Many in the local community see TRX-USDD as the “second version” of LUNA-UST. However, is this specified? Let’s analyze some aspects that display the clear variation among these two stablecoins with Coinlive!

Note: This short article may possibly signify the author’s personalized views and opinions. It should not be viewed as investment tips.

Update USDD and TRX

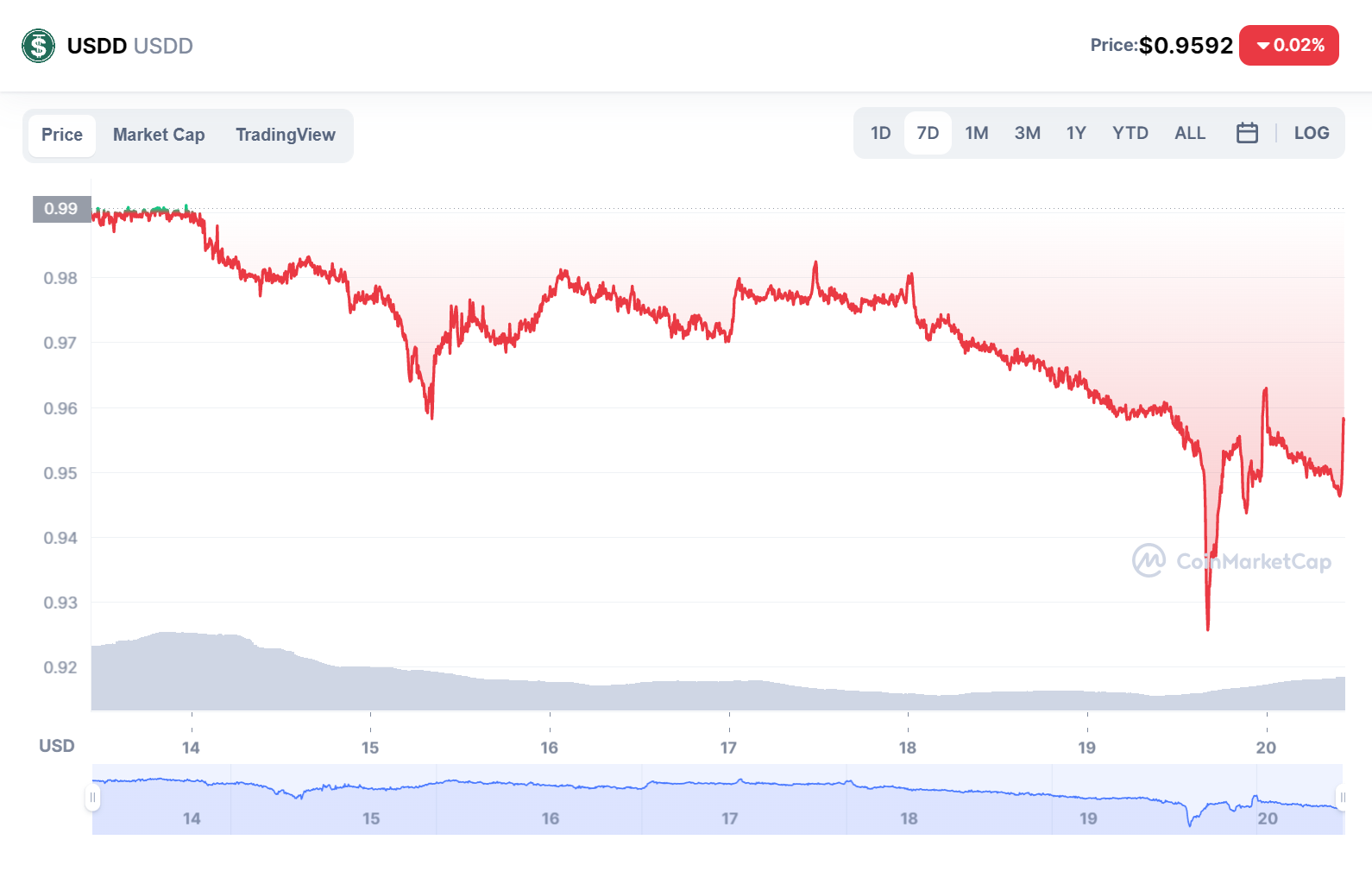

In the most latest short article reported by Coinlive, TRON withdrew seven.one billion TRX from the exchange, the USDD selling price has not but returned to one USD. Since that date, TRON DAO Reserve (TDR) has continued to include collateral to the USDD.

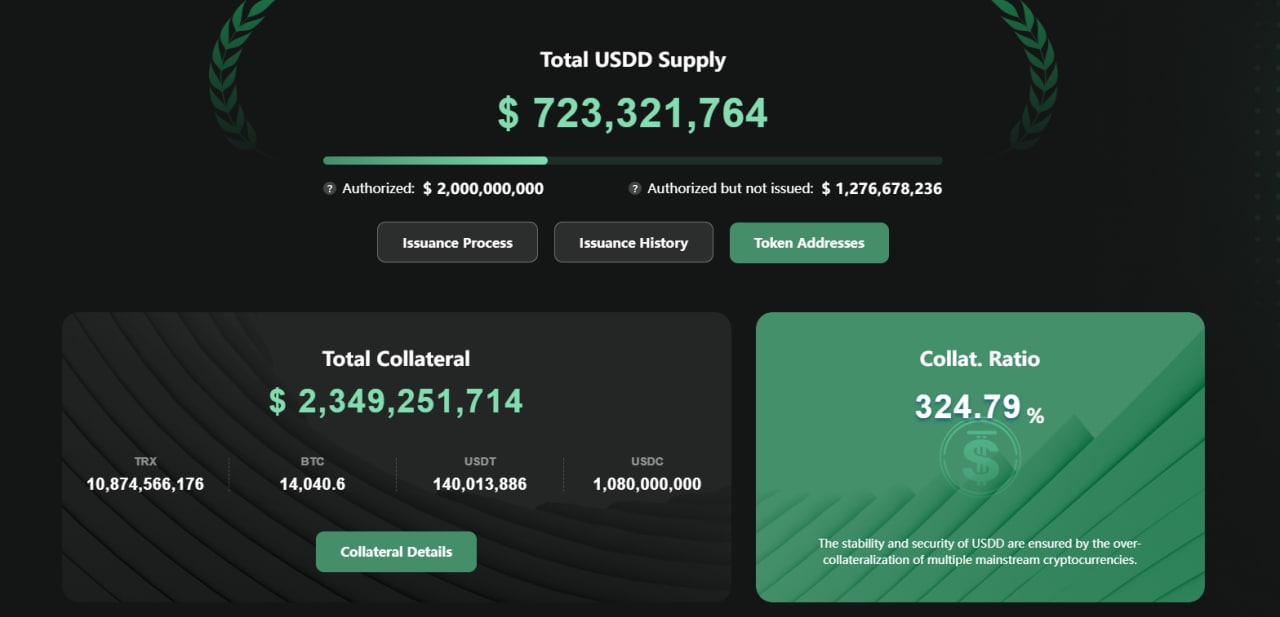

As of June twenty, 2022, there had been 14,000 BTC, 140 million USDT and in excess of one billion USDC, totaling roughly one.five billion USD, double the provide of 723 million USDD in circulation.

Therefore, USDD has ensures twice as large circulating assets.

With that quantity of exercise, it is adequate for USDD to be priced at USD two as a substitute of becoming depeg as it is now.

However, the USDD selling price nonetheless deviates from the USD one mark and was unable to recover.

And the selling price of the TRX, though declining based mostly on the general industry decline, nonetheless maintained a secure selling price array, hovering all around $ .06 – $ .065.

Is USDD actually the exact same as UST?

Since the collapse of LUNA, the local community has began wanting for equivalent algorithmic stablecoin styles to be created “shortened for life”. However, TRX’s “The Big Short” will be unlikely, at least for the time becoming.

Here are some vital distinctions among USDD and UST:

Why USDD depeg does not matter and why there will not be a death spiral for USDD / TRX pic.twitter.com/8Ljjk4tim7

– ylv (@ylv_io) June 19, 2022

USDD does not have a mint burn up mechanism like LUNA-UST

Because to stay away from following in the exact same footsteps as LUNA-UST, USDD was born with several enhancements. One of the most significant distinctions is that not anyone can mint USDD like with LUNA-UST.

