If you have been in the market place prolonged ample, you happen to be almost certainly no stranger to names like Alameda Research, FTX, and Sam Bankman-Fried (SBF), generally referred to as the “wild” hedgehog Sam. These 3 names are linked by an incredibly near partnership, but it is also quick for other folks to inquire themselves queries:

After all, how are Alameda Research and FTX linked with each other beneath the hands of SBF? Or additional exactly, how do these three entities “shake hands” to dominate the market place?

Let’s reveal the secret by the evaluation of Bloomberg Please!

This cryptocurrency trading company aided make Sam Bankman-Fried a billionaire. Now, his rising influence is producing it more difficult for him to keep out of the spotlight https://t.co/FIb6QwANBH

– Bloomberg (@company) September 14, 2022

Sharing a popular origin

The journey into the cryptocurrency market place has been advised by Sam several instances, you can read through it in the write-up: Who is Sam Bankman-Fried? Sam Curly’s influence on the cryptocurrency market place.

Originally a “financial man” on Wall Street, Sam immediately acknowledged the chance to trade Bitcoin arbitrage involving the US and Japanese markets. So Alameda Research was founded in November 2017 exactly to “buy BTC at a low price in the US market and sell it at a higher price in the Japanese market”. At its peak, Alameda Research was earning $ one million a day.

Business was fine, but Sam nevertheless had difficulty operating with time exchanges. So the FTX exchange was born in April 2019 in Hong Kong. In its to start with yr, Alameda played an vital function in FTX: as the principal liquidity supplier, accounting for half of the volumes on the exchange. Over time, Alameda’s market place-producing company for FTX has also declined, as SBF says.

Fast forward to the existing day, FTX is the 2nd greatest exchange in the planet and Alameda Research is a main cryptocurrency investment fund, engaging in all varieties of companies, from venture capital to market place producing, yield farming to dwell transactions.

Sam stepped down as CEO of Alameda Research in October 2021 to develop into FTX “full time”, and at the moment holding this place is Caroline Ellison, a crucial worker and longtime colleague of SBF.

Since then, Sam has constantly maintained that Alameda and FTX are two independent organizations with separate companies and rigid barriers to sharing data and sources involving them. Additionally, FTX has its very own investment fund, FTX Ventures.

In an interview, SBF stated:

“Alameda is a wholly separate organization from FTX. Alameda destinations orders and accesses purchaser data on FTX just like other customers do. There is no particular preference for them. “

But what about actuality?

Cash movement

FTX earns from consumer transaction charges and loan curiosity. Alameda’s income comes from investment earnings and trading routines (getting / marketing of tokens).

As with common money markets, these two companies are generally not linked to just about every other to make sure honest competitors and balanced pricing for prospects. But with the cryptocurrency market place, this kind of a new area and devoid of clear regulation, the fine lines are effortlessly blurred.

One can visualize FTX as the NYSE and Alameda as the big market place producing company Citadel Securities. So what comes about when NYSE and Citadel stock owners?

Larry Tabb, Bloomberg Intelligence’s head of market place framework exploration, expressed concern:

“Having exchanges and market makers closely linked and linked to financial interests does not favor being a fair market”.

It is challenging to assess Alameda’s market place producing action on FTX simply because the transactions that consider area on CEX exchanges are not all blockchain transactions. However, it is attainable to observe the routines on the chain to get a primary see of this partnership.

According to scientific studies by Bloomberg, from June one to July 22, Alameda’s recognized wallets had been the greatest depositors of stablecoins on FTX and the supply of liquidity for all recognized FTX wallet addresses. Additionally, Alameda accounts for more than ten% of all Tether-linked (USDT) transactions and thirty% of all USDC transfers.

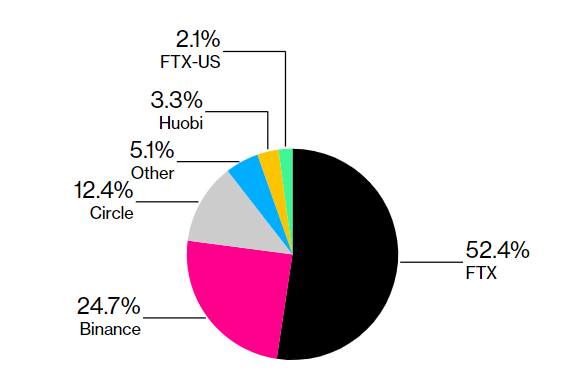

According to information from the exploration organization Arkham, about 50% of Alameda’s deposit and withdrawal volume considering the fact that the starting of 2018 was produced by the FTX exchange. Overall, FTX is one particular of the main exchanges in Alameda.

Similarly, 22% of the on-chain deposits and withdrawals of FTX wallets are interactive with Alameda-owned wallets. By comparison, only four% of the on-chain action of the Binance exchange wallet interacts with the Alameda wallet.

As explained, on-chain metrics alone are not ample to verify Alameda as FTX’s greatest market place maker. But they present that there is a big quantity of digital assets consistently circulating involving FTX and Alameda.

However, CEO Alameda Ellison explained:

“We have rigid data sharing guidelines to make sure that no one particular in Alameda receives purchaser data from FTX or something like that, or any other kind of particular remedy from FTX.

FTX’s best priority is to be a honest and neutral market place in which all customers have equal options. “

finish

In common money markets, when a stock exchange registers for a license to operate with the SEC, it should deliver money data, ownership, customers and protocols and be topic to regulatory oversight.

But with cryptocurrencies, there are no this kind of guidelines. Legal loopholes will facilitate hidden interests and lead to a lack of market place transparency. In the finish, the one particular who suffers the most is nevertheless the customer.

Therefore, the “close” partnership involving Alameda Research and FTX is constantly questioned by the local community, even if definitely the over speculations are only marginal. Bloomberg and there is genuinely no precise proof for these speculations.

Synthetic currency 68

Maybe you are interested: