Solidus Labs’ 2022 Rug Pull Report reveals that eight% of all Ethereum (ETH) tokens and twelve% of all BNB Chain tokens are carpet pulling scams.

The report seems to be at information from January one to December one, 2022, and also finds more than $eleven billion well worth of ETH transactions that are straight linked to fraudulent tokens or integrated in the system. funds laundering of carpet pulling.

This information prospects to an estimate that eight% of all Ethereum tokens are programmed to execute carpet pulling.

Assessing the publicity to these scam tokens, the report also exposed that BNB Chain hosts the highest quantity of scam tokens, with twelve% of all BNB Chain tokens currently being scams.

117,629 scam tokens in 2022

The report acknowledges that market analysis has recognized 24 carpet pulling incidents in 2021 and 262 in 2022. However, Solidus Labs Danger Intelligence’s intelligent contract scanning engine has recognized much more than 200,000 tokens. Phishing alert was deployed from September 2020 to December 2022.

Threat Intelligence detected 83,268 phishing tokens concerning January 2021 and December 2021. This quantity recorded a 41% spike in the initial eleven months of 2022 and improved to 117,629.

Greater effect than FTX

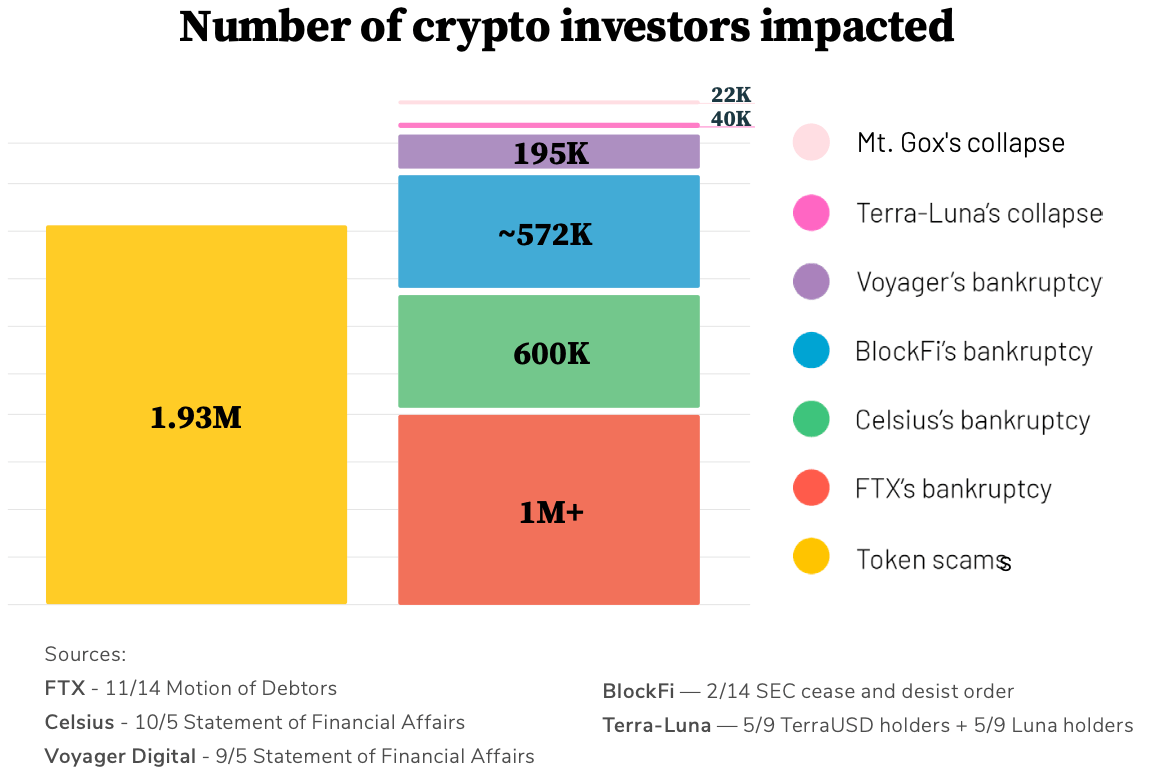

Solidus Labs also in contrast the effect of these scam tokens to the main occasions of 2022, which includes the collapse of Terra (LUNA) that begun the bear marketplace and the crash of FTX.

The success showed that one.93 million traders misplaced funds due to the token scam, much more than the quantity of traders impacted by the collapse of Terra and FTX mixed.

Excluding the effect of scam tokens, the collapse of FTX had the most significant effect on the market, affecting just more than one million traders. Celsius’ and BlockFi bankruptcy followed in 2nd and third by affecting 600,000 and 572,000 traders respectively.

Considering the magnitude of these numbers, Terra’s demise was largely a small crisis as it impacted just about forty,000 traders.

publicity to CeFi

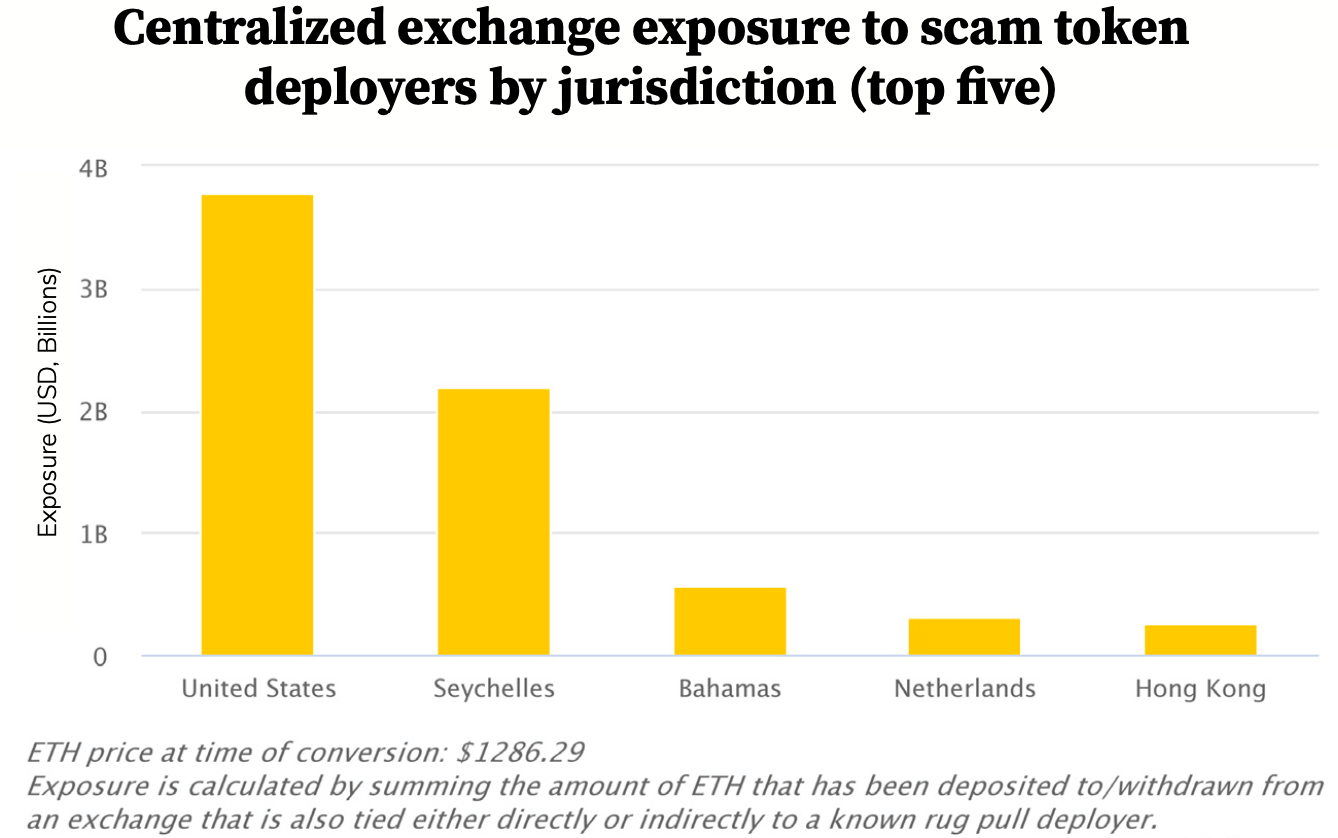

According to the report, 99% of these scam tokens are not detected by common approaches. These scams prioritize deployment on centralized exchanges (CeFi) and deal with to deposit and withdraw from 153 distinct CeFi platforms.

The report also supplies a breakdown of the exchanges described. According to the information, US-primarily based CeFi exchanges have the highest publicity to scam tokens, with all-around $three.75 billion.

The East African nation of Seychelles came in 2nd with more than $two billion, though the Bahamas came in third with $500 million.