RAY, the native token of liquidity provider and automated market maker Raydium on Solana, has emerged as the market’s top gainer over the past 24 hours, despite a broader market decline. school during this period.

With trading activity surging, RAY is trading at its highest price since 2021 and is likely to continue growing.

Rising demand for Raydium boosts RAY prices

One-day RAY/USD chart review shows an increase in demand for altcoins. This is evidenced by the setup of the Ichimoku Cloud, with its Spans A and B forming dynamic support below the Token’s price, at $6.04 and $5.87 respectively.

Ichimoku Cloud tracks the dynamics of market trends and identifies potential support/resistance levels. When an asset trades above this cloud, it is in a state of growth. In this situation, the cloud acts as a dynamic support zone, reinforcing the possibility of continued growth as long as the price remains above it.

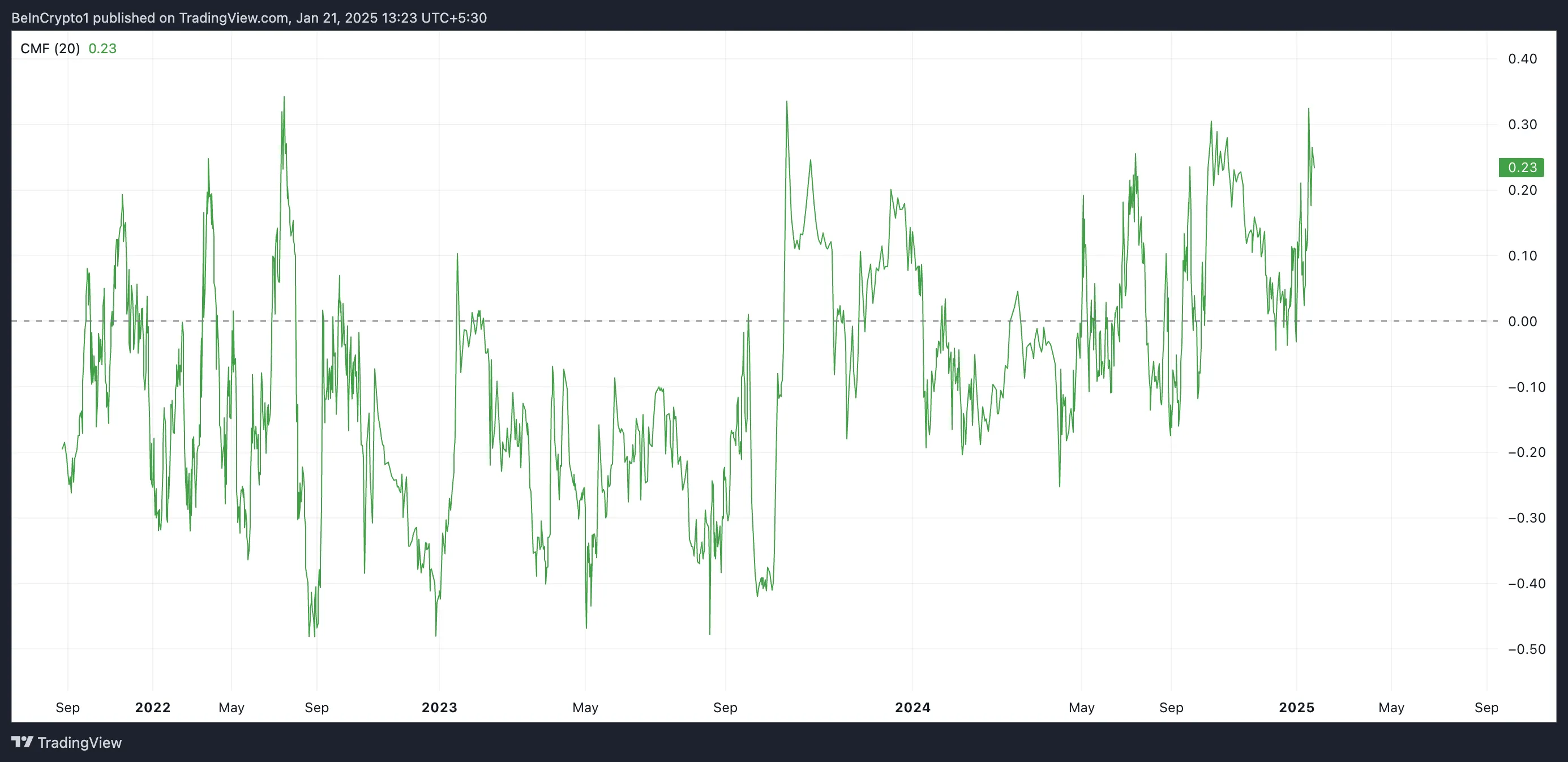

Furthermore, RAY’s Chaikin Money Flow (CMF) is showing a positive bullish outlook. At the moment, it is above the zero line at 0.23.

This momentum indicator tracks the flow of money into and out of the asset. When the value of CMF is positive as with RAY, buying pressure prevails in the spot market. This suggests accumulation among market participants and implies a continued upward trend in the asset’s price.

RAY Price Prediction: Will a new high be reached?

According to RAY’s Fibonacci Retracement indicator, if the current uptrend continues, it could attempt to break above the resistance at $8.96. If successful, the price could reach $11.05 and reach a record high of $17.80.

However, if there is a spike in selling, this bullish assumption will be invalidated. In that situation, the price of RAY Token could lose recent gains and fall below the Ichimoku Cloud support zone to trade at $4.30.