Bitcoin’s lucrative provide dropped to just fifty five% in a single month of industry volatility, signaling a significantly less than brilliant outlook for BTC charges in the close to phrase.

According to the most recent information launched by blockchain analytics company CryptoQuant, in past cycles, the provide of Bitcoin was lucrative even under its existing worth.

About fifty five% of the $ BTC the offer you is nevertheless lucrative

“2-three months of dull rate action. So the final achievable capitulation with an extra rate drop of thirty% – 50% “.

from @KriptoMevsimiRead more👇https://t.co/BTolS8aBET pic.twitter.com/GQcPojIzXC

– CryptoQuant.com (@cryptoquant_com) May 27, 2022

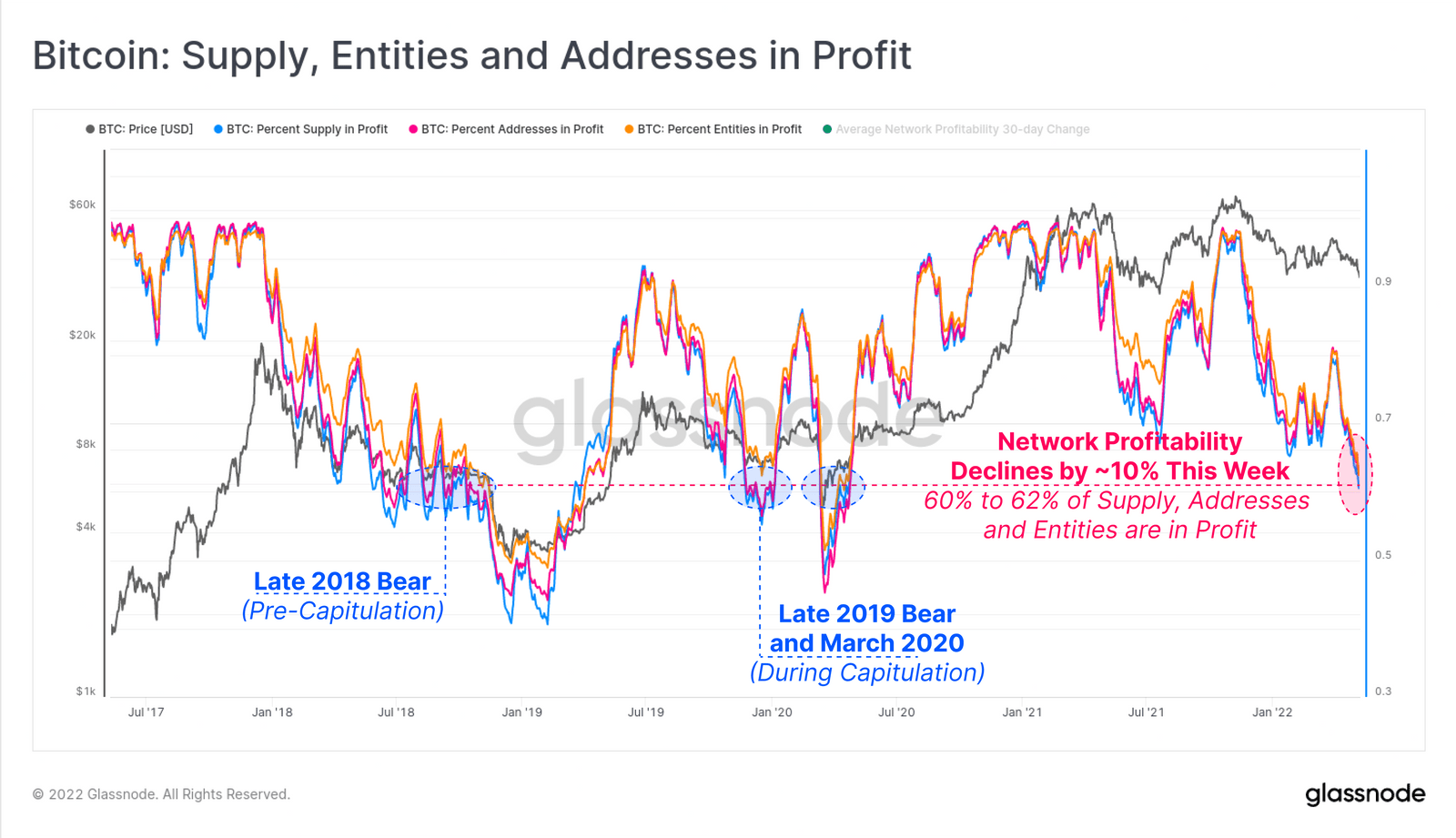

Profit Supply is an indicator that measures the percentage of the complete provide of Bitcoin that is at the moment lucrative relative to the industry rate of BTC. This indicator performs by seeking at every single coin’s on-chain background and checking if the rate it final moved is reduced than the rate it is at the moment trading.

As we can see in the graph over, the percentage yield of Bitcoin’s provide has declined in excess of the previous couple of months. Currently, the index worth is all over fifty five%, down five% in just one month from Glassnode’s information and just after the market’s peak hibernation cycle in 2017. 2018.

After hitting the aforementioned lucrative thresholds (over 50%), the revenue provide remained steady for a when as the worth of BTC observed a consolidation. However, in direction of the finish of the sideways trend, Bitcoin’s rate noticed a different steep drop, taking the lucrative percentage of Bitcoin’s provide to its lowest degree (41.9%).

Only just after this signal will the ultimate reduced formation consider spot. In 2019, a related pattern repeats itself in the cycle just explained. This signifies that the at the moment lucrative fifty five% bid figure is nevertheless not adequate to meet the disorders for the Bitcoin minimal, foremost to a even further drop in the rate of BTC in the close to phrase.

Hence, CryptoQuant has come up with a related trend which is pretty probably to repeat itself this time all over. As a end result, the rate of BTC could see a couple of months of dull sideways motion set off a capitalization shock with a thirty% to 50% decline, ahead of setting a new minimal for the up coming bullish cycle.

Due to basic downward strain, with virtually $ one trillion in industry capitalization evaporating considering the fact that the get started of the 12 months, the variety of Bitcoin (BTC) addresses holding in excess of $ one million or a lot more has also plummeted. As of May 28, 2022, the variety of addresses with a BTC stability better than $ one million is only about 77,936, in accordance to statistics from BitInfoCharts.com.

Notably, the variety of Bitcoin millionaires has significantly declined if we count even further from October 2021, when Bitcoin was all over $ 60,000. Indeed, on October 28, 2021, when 116,139 addresses will be verified as Bitcoin millionaires, this would demonstrate a drop of 32.89% in the 7 months to date. The mixture of elements this kind of as improved regulatory scrutiny, industry turmoil, political uncertainty and Fed charge hikes are the principal drivers that carry on to negatively influence BtC’s efficiency.

Synthetic currency 68

Maybe you are interested: