Ethereum (ETH) is currently under significant downward pressure, with the price down 3% in the past 24 hours. This bearish trend could push ETH below the key price mark of $3,000.

This analysis examines the factors that contribute to this possibility.

Ethereum Seller Reappears

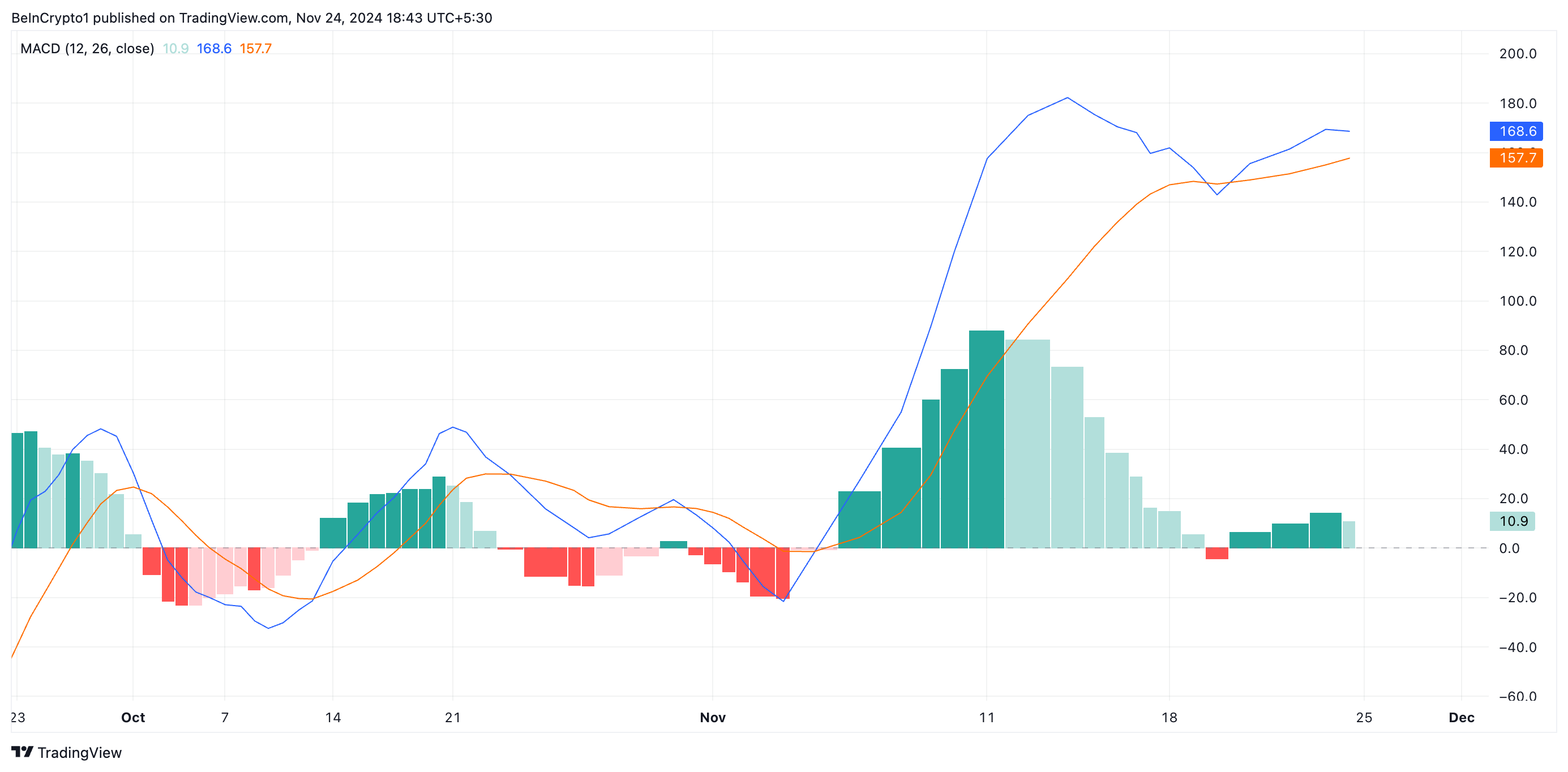

A review of the one-day ETH/USD chart has revealed that the coin’s MACD is forming a potential “death cross.” At this moment, the coin’s MACD line (blue) is trying to fall below the signal line (orange).

This indicator measures the price trend and momentum of an asset, highlighting buy or sell signals. MACD “death cross” occurs when the MACD line (short-term moving average) crosses below the signal line (long-term moving average), indicating a downtrend or momentum reversal. This signal suggests that selling pressure is increasing and the asset’s price may decline further.

