The USDC depeg impacts not only other stablecoins, but also main DeFi tasks in the market.

As Coinlive constantly reported, the local community has witnessed a hefty USDC stablecoin depeg occasion for the previous two days due to the influence of the Silicon Valley Bank situation.

USDC is the 2nd biggest stablecoin on the industry, behind only Tether (USDT). More importantly, USDC is a extensively applied secure coin in the DeFi array. Thus, the USDC value drop impacts not only other stablecoins but also big DeFi tasks.

Let’s get a search at some hazards the industry is dealing with with Coinlive!

Centralized stablecoins

Wire (USDT)

USDT seems to be the “safest” of this group mainly because it was least impacted by the Silicon Valley Bank (SVB) situation.

Currently, Tether nonetheless holds the USD one mark and is a “storm” area for several end users when fleeing USDC.

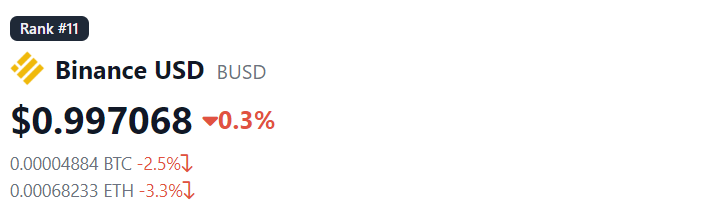

BUSD

BUSD also professional a depeg occasion not as well prolonged in the past. Currently this stablecoin has dropped out of the prime ten by capitalization, providing industry share to other coins mainly because there will be no new BUSD minted in the long term.

After discontinuing its partnership with BUSD, Binance has started out shifting its concentrate to other stablecoins, particularly TUSD.

With USDC depegging and end users fleeing in panic, Binance just announced the opening of additional spot trading pairs for stablecoins. Also pause the automated BUSD conversion characteristic. Readers can see additional information at this website link.

The BUSD also fell somewhat beneath $one, hovering all-around $.997.

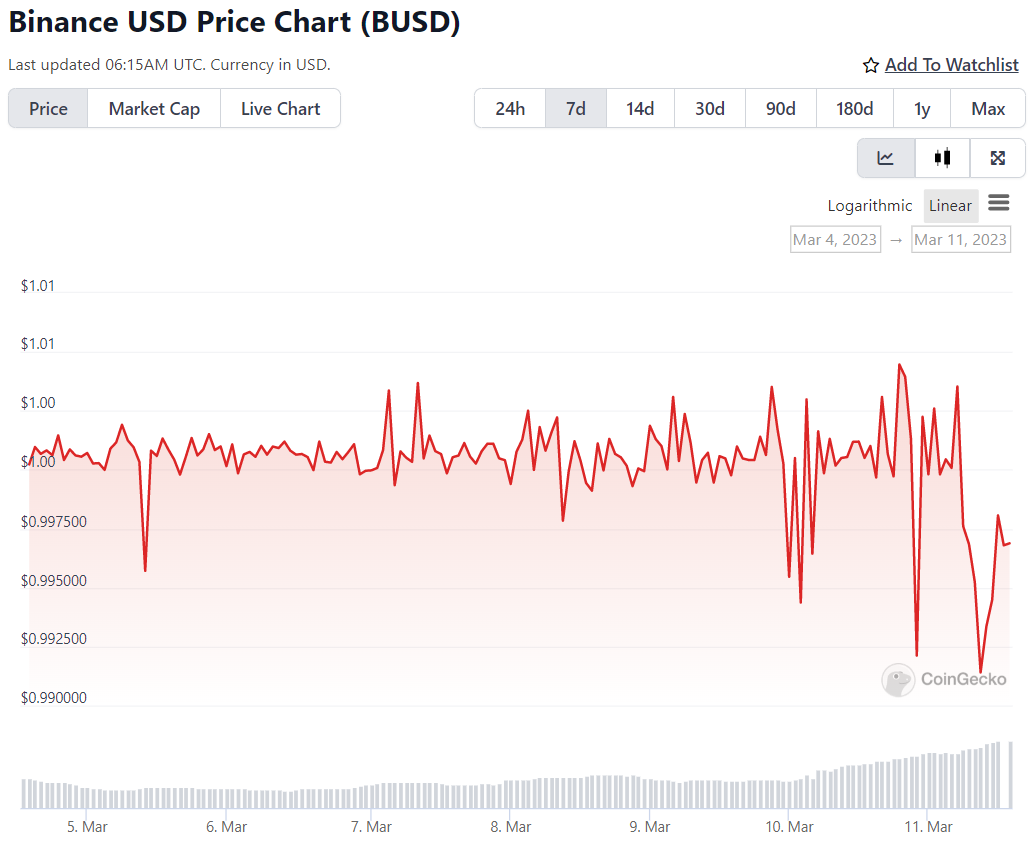

Decentralized stablecoins

Decentralized stablecoins this kind of as FRAX and DAI use a backstop mechanism with a basket of diverse reserve assets. And that incorporates USDC, but the variation in the ratio of USDC to the basket of assets.

Hence, when USDC depegs, stablecoins that use USDC as a reserve asset encounter a incredibly higher possibility.

Below are the utilization costs of USDC as collateral for main decentralized stablecoins right now.

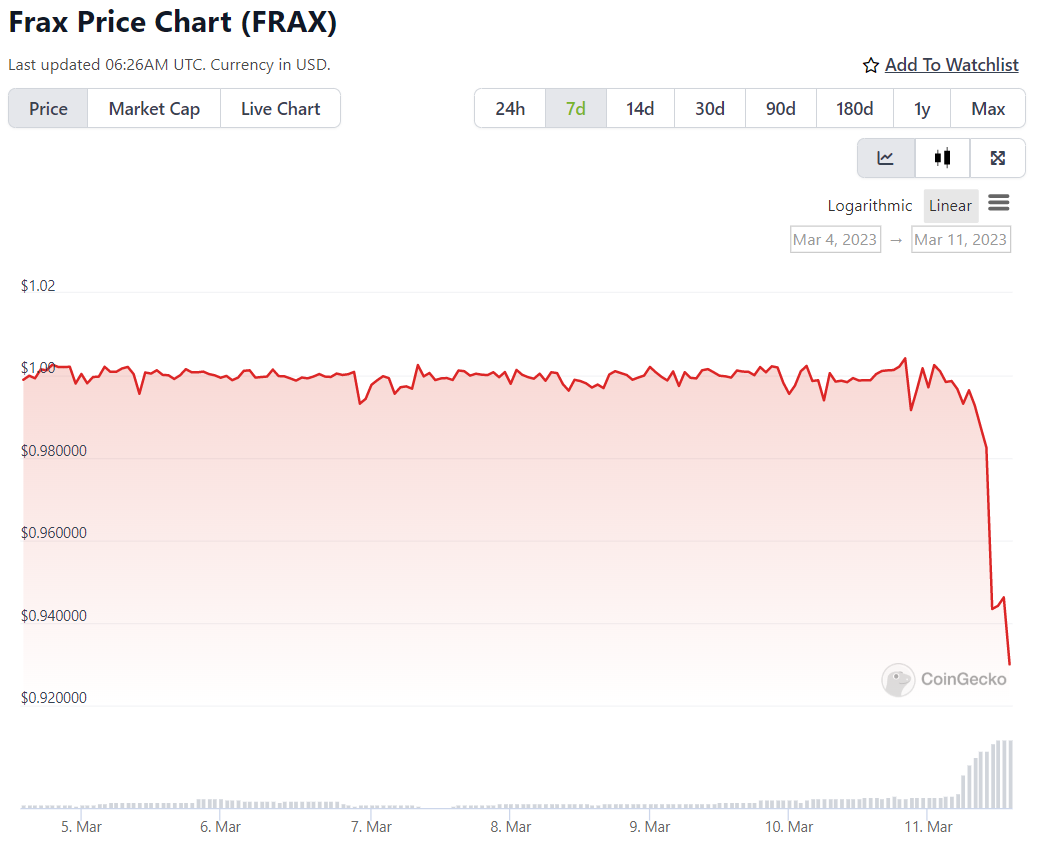

FRAX extension

FRAX employs additional than 90% USDC as collateral, so it suffers a good deal, hovering all-around $.929.

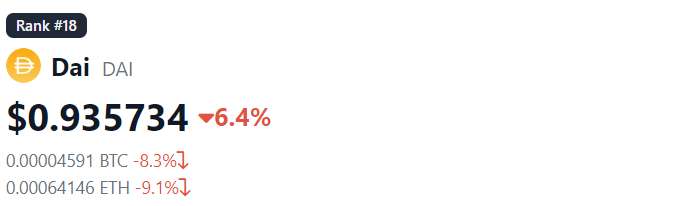

Tough

USDC’s share of DAI’s collateral is 48%, which is no compact variety. This stablecoin is also down about six%, hovering all-around $.935.

DeFi arrays

GLP of GMX

Some DeFi tasks have collateral pools with USDC, generally the GLP coin of the DEX GMX exchange.

Those interested can go through other content articles: GMX Project Overview – Impressive and Potential Decentralized Perpetual Exchange Project.

According to on-chain information, the GLP escrow pool is presently above 50% USDC.

just about 50% of GMX $GLP swimming pool is fully $USDC

presently $GLP holders not only encounter counterparty possibility vis-à-vis great traders like @Rewkang but even at Circle it ought to $USDC even further depeg pic.twitter.com/py3JLbaPLd

— Carl (@karl_0x) March 11, 2023

Now, the venture and end users not only bear the DeFi possibility, but also bear an more possibility from stablecoins, coins that are inherently known as “stable”.

Synthetic currency68

Maybe you are interested: