Bitcoin L2 Labs, the main development team behind Stacks, just announced the successful launch of its 1:1 Bitcoin-backed programmable asset on the mainnet, sBTC. This is a major step forward in building the on-chain Bitcoin economy and follows the October Nakamoto upgrade, which brought faster transactions and 100% Bitcoin transaction completion to the Stacks network.

For the broader Bitcoin community, this is more than just a milestone — it heralds a new era of programmable Bitcoin. The world’s most secure blockchain can now actively participate in DeFi (DeFi).

sBTC Launches on Stacks Mainnet

sBTC is designed to unleash Bitcoin (BTC) liquidity and comes after Stacks launched the Nakamoto Upgrade at the end of August. It will allow BTC holders to access DeFi opportunities while remaining principled Bitcoin’s unparalleled security.

Specifically, users can participate in DeFi applications, such as lending and borrowing on protocols like Zest, decentralized exchanges (DEX) like Bitflow and ALEX, or even AI-based tools like aiBTC.

“Unlike locking BTC in proof-of-stake systems, sBTC is designed to be completely expressive and enable an on-chain Bitcoin economy. It can power decentralized lending services, DEXs, AI bots and more, while enjoying the 100% security of Bitcoin’s hashing power,” said Muneeb Ali, founder of Stacks, said in a press release shared with TinTucBitcoin.

One of the standout features of sBTC is its 1:1 Bitcoin guarantee, where the pioneering cryptocurrency fully backs each sBTC Token. Second, there is an institutional signing network, which helps reduce dependence on single entities, thereby enhancing trust.

Besides, sBTC has the 100% finality of Bitcoin, meaning it is protected by Bitcoin hashing power, ensuring solid security. Additionally, the product is transparently open source, providing transparency and verifiability to developers and users.

However, the current mainnet phase only introduces deposit-only functionality, capped at 1.K BTC. Despite this limitation, it will provide initial liquidity to developers and enable subsequent integration with institutional custodians and ecosystem partners.

According to the press release, withdrawals will only be made in Q1 2025 when the system transitions to a fully open arbitrary dot set. Depositors will also receive annual rewards of up to 5% in sBTC for holding assets, providing exceptional profit opportunities for Bitcoin Holders.

Unlock Bitcoin’s Full Potential

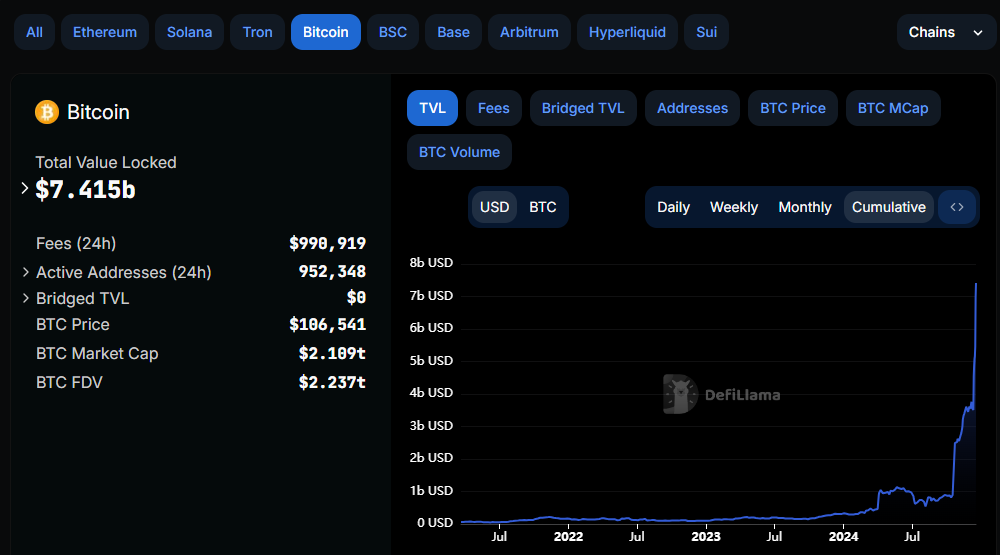

Meanwhile, the launch of sBTC is preparing to bring Bitcoin closer to Ethereum’s dominance in the DeFi space. While Ethereum boasts a total value locked (TVL) of nearly $80 billion, according to data from DefiLlama, Bitcoin is fast approaching after toppling Binance Smart Chain (BSC).

The successful implementation of sBTC is laying the foundation for a stronger Layer-2 Bitcoin ecosystem. Gradually phasing out the BTC cap, introducing withdrawals and transitioning to a permissionless signing network, could drive adoption even further. With sBTC, Bitcoin is no longer just a store of value but also a versatile asset for decentralized applications (dApps).

“With sBTC, Bitcoin becomes more than just a store of value, unlocking the full potential of BTC in decentralized applications,” noted Andre Serrano, Head of Product at Bitcoin L2 Labs. strong.

This development also enhances opportunities for DeFi builders. Zest Protocol, for example, allows users to earn additional rewards for holding sBTC.

“Earn more Zest points. Simply holding sBTC gives users a 5% return, thanks to the Stacks rewards program. With Zest, users can enhance their returns with sBTC,” the platform has noted.

With Bitcoin capital flowing into DeFi protocols, builders, developers, and users will benefit from enhanced liquidity and innovative financial tools.