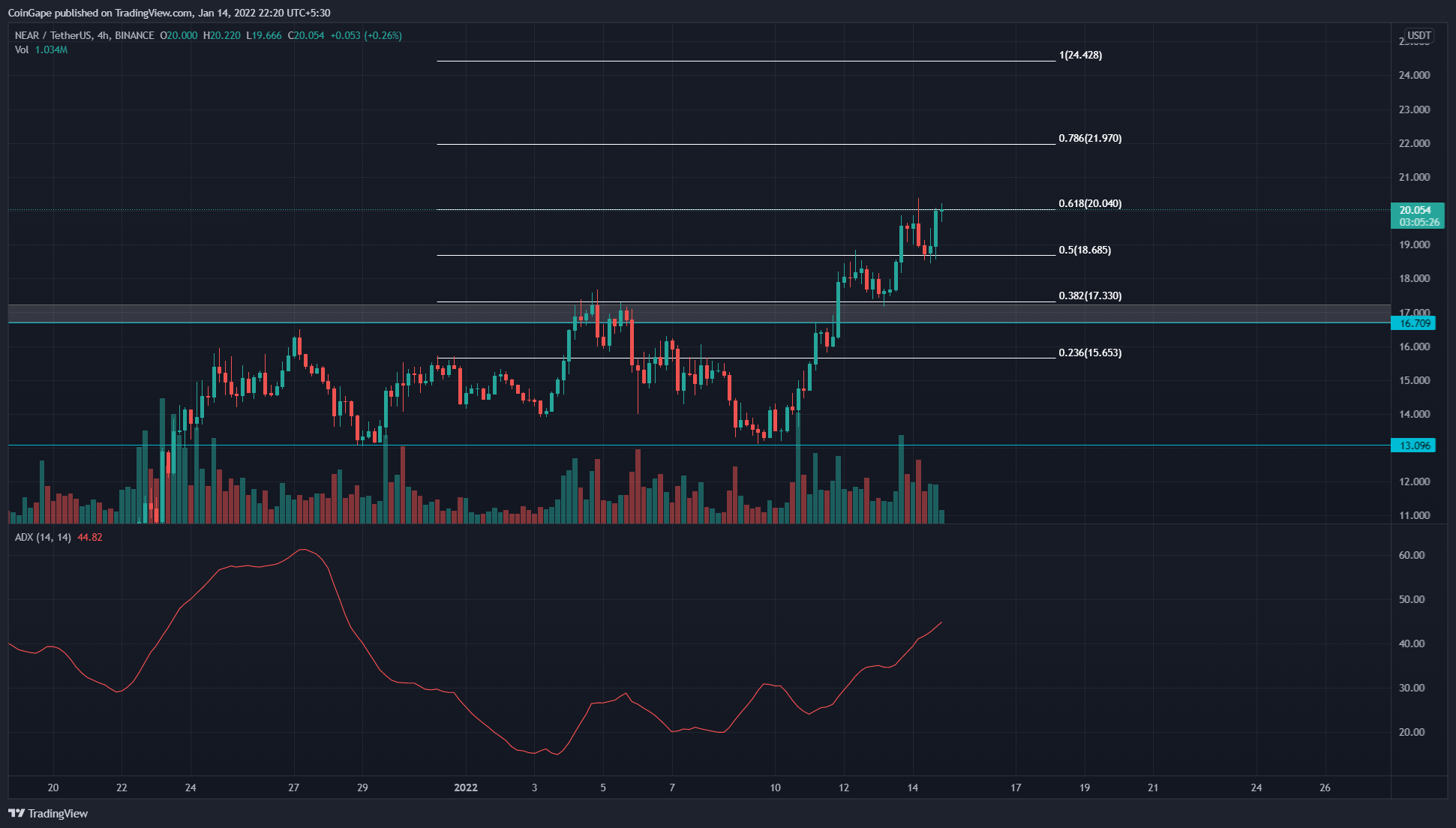

Fibonacci Extensions Hints Possible Resistance to Price Rally Close to

The supply-Tradingview

The supply-Tradingview

The four-hour timeframe chart exhibits a fresh greater and decrease bounce over the $17 mark. While charges are new to these chart ranges, they are closely following the trend-based mostly Fibonacci extension.

Following these ranges, the upcoming provide zone for the Close to coin selling price is $twenty, followed by $22 and $24.five. The bullish slope in the typical directional motion indicator (34) signifies that bullish momentum is expanding.