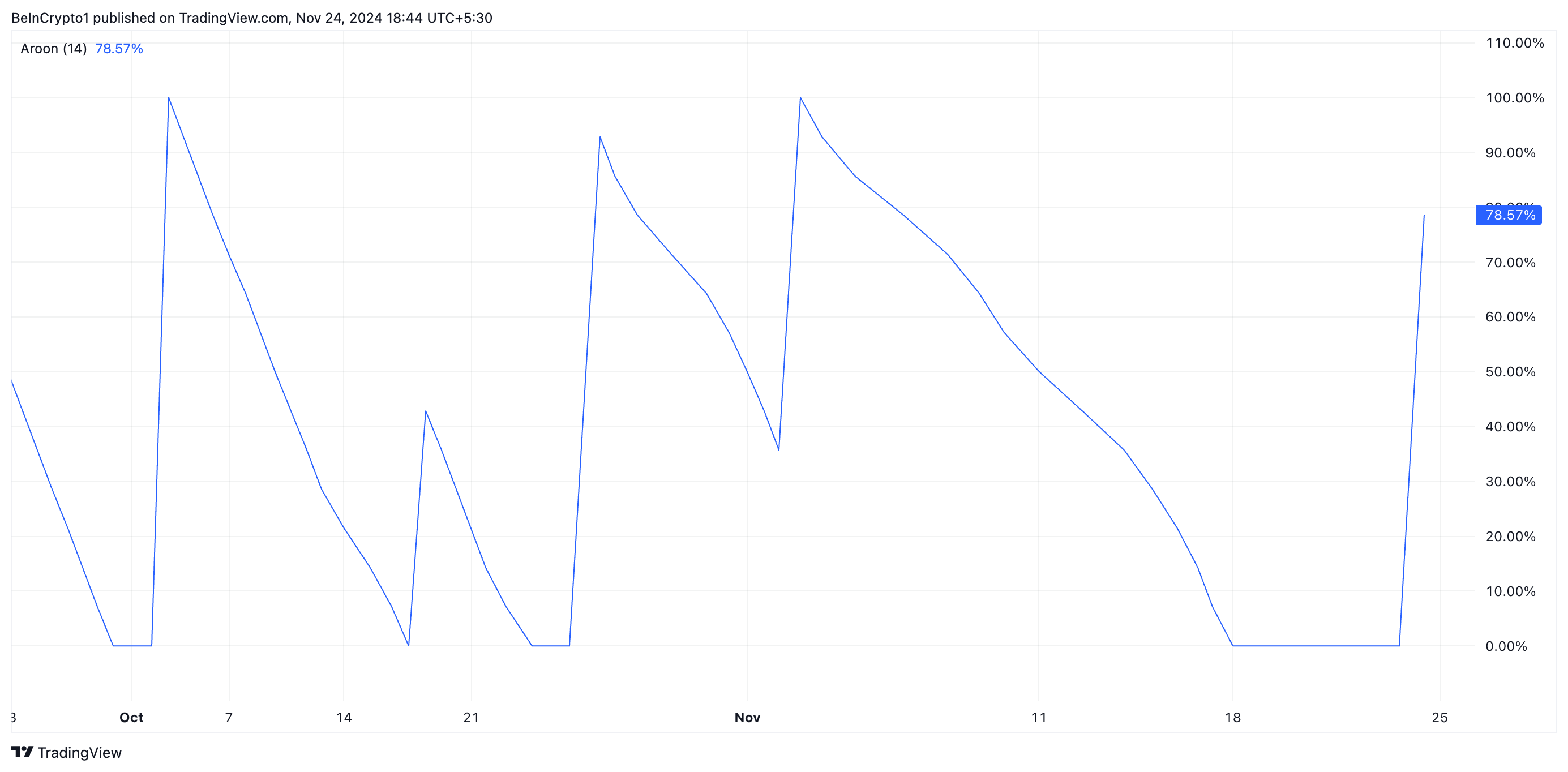

ETH’s rising Aroon Down line confirms bearish pressure is strengthening. Currently, it is at 78.57%, confirming that ETH price decline is accelerating.

The Aroon indicator evaluates the strength of the asset price trend through two components: the Aroon Up line, which reflects the strength of the uptrend, and the Aroon Down line, which reflects the strength of the downtrend. A rising Aroon Down line shows that recent bottoms are occurring more frequently, signaling increasing bearish momentum or the start of a new downtrend.

ETH Price Prediction: Key Support Level to Watch

ETH is currently trading at $3,333, above the support formed at $3,203. This is an important level because if it drops below, ETH will be trading below $3,000. According to data from the coin’s Fibonacci Retracement tool, Ethereum price will drop to $2,970 if this happens.

However, if demand for this leading altcoin recovers, the bearish assumption will no longer be accurate. If this happens, Ethereum will rise to $3,500.