[ad_1]

Ripple (XRP) price has increased the most among the top 10 cryptocurrencies in the past 30 days, with a 333% increase. However, recent indicators suggest that this upward momentum may be waning.

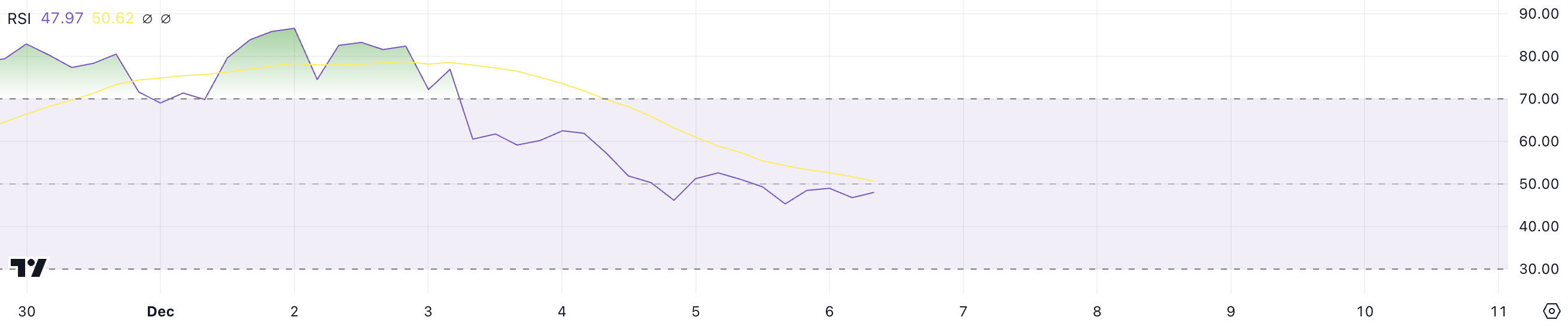

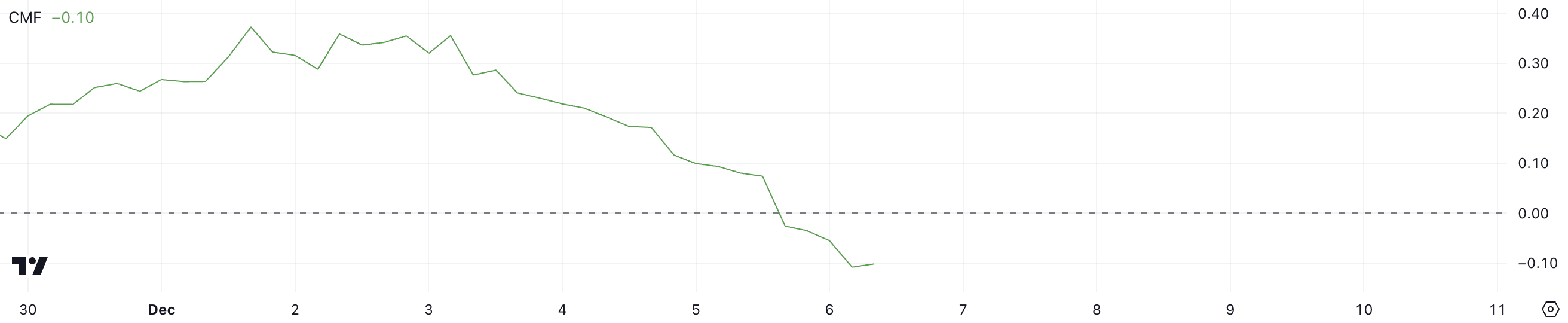

XRP’s RSI is currently at 47.9, signaling neutral status after once being in overbought territory. Additionally, the Chaikin Money Flow Index (CMF) has moved into negative territory, indicating increased selling pressure, which could signal a further decline in prices.

XRP RSI Is Currently Neutral

Ripple’s RSI is currently at 47.9, a significant drop from its previous value above 70 from December 2 to December 3. An RSI above 70 usually indicates that the asset is is overbought, which suggests a correction or retracement may be needed.

A drop below 70 suggests that XRP is no longer in overbought territory, and the recent decline may reflect a weakening of the uptrend that has pushed its price higher.

Relative Strength Index (RSI) is a momentum indicator that measures the speed and variability of price movements. It ranges from 0 to 100, with readings above 70 indicating overbought conditions, while below 30 indicating oversold conditions.

As XRP’s RSI has fallen below 70, this could signal the end of the recent upward momentum. If RSI continues to trend down, it could indicate the possibility of a deeper decline for XRP, with the price likely to encounter more headwinds as the uptrend weakens.

Ripple’s CMF Index Is Now Negative After 6 Days

XRP’s CMF index fell to -0.10, after a period of positive values from November 29 to December 5. The move into negative territory shows that selling pressure has increased as the CMF measures the flow money in and out of an asset.

A negative CMF indicates that more money is flowing out of the asset than in, which can be a bearish signal.

CMF is an indicator that combines price and volume to measure buying and selling pressure over a specific period of time. It ranges from -1 to +1, with positive values indicating accumulation (buying pressure) and negative values indicating distribution (selling pressure).

XRP’s current CMF at -0.10 is the lowest value since November 21, indicating a bearish change in market sentiment. This negative CMF could imply continued downward pressure on the XRP price in the short term, suggesting the asset may have difficulty maintaining its value or may experience additional price drops. fig.

Ripple Price Prediction: Will XRP Fall Below $2 in December?

Ripple’s EMAs show that the short-term lines are currently above the long-term lines, pointing to an overall bullish outlook. However, XRP price is currently trading below the shortest EMA, which could signal the start of a downtrend.

If this trend continues, XRP price could come under downward pressure, potentially testing support at $1.88.

If the downtrend is avoided and the uptrend continues, Ripple price could rise to test the $2.90 resistance level. If this resistance is overcome, further growth is likely, with the next major level of interest possibly at $3.

General Bitcoin News

[ad_2]