[ad_1]

Declining withdrawal volumes on Bitcoin brief goods could be a signal that fundamentals are enhancing as opportunistic traders rush to purchase.

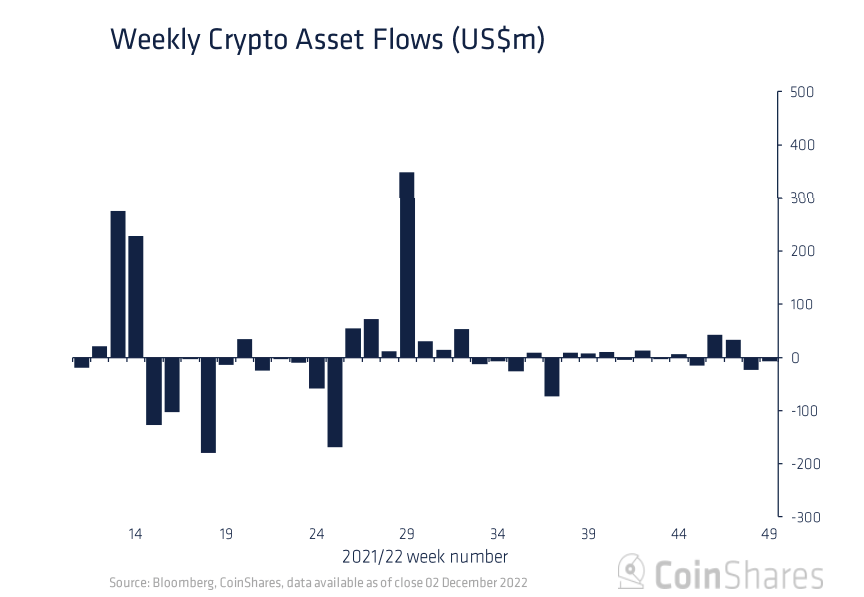

On the other hand, digital asset investment goods (typically consisting of brief-phrase goods) noticed outflows totaling $seven.five million, although prolonged-phrase goods recorded a complete of $seven.five million in outflows. acquired $three.three million.

Despite weeks of brutal capitulation and unfavorable Bitcoin sentiment triggered by the crash of FTX, BTC investment goods have noticed inflows totaling $eleven million. Hence, displaying improvement in sentiment close to the primary coin.

According to Coinshares information, Solana and Polygon recorded inflows of $.two and $.three million, respectively, although Litecoin and Polkadot recorded $.9 and $.four million in complete, respectively. revenue out.

Unfortunately, Ethereum information demonstrates sizeable outflows ($four million) for the third week in a row, which may perhaps stem from uncertainty about the suitable time to transition to evidence. share.

The information also recorded capital inflows across crucial areas, with Canada primary with $twelve million, followed by Germany with $three.two million. On the other hand, the United States recorded the biggest outflow of $15 million, of which about 75% consisted of brief-phrase investment goods.

Reduced outflows on Bitcoin brief-promoting goods is a fantastic signal that usually signifies traders are not seeking for options to brief but are as an alternative accumulating additional digital assets more than the prolonged-phrase. When these traders are brief, they are betting that the Bitcoin value will see more declines.

As of this creating, BTC is trading at $sixteen,950 and has been struggling to break the pivoting resistance at $17,494. This demonstrates that Bitcoin has plunged and retraced beneath recent value amounts which could signal an imminent bottom. According to former report by CryptoSlate, the aSOPR indicator was flashing a warning about a new Bitcoin bottom.

[ad_2]