[ad_1]

RENDER price has surged recently, and the coin reached a market capitalization of $5 billion, solidifying its position as one of the leading AI coins. Although the EMAs show a strong uptrend, with RENDER price surpassing every key average, the changing market sentiment has resulted in a negative BBTrend, signaling potential challenges ahead.

If momentum recovers, the price could test resistance, potentially surpassing TAO to become the largest AI coin. However, if the negative trend increases, RENDER could face a correction.

RENDER Attracts Attention, But Not As Much As VIRTUAL

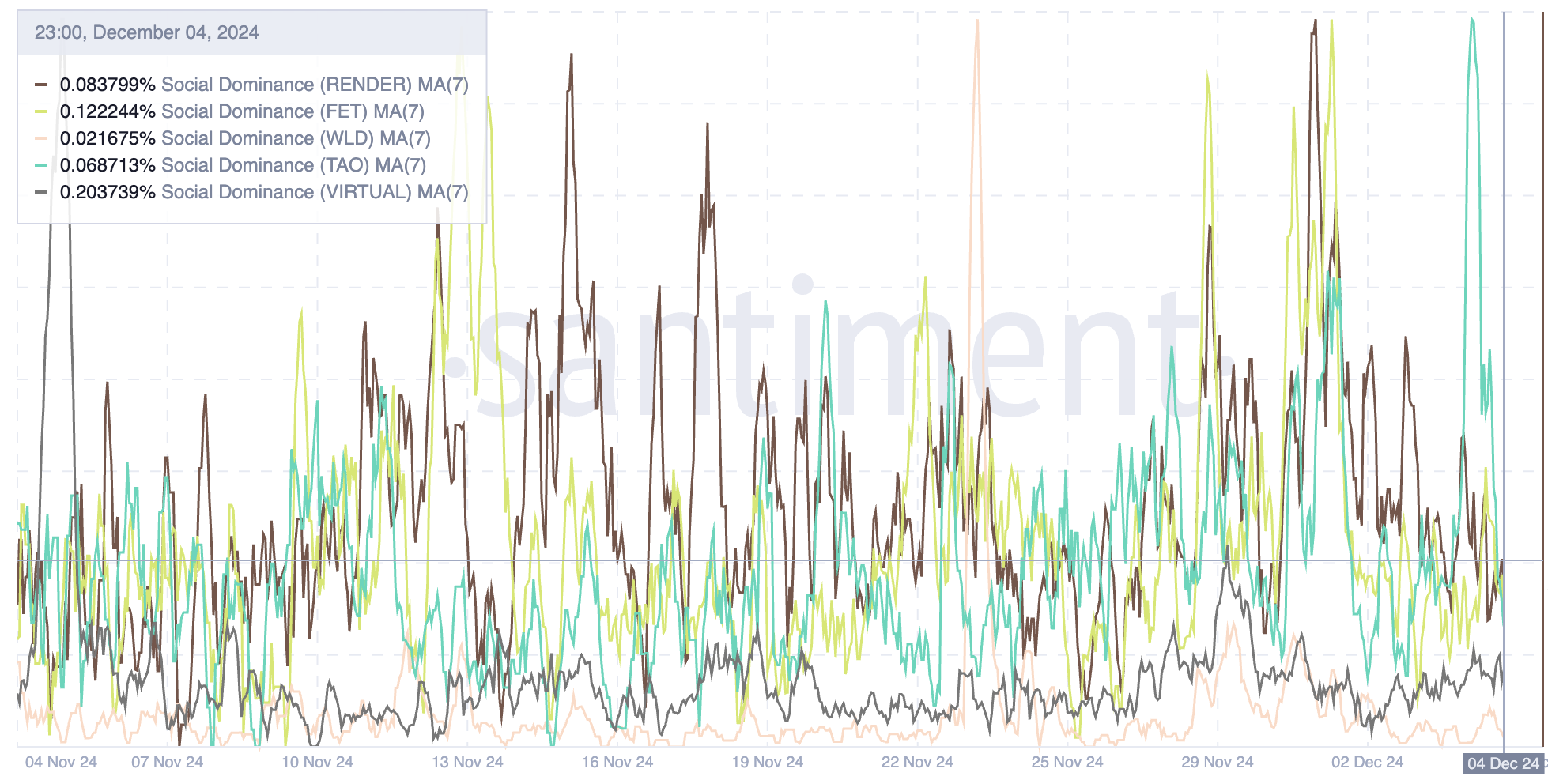

Currently, Render ranks 3rd in social dominance among the top five AI coins, based on 7-day moving average.

