The SEC located that Sam Bankman-Fried employed $200 million in consumer money on the FTX exchange to make venture investments as a result of FTX Ventures. Of that, there is a $one hundred million investment in Mysten Labs, the enterprise building the Sui Network (SUI) venture.

As Coinlive reported, right after FTX filed for bankruptcy, the SEC charged Sam Bankman-Fried with fraud and is investigating FTX’s money transactions.

Of the billions of bucks in client money embezzled by FTX, somewhere around $200 million has been employed to make investments in two firms, Dave and Mysten Labs.

FTX hijacked $200 million of consumer income in excess of two risky discounts that caught SEC focus https://t.co/na9f6EWAz1

— CNBC (@CNBC) December 28, 2022

Under the route of SBF, FTX transferred consumer money on exchange to FTX Ventures, the venture capital arm of FTX. Subsequently, FTX Ventures produced investments in Dave and Mysten Labs, $one hundred million every.

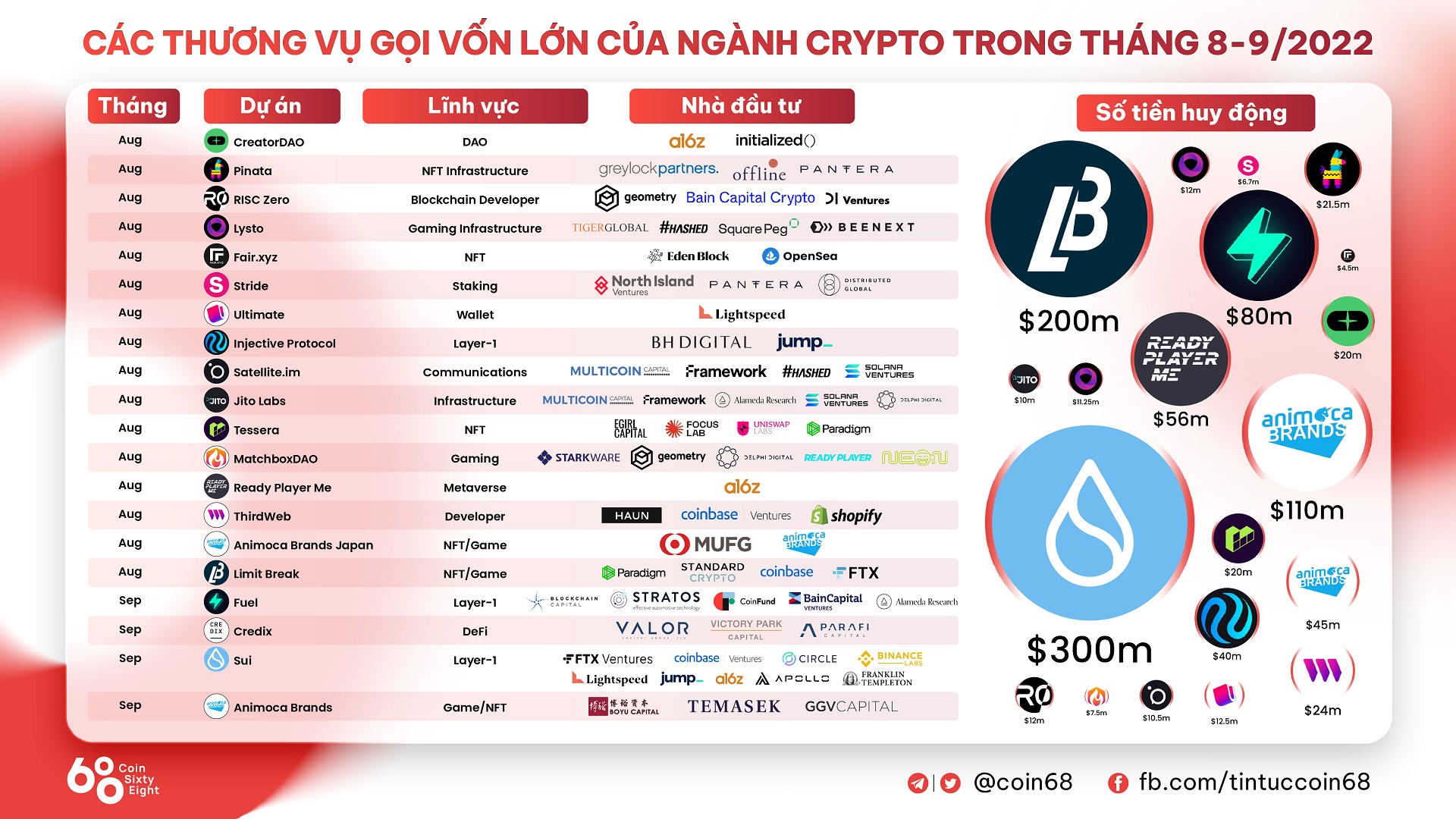

As reported in September 2022, Mysten Labs closed a $300 million funding round led by FTX Ventures, along with major VC names this kind of as Coinbase Ventures, Binance Labs, and a16z. At the time, Mysten Labs was valued at $two billion.

Thanks to this funding round, Sui Network (SUI) produced by Mysten Labs has speedily emerged as a formidable Layer-one competitor, capable of competing with Aptos or Sei Network.

Of program, neither Dave nor Mysten Labs are suspects in this situation. However, if FTX’s insolvency practitioner gathers enough proof that the two investments outlined over had been produced with FTX’s consumer money, he may well be capable to recover the money.

This can impact the money problem of the venture, particularly one hundred million bucks is not a tiny volume.

Synthetic currency68

Maybe you are interested: