On the evening of April 21, the cryptocurrency neighborhood had an uproar when rumors spread that Microstrategy had offered off some of its Bitcoin holdings.

It all commenced when a Twitter account termed “Ozz” posted some information and facts connected to the declare that Microstrategy went towards its guarantee to hold Bitcoin for the lengthy phrase and just offered one,500 BTC, equivalent to close to $ 63 million from the reserves of Bitcoin. Company bitcoin.

️I just recognized that MicroStrategy offered bitcoin without having telling everyone. Michael Saylor stated he would hardly ever do that, but yesterday he offered above one,500 bitcoins. Read extra under

one/three pic.twitter.com/AtJ8TNqg1O

– Ozz, CEO of Altseason (@Coinsandtoken) April 21, 2022

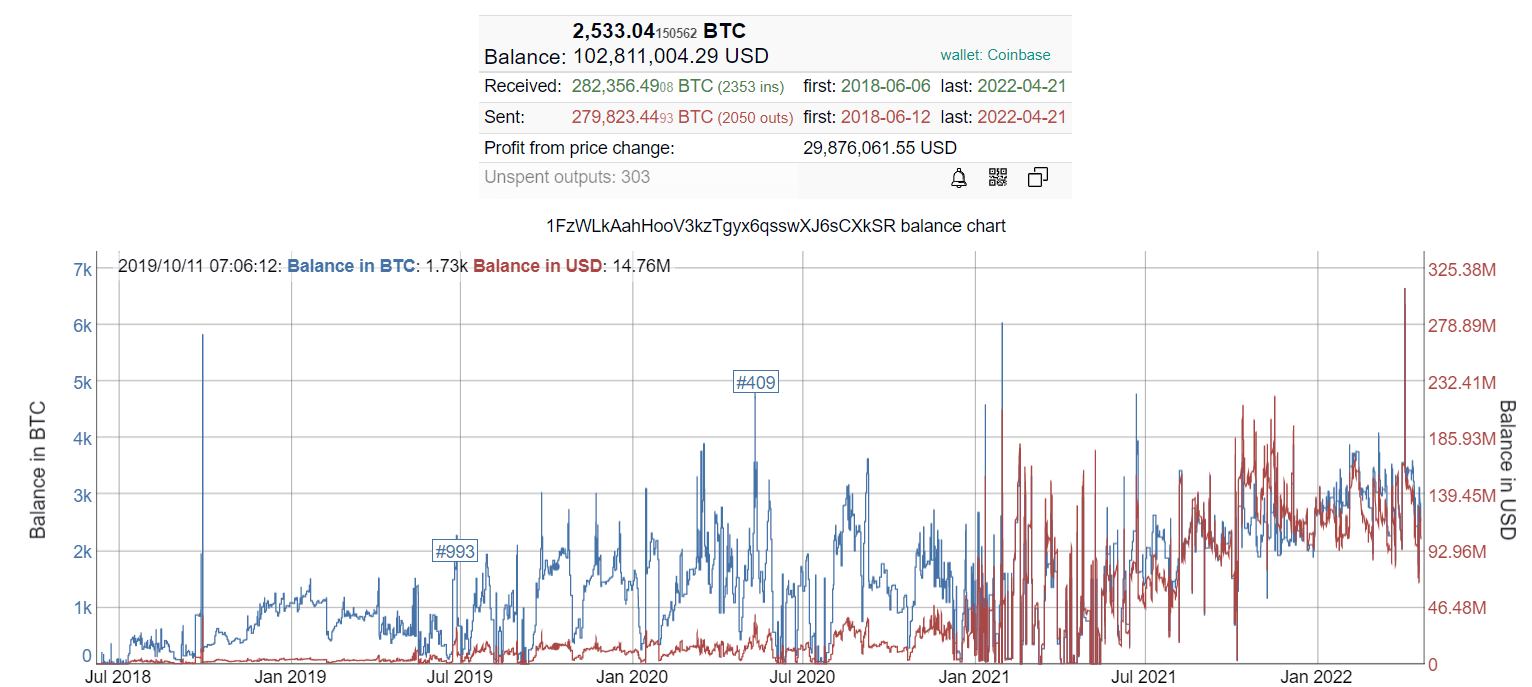

Ozz stated Microstrategy moved the aforementioned one,500 BTC from their main wallet deal with to a secondary wallet deal with, which was employed by the Coinbase and Okex exchanges to promote Bitcoin. This account also states in no uncertain terms that from the starting of 2022 to the existing, the complete sum of Bitcoin that Microstrategy has offered “silently” is up to eight,000 BTC.

While the sum offered yesterday is insignificant in contrast to MicroStrategy’s holdings, marketing bitcoin really worth $ 63 million is a single point and as they announce their purchases, they need to also announce their product sales actions.

They have offered extra than 8k bitcoins considering that the starting of the 12 months.

three/three

– Ozz, CEO of Altseason (@Coinsandtoken) April 21, 2022

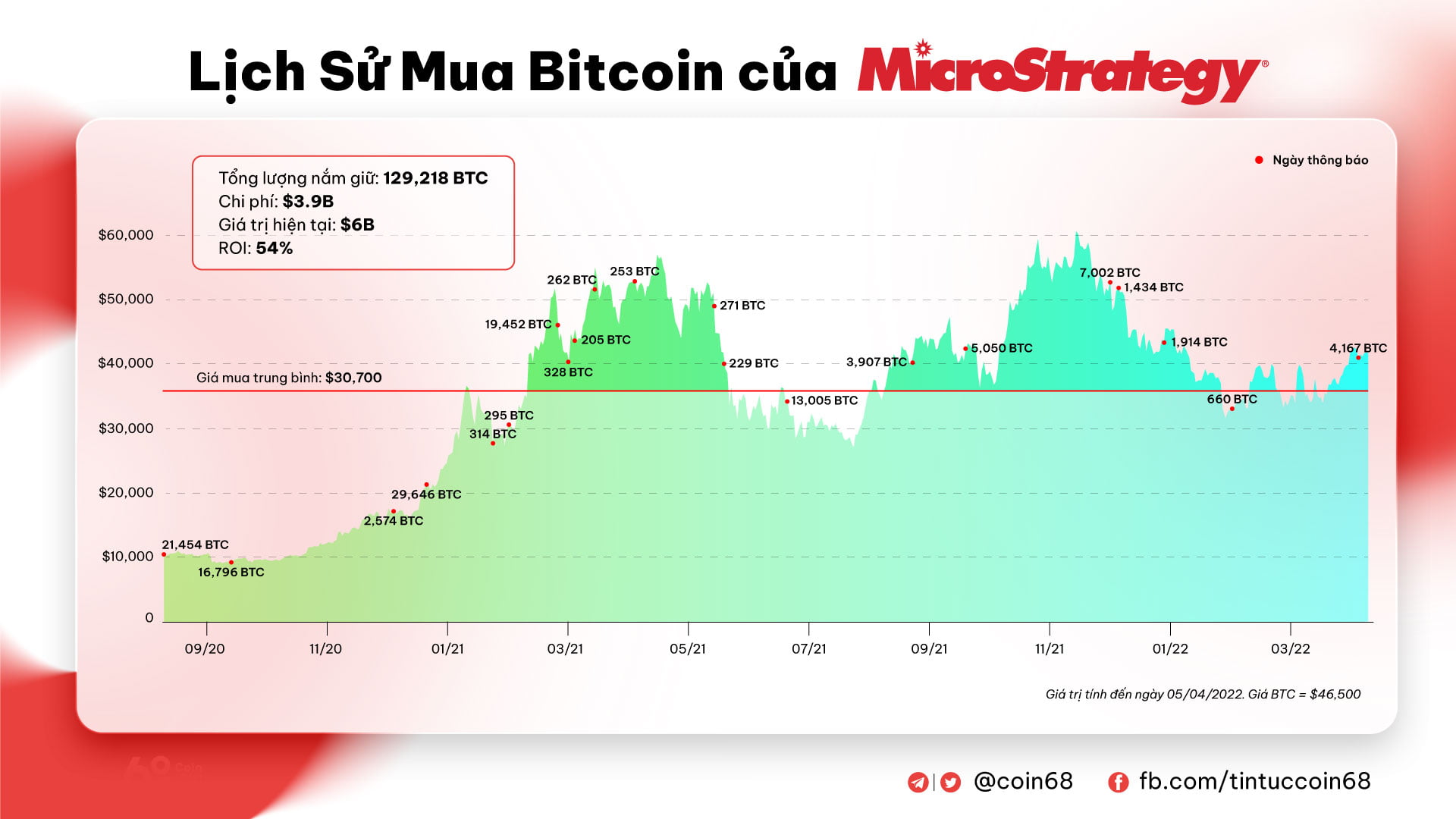

However, this rumor about Microstrategy is totally false thinking about the following things. First, when you trace the two Ozz wallet addresses stated plus the one,500 BTC just offered, at very first glance it seems to be very related to the complete sum of 129,218 Bitcoins that Microstrategy owns, which helps make it effortless to fool traders.

But the two wallets have been designed, recording the very first transaction on ten/02/2019 and twelve/06/2018 respectively. While Microstrategy only commenced shopping for Bitcoin in September 2020. Therefore, this is unlikely to be Microstrategy’s Bitcoin wallet.

Next MicroStrategy is a publicly traded firm, so any order or sale of the firm need to be reported to the SEC, particularly when Bitcoin is an on-stability sheet asset. The evidence is that by means of each and every addition of Bitcoin, the firm publishes clear legal paperwork to display transparency.

A certain situation that clarifies this level is the Tesla of billionaire Elon Musk. According to its Q1 2021 monetary report, Tesla offered ten% of its investment in Bitcoin, raising $ 272 million to check market place liquidity. However, Tesla is even now needed to notify the company’s shareholders and regulators of its shares.

Going back to MicroStrategy, the firm has not presently taken any action on the occasion that just occurred. So the query arises irrespective of whether CEO Michael Saylor has the guts to place himself and the firm in a tough place, other than to be severely legally beaten when he conducts “clandestine sales” of Bitcoin?

Additionally, Michael Saylor has place a whole lot of hard work into building MicroStrategy a correct Bitcoin whale. All of his difficult operate paid off as Bitcoin’s worth skyrocketed. Both Michael Saylor and MicroStrategy have not only won major on the Bitcoin investment front, but the company’s stock has also benefited, quadrupling in the previous two many years, bringing it back into the club of “billionaires” of the planet.

What has acquired so a lot respect from MicroStrategy from the industry’s investment neighborhood is largely due to claims that they help Bitcoin in the lengthy run, it now seems to be observed as a guideline in the system.

On April 15, CEO Michael Saylor reiterated when once more that MicroStrategy will vigorously pursue a system of shopping for and holding extra Bitcoin, irrespective of market place circumstances, as effectively as a program to leverage the company’s substantial Bitcoin fund to make supplemental revenue. , typically by paying out.

And definitely he would not be ready to bet on this kind of a substantial inheritance for just $ 63 million. It need to be mentioned that Michael Saylor himself was on the verge of failure with MicroStrategy for the duration of the dot-com crash of the 2000s when he noticed his fortune plummet.

Synthetic currency 68

Maybe you are interested: