RENDER price has skyrocketed 48% in the past month, cementing its position as the largest artificial intelligence coin with a market capitalization of $4.1 billion. It is currently ahead of its closest rivals, TAO, FET and WLD, reflecting growing interest in AI-focused assets.

However, despite this impressive increase, the decline in activity of the “big players” along with weakening trend indicators indicates potential challenges ahead. Whether RENDER can maintain its upward momentum depends on the development of market confidence in the coming days.

“Big Guys” Do Not Accumulate RENDER

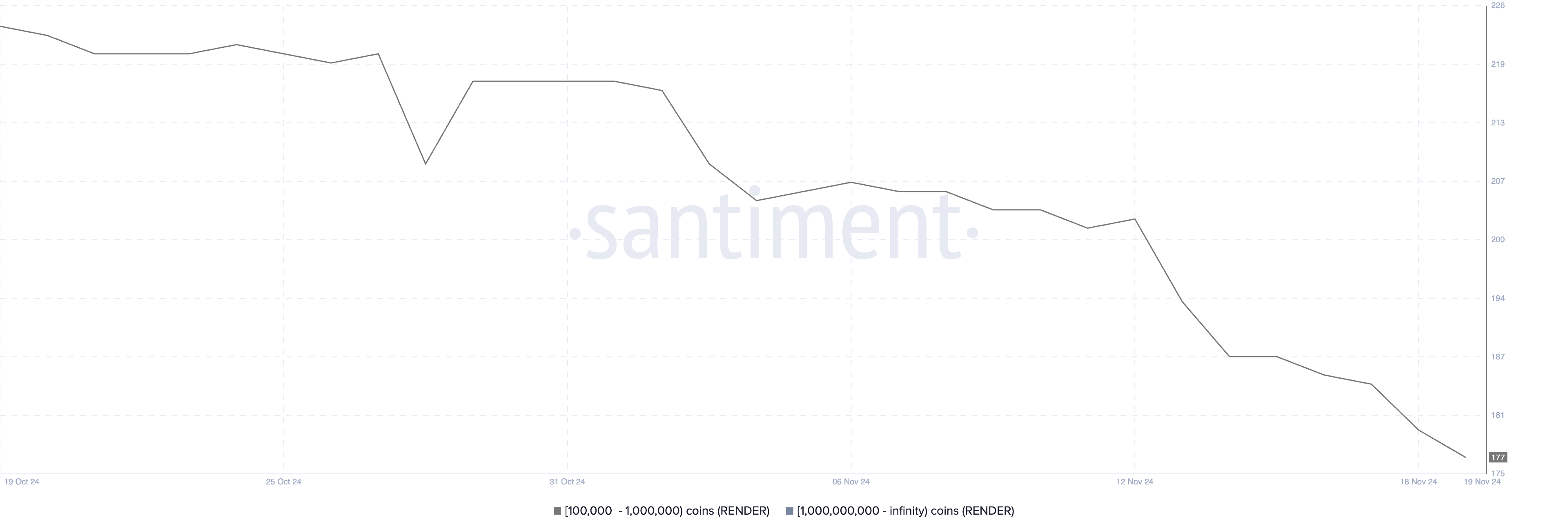

RENDER is having difficulty attracting interest from “big players”, when the number of owners with balances from 100,000 to 1 million VND has decreased sharply since the beginning of November.

The metric started at 218 on November 1 and has fallen to 177, marking a significant decline among large holders despite recent market activity.

This trend is notable because “big players” often play an important role in promoting and maintaining price momentum. Although the RENDER price has increased by 48% in the last month, the continuous decline in the number of large investors shows a lack of confidence among large investors.

This may indicate that the recent price rally may have difficulty maintaining an upward trend without strong support from large holders.

RENDER’s BBTrend Still High

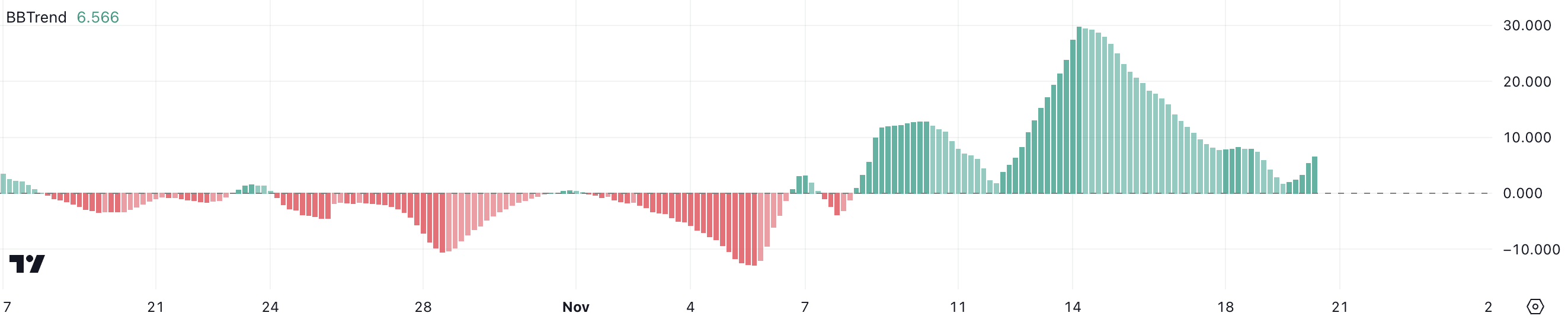

BBTrend for RENDER is currently at around 6.4, recovering from the recent low of 1.7 on November 19.

Despite hitting a three-month high of 29.7 on November 14, the index has fallen sharply since then, reflecting a loss of momentum after its peak.

BBTrend measures the strength and direction of a trend by analyzing Bollinger bands, with positive values indicating an uptrend and negative values indicating a downtrend.

Although BBTrend for RENDER has been positive since November 8 and is now showing signs of recovery, it is still far from the mid-November high. This suggests that while the trend is not over, the current strength of it is relatively weak, indicating hesitation in sustaining further upside momentum.

RENDER Price Prediction: Return to $5 Soon?

RENDER’s EMAs currently show a bullish setup, with the short-term lines above the long-term ones and the price trading above all of them.

If the uptrend continues to gain momentum, RENDER price could test resistance at $8.29, with the possibility of a move higher to $9.47, which would mark the highest price since May and establish RENDER as the largest artificial intelligence currency on the market.

On the contrary, indicators such as BBTrend and the activities of “big hands” point to a weakening of confidence. If the trend reverses, RENDER could test the support levels at $6.3 and $5.8, and if these levels fail to hold, the price could drop to as low as $5.0.