Although behind FET and some distance behind VIRTUAL, both of which have received increased social attention in recent weeks, RENDER’s strong market presence ensures that it remains a major player. key player in the artificial intelligence space.

In terms of market capitalization, RENDER ranks 2nd with 5.18 billion USD, just behind TAO with 5.22 billion USD, showing the possibility that these two coins may swap positions.

RENDER is also the 2nd best performing coin among the top five AI coins over the past 30 days, with a staggering 128% price increase, second only to VIRTUAL’s impressive 367% increase.

RENDER’s BBTrend Is Currently Negative

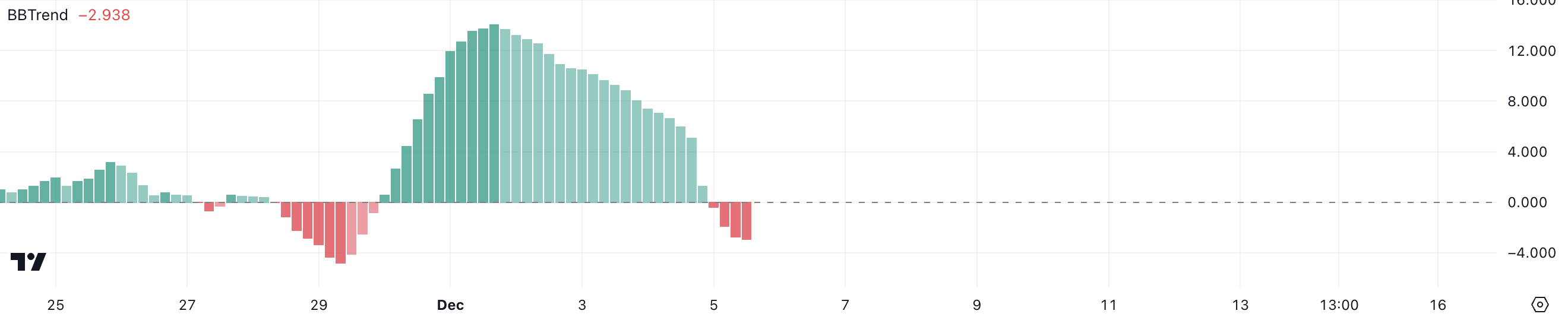

Despite the recent price increase, data shows that traders may be shifting their attention from RENDER to other AI coins or other alternative scenarios.

This shift in focus is consistent with a marked shift in RENDER’s BBTrend, which remained positive from November 30 to December 4, peaking at 14 on December 1. However, BBTrend has turned negative, now at -2.9, signaling a clear weakening in momentum.

BBTrend (Bollinger Band Trend) measures price momentum relative to Bollinger Bands, with positive values indicating bullish pressure and negative values reflecting bearish pressure. RENDER’s rapid move into negative territory indicates increased selling pressure or a decline in buying interest, possibly signaling the beginning of a pause or a price correction.

If BBTrend continues to decline, it could signal further weakness for RENDER, especially as market attention appears to be drifting towards other assets.

RENDER Price Forecast: Will the Uptrend Take RENDER to 11.9 USD?

RENDER price maintains a bullish profile within the EMAs, with the short-term average above the long-term average and the current price trading above all of those levels. This configuration indicates a persistent uptrend, suggesting the potential for upward momentum if market conditions continue to be favorable.

If BBTrend recovers and the uptrend strengthens, RENDER price could test key resistance points at $10.8 and $11.9, potentially surpassing TAO’s market capitalization to become the leading cryptocurrency. Largest AI coin by value.

Conversely, if BBTrend continues its negative direction and the current trend reverses, RENDER price could drop to the support levels at 9.2 USD and 8.2 USD.

Failure to hold these support levels could push the price deeper to $7.10, marking a significant correction.

General Bitcoin News

[ad_2]