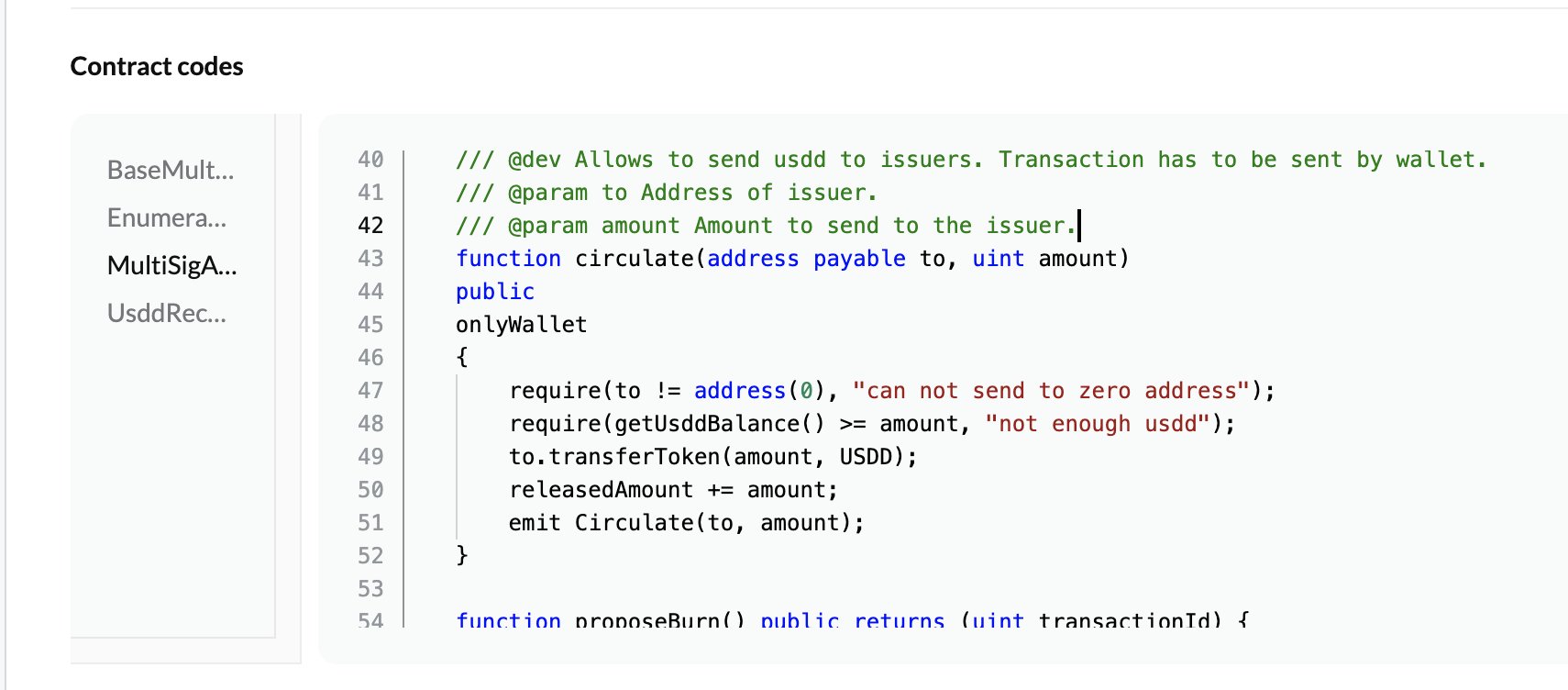

USDD is only issued from the USD two billion pool from authorized wallet addresses, not “everyone can coin”. Reading from the good contract code, only wallet addresses with “onlyWallet” authorization can send USDD from the pool.

This suggests that TDR has complete management in excess of the quantity of USDD coins (not “decentralized” of program, but adapted to the latest predicament).

From there you can see:

USDD is (primarily) a centralized stablecoin disguised as a decentralized algorithmic stablecoin, additional like USDC and USDT than UST.

USDD has much less effect than UST

One of the motives why the LUNA-UST crash impacted the complete cryptocurrency industry is due to the fact LUNA-UST is strongly related with other tasks / protocols. Therefore, as soon as Terra collapses, the ripple result will carry in excess of to DeFi and CeFi tasks employing LUNA-UST.

This result is also evident in the situation of Celsius-stETH. Due to the “mutual loan” protocols, the ETH and the stETH exploited the “pivot” numerous instances main to the collapse of the chain.

Meanwhile, extremely handful of tasks use USDD.

Therefore:

If USDD actually does have a “rollback”, the effect on other DeFi / CeFi tasks is also extremely modest.

Justin Sun else Do Kwon?

Another variation is that the “back” for USDD is Justin Sun. As viewed from Sun’s Twitter, he interacts regularly and offers opinions on Do Kwon’s LUNA-UST situation.

Therefore, it can be viewed that Sun obviously understands the blunders created by Do Kwon, he is aware of the mechanisms that triggered the collapse of LUNA, so he can totally apply it and stay away from it for his undertaking.

* The writer does not suggest right here that Sun is “better” than Kwon.

And it seems that Justin Sun has unveiled one thing to FatMan, a character who criticizes and exposes the techniques of LUNA-UST who has been of curiosity to the local community in latest instances.

USDD, a further algostable, fell sharply to $ .937. Some of you are tempted to perform a game, assuming this is the following UST.

* not * brief USDD – it will not finish properly for you, I guarantee – this is not like UST.

(I acquired some alpha from HE itself)

Look at the following two weeks – FatMan (@FatManTerra)

June 19, 2022

“Another algorithmic stablecoin, USDD, is heavily depegd, at just $ .937. Many people today are encouraged to go brief due to the fact they imagine this is UST two..

* NOT * brief USDD! You will not get very good final results!

I’m certain USDD is practically nothing like UST!

(Justin Sun just leaked some secret info to me)

Make certain you hold an eye on the following two weeks. “

What must we do?

From the over examination, it can be viewed that there is no on-chain information to assistance the USDD depeg. So this predicament is nonetheless occurring in all probability due to the fact of Justin Sun would like

hold USDD depeg.

TDR has also published some examination which confirmed that USDD is not depeg, which is usual due to the fact it depends on the promise and on-chain mechanism. (1/8) Questions and answers on

#USDD

one. Is USDD depegging?

No. USDD is a decentralized stablecoin that depends on an on-chain mechanism and collateralized assets, contrary to the ex-USDC centralized stablecoin, which is linked to the USD in a extremely shut spread from the financial institution mint and redemption. – TRON DAO Reserve (@trondaoreserve)

June 17, 2022

So, with the latest predicament, the most effective factor we must do is “stand still” – do practically nothing. Whether it is extended or brief USDD correct now is not the optimum system.

Giovanna

Maybe you are interested: