In this incident, what anyone sees is that UST de-peg, LUNA on the ground, and Bitcoin are also in will need of resuscitation. However, right now let us dig into some information of the secret background behind this incident, to see who is to blame and why!

Background

To have an explosion this time, let us discover out wherever the fuel deposit is! If you are interested in the working model of LUNA-UST, you can click on the report under to read through it very first!

> See also: five inquiries about Earth (LUNA) and UST stablecoins that the writer himself wants solutions to

Thus, it can be noticed that, from the incredibly starting, the Luna – UST setup was a big fuel deposit, with holes on many sides. However, the explanation this fuel deposit did not explode is mainly because the help units and Luna defended themselves pretty firmly. If the 4pool phase is effective, it is achievable to make a liquidity reserve dense sufficient for Luna to “settle down and live happily”.

First domino to fall

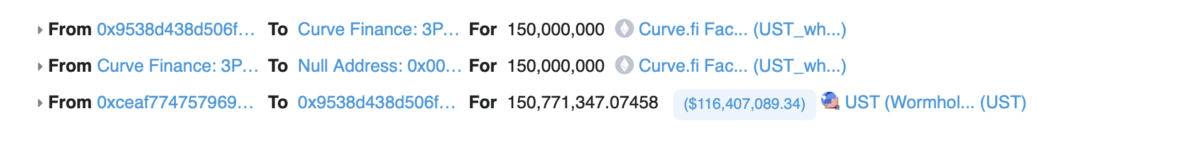

So wherever is the very first domino in this incident. Let’s go back to the time when Do Kwon withdrew $ 150 million in money from the 3Pool-UST pool. The objective of this move is to have ample liquidity to put together for a new 4pool time period. But it was at this second that the FSO was exposed and attacked.

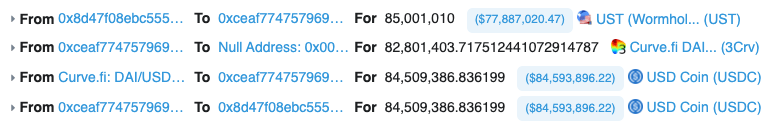

At this time, 85 million USTs are dumped into the 3Pool-UST pool. And with subtle armor as liquidity has just been withdrawn, UST promptly scales this pool.

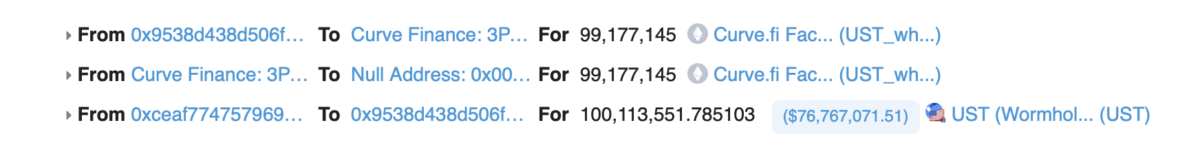

The subsequent move by UST is to withdraw a further one hundred million from the 3Pool-UST pool, to rebalance the exchange fee.

This paragraph approximately signifies that the UST volume is higher -> the UST fee will be lower -> LFG will have to withdraw UST from the pool to lessen the variety of tokens -> assist the exchange fee stabilize yet again. However, the trade-off with this move is that the liquidity in the pool will dwindle, hence producing it simpler to depeg if a big volume of revenue is launched into the pool.

Strange spread

It can be stated that Luna was not very good, but also unfortunate to have been “beaten” at the appropriate time MicroStrategy… she purchased additional Bitcoins. The cost of bitcoin fell swiftly, dragging the standard industry decline and officially placing Luna on the spiral of death.

Negative details appeared all the time, coupled with the reality that UST could not go back to pegging even however the distinction at that time was only two%. Negative details chains can contain:

- LUNA positions liquidated on Anchor.

- Cash movement withdrawn from Anchor due to UST threat aversion.

- UST continues to deepen the .7x-.8x area.

- Binance blocks LUNA deposits and withdrawals.

- FSO was pointed out at a meeting of the regulator.

Late efforts

It can be stated that LFG and backer have created wonderful efforts to reverse the condition.

LFG and its partners (most notably Jump Cypto) promptly pumped all-around $ 280 million of added money into the 3Pool-UST pool (one thing they need to have completed from the start out and I’ll describe in additional detail later on).

Look closely at the pool for a battle standing. Sitting at all-around $ 285 million in 3CRV following Jump deposited a further $ thirty million in Tether. The whale turns. pic.twitter.com/qdzJZvKJ0f

– Jack (@YoniJMel) May 7, 2022

The move to deduct $ one.five billion to stability the industry proved weaker for the opponent’s assault.

>> See additional: Luna Foundation Guard “lent” $ 750 million in Bitcoin to defend UST’s cost

Finally, a reassuring message from the founder of Terra Do Kwon.

However, UST can’t revert to peg, partly due to spread limits. Simply place, if you do a mint burn up operation for refereeing, there will be a distinction in the volume you get in the finish. This inadvertently designed a barrier to UST acquire arbitrage to redeem LUNA, producing the shopping for strain on UST not sturdy sufficient.

Things that could have “been improved”

I feel when almost everything has been broken and talked about more than and more than yet again, it helps make no sense to a whole lot of folks. However, the following part is my private point of view, not meant to criticize the Moon Foundations or especially Do Kwon. Respect the builders!

All written content in this report is for informational functions and features views on this incident.

For now, let us seem at the items Earth could have completed superior.

First, it is the growth of the UST providing at this kind of a quick speedit has not tended to slow down, whilst the industry did have terrible information following the Fed’s intervention.

LUNA’s drop in industry capitalization to all-around $ thirty billion is a red flag mainly because it is incredibly near to UST’s $ 18 billion industry capitalization. Simply place, if there is a fluctuation, it is incredibly tough for consumers to use UST to redeem LUNA.

Secondly, the withdrawal of UST’s money is also hasty at a time when the industry is volatile that Earth has to shell out dearly for. The provision of $ 280 million of liquidity by TLF and its partners would not have been essential had they been additional mindful in the very first phase.

Instead of right withdrawing money and eagerly attacking and expanding 4Pool’s influence, Terra can decide on a “concession” alternative rather than utilizing USDC, USDT or DAI to enter the pool, from which the swap slowly withdraws. in the swimming pool. In return, this move will get time and price, but will reduce the opening of the ribs as pointed out over.

Instead of right withdrawing money and eagerly attacking and expanding 4Pool’s influence, Terra can decide on a “concession” alternative rather than utilizing USDC, USDT or DAI to enter the pool, from which the swap slowly withdraws. in the swimming pool. In return, this move will get time and price, but will reduce the opening of the ribs as pointed out over.

The explanation for this move, I personally feel it could be that Do Kwon was below wonderful strain when he had to promptly and efficiently deploy 4Pool to cast optimistic information for Luna.

Of program, following becoming exonerated from $ 80 million, triggering the exchange fee to drop somewhat, Luna officially fell into a passive place and subsequent protests unveiled even additional vulnerabilities. And the third blunder is a consequence of this very same passage.

The third matter is the move to extract (or in accordance to Luna’s announcement, “loan”) $ one.five billion in the kind of ($ 750 million in BTC and $ 750 million in UST) to a third celebration to industry and stability the exchange fee.

This phase is approximately meant as producing two scales, one particular side is BTC, one particular side is UST, if the UST cost is depeg, then you promote BTC to acquire UST. Conversely, if UST returns, use UST to acquire back BTC.

However, this is specifically the weak stage the attacker desires to see. And they have selected to assault the weaker celebration, which is the MTS. The UST depeg cost brought on BTC to promote to the industry to conserve the peg. And as soon as BTC collapsed, the complete industry was dragged on, dragging LUNA deeper into the spiral of death.

finish

As pointed out over, I respect the suppliers in the industry. Do Kwon is not with out notable enhancements, this kind of as the 4Pool alliance. But Terra’s challenge is that the framework is pretty “walking the rope” and leaves the hips open for the opponent’s assault. Had the FSO been effective, it is achievable that what we see on Twitter would have been wholly various. And it can’t be concluded that UST has failed wholly.

Today’s report is just that and if you have any optimistic contributions, you can comment under.

Synthetic currency 68

Maybe you are interested: