The US Securities Commission (SEC) has just filed a new lawsuit accusing Kraken of working an unlawful on the web trading platform.

SEC Sues Kraken for Illegal Trades, Stirring Client Funds. Photo: cryptopolitana

After the two prominent names Coinbase and Binance, Kraken is the most recent target of the US Securities Commission. According to press data launched this morning (November 21), the SEC just did legal action is focusing on Kraken’s mother or father organizations, Payward and Payward Ventures, for allegedly engaging in on the web trading action in violation of federal securities laws.

JUST IN: 🇺🇸 The SEC accuses Kraken of working as an unregistered stock exchange, broker, and dealer. pic.twitter.com/19qyNYJzX2

— Bitcoin Magazine (@BitcoinMagazine) November 20, 2023

In paperwork filed with the Northern District Court of California (USA), The SEC confirmed that the organization is based mostly in San Francisco not registered with the SEC in any capabilitywhilst the exchange operates as a broker, dealer, exchange and clearing residence for a lot of assets regarded as securities underneath US law.

From that, SEC fees towards Kraken bypass the authorities as very well as rules aimed at defending traders, shifting possibility to the public, pocketing billions of bucks in commissions and trading revenues.

At this level, the lawsuit continues to target Kraken’s company operations, inner controls, and reporting. The SEC stated that was the word mixing purchaser deposits with its personal assets. Today’s incident continues to show the significance of SEC and regulator registration to defending U.S. capital markets, the Securities and Exchange Commission additional.

“Kraken at times held over $33 billion in client cryptocurrencies and mixed them with its own assets, creating significant losses for its clients.”

Likewise, Kraken mixed a lot more than $five billion in standard purchaser liquidity with its personal liquidity. Sometimes the floor also pays working expenditures immediately from customers’ money accounts.

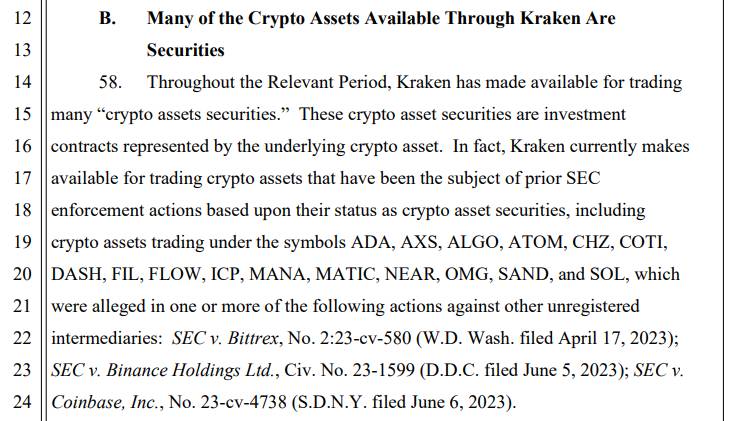

Subsequently, the Federal Regulatory Agency listed a checklist of tokens that it listed as securities, such as Algorand (ALGO), Polygon (MATIC), Close to Protocol (Close to)… According to the lawsuit, Kraken played a function in direct promotion of these tokens to the investing public.

List of SEC tokens listed as securities. Source: SEC complaint

List of SEC tokens listed as securities. Source: SEC complaint

With the over fees, the SEC needs the court to challenge a long term injunction, forcing the defendants to comply with securities laws and demand reimbursement of the misplaced cash. Furthermore, the committee also needs to “abolish” Kraken’s function as an exchange, broker, agent and clearing company. Previously, Bittrex had also faced comparable disasters and the value to pay out was the closure of its US branch founded 9 many years in the past.

Also this morning, Kraken confirmed the data reported by the SEC, publicly announced its disagreement and will operate to refute the agency’s allegations.

Today, the SEC filed a complaint alleging that Kraken operates as an unregistered nationwide securities exchange, broker, and clearinghouse. We disagree with their claims and intend to vigorously defend our place. https://t.co/a0C4wzBo3f

— Kraken Exchange (@krakenfx) November 21, 2023

In February this yr, The SEC asked Kraken’s mother or father organizations Payward Ventures and Payward Trading paid a $thirty million fine and completely banned the exchange’s staking services on the US marketplace.

At the time, Kraken neither admitted nor denied the SEC’s allegations and agreed to “dissolve” the staking facility in addition to paying out a civil fine. However, the exchange continues to open this services to consumers outdoors the United States by means of its subsidiary.

Further updates on Kraken, the exchange has just uncovered its intention to produce layer-two and enable the British police refund $two million to victims of a scam. The exchange also a short while ago appointed a new CEO in the United kingdom.

Coinlive compiled

Join the discussion on the hottest troubles in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!