Alameda Research cryptocurrency investment fund founder Sam Bankman-Fried explained he diminished his do the job to invest far more time on the FTX exchange.

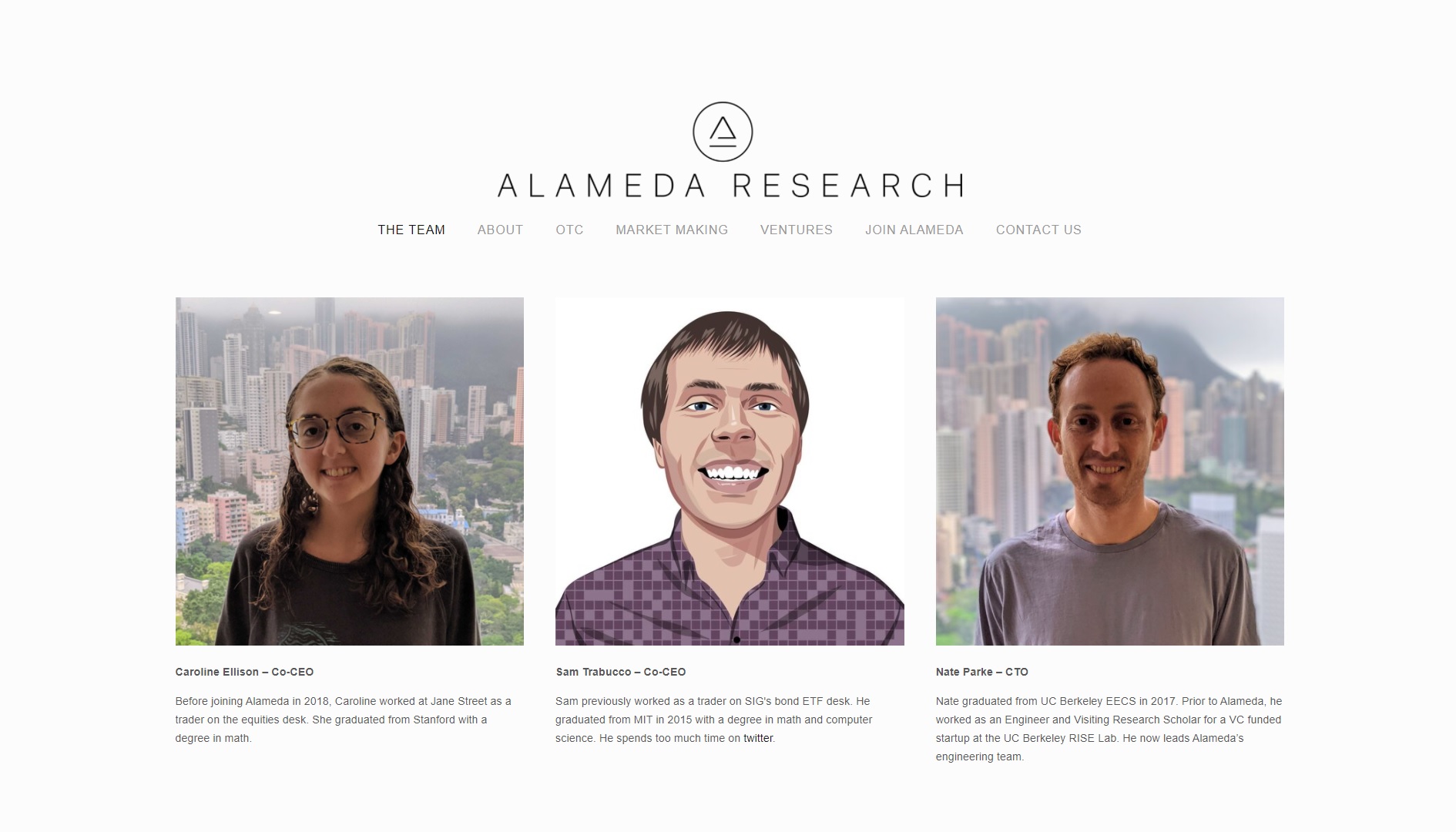

Cryptocurrency billionaire Sam Bankman-Fried announced that he has left his place as CEO of Alameda Research and appointed two new co-CEOs, Sam Trabucco and Caroline Ellison. Both are principal staff members of Alameda Research, acquiring been deputy to Sam Bankman-Fried for numerous many years.

Alameda Research is Sam Bankman-Fried’s springboard in cryptocurrencies. He founded the fund in 2017 to seek out arbitrage possibilities, recruiting Ellison and Trabucco in 2018 and 2019 respectively.

By 2021, Alameda Research is a top cryptocurrency investment fund, engaging in all sorts of enterprises, from venture capital, industry generating, yield farming, and direct trading. To adhere to Forbes, in 2020, this fund manufactured a revenue of up to $ one billion.

Thanks to this, Sam Bankman-Fried had the sources to create FTX, 1 of the top crypto derivatives exchanges right now. However, due to the ambition to additional create FTX, the CEO determined to minimize jobs at Alameda Research.

Mr. Trabucco shared:

“Once he begun undertaking FTX, he invested all his time on it. two% of the time for Alameda, 98% of the time with FTX.

The two new CEOs explained there will be no new improvements to Alameda Research soon after Sam Bankman-Fried’s departure. The fund will carry on to get benefit of possibilities in the cryptocurrency market to make a revenue.

Previously, as reported by Coinlive, Sam Bankman-Fried was Forbes honored as the richest American billionaire in the area of cryptocurrencies, with a fortune of $ 22.five billion.

FTX a short while ago moved its headquarters to the Bahamas, revealing that Hong Kong’s regulatory surroundings is no longer appropriate. The prepare also promotes the promotion of the brand by means of cooperation agreements with important sports activities brand names, with the most apparent purpose becoming the US industry.

Synthetic currency 68

Maybe you are interested: