Rocket Pool (RPL), a decentralized Ethereum staking pool, has just lately produced waves the two in terms of its cost improve and all round protocol thanks to the companies it provides. According to information from IntoTheBlock, Rocket Pool has largely returned additional returns to its wallet addresses than most cryptocurrencies these days.

The RPL token is presently trading at $45.36, down four.47% at press time. Despite this day-to-day reduction, Rocket Pool is a single of the highest gainers for the 12 months-to-date time period. The cryptocurrency has acquired in excess of 126% in the previous 3 months, trying to keep the cryptocurrency at a extremely very good return on investment.

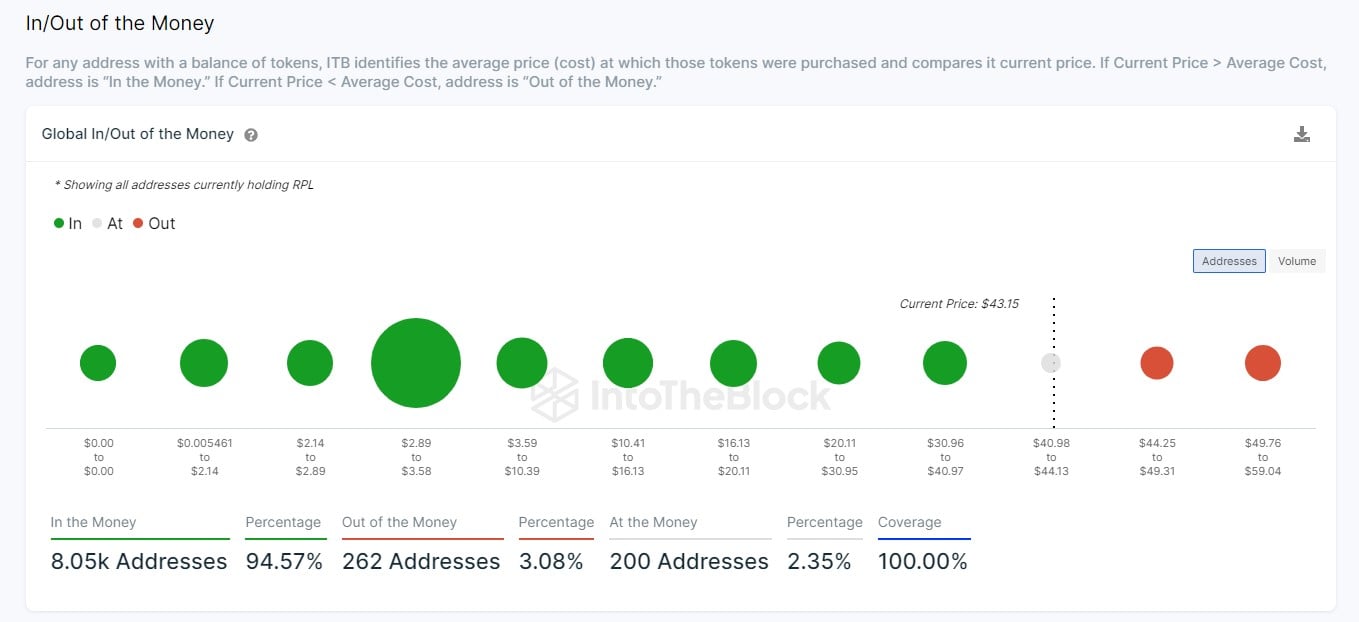

Rocket Pool ITB information displays that about 94% of crypto holdings are lucrative. These deal with numbers are somewhat larger than eight,000 at the time of creating.

By comparison, only about 262 addresses are shedding revenue at the minute, when a complete of 200 addresses are at breakeven, in accordance to ITB information.

Benefit from Ethereum Liquid Staking

While Lido Finance stays the most liquid staking protocol about, Rocket Pool has also exploited Ethereum to its benefit as it relates to its staking item, following the transition from evidence of function (PoW). ) to evidence of stake (PoS).

Data from DeFiLlama displays that Total Value Locked (TVL) on Rocket Pool as a liquidity staking platform has grown from $564.93 million on January one of this 12 months to an all-time substantial. (ATH) is $one.26 billion these days, supported in aspect by its substantial profile exchange listing.

The around a hundred% development price is evident in the hype surrounding Rocket Pool as a DeFi platform and RPL tokens as a digital currency. Based on modest predictions, it is extremely possible that the protocol will make more development even as Ethereum grows and matures.

As a consequence, RPL bulls ought to be wary of innovations, as an simple transition to competitors can be strategic dependent on how Rocket Pool evolves.