This is deemed the most up-to-date move by the SEC in the escalating battle amongst this company and the cryptocurrency marketplace.

The United States Securities and Exchange Commission (SEC) is to file a lawsuit towards Paxos Trust Company as issuer of BUSD, claiming that the coin is an unregistered safety, second Wall Street Journal.

The SEC has advised cryptocurrency company Paxos Trust Company it intends to sue the corporation for violating investor safety laws https://t.co/kTHTkB9GjG

— WSJ Markets (@WSJmarkets) February 12, 2023

According to sources acquainted with the matter, the SEC sent a observe letter (Wells Notice: for companies the SEC is about to sue) to Paxos stating that the enforcement action was due to issuer BUSD acquiring “violation of the investor protection law“. The letter also reads “Binance USD is an unlicensed safety“.

Binance USD, or BUSD, is a Binance-branded stablecoin pegged one:one to the USD, which the exchange partnered with Paxos launched in 2019.

As of January 31, 2023, Paxos manages $sixteen.15 billion of BUSD collateral, which contains money (three.94%), US Treasury expenses (twenty.58%) and repurchase agreements (75.48%).

In a statement, Binance stated that BUSD is issued and owned by Paxos and is solely tied to its brand. “We will continue to monitor the situation and problems of Paxos,” the statement go through.

However, the Wells observe is not the ultimate phase to indicate that the SEC will act. The agency’s 5 commissioners will have to vote to proceed with any dispute. According to Investopedia, right after getting the Wells Notice, the defendant has thirty days to reply with a legal quick identified as a Wells Submission, which contains arguments to counter the former allegations.

Less than three days in the past, this well-liked stablecoin issuer has just come beneath investigation by the New York government, but the motive is nevertheless unknown. It is uncomplicated to see that the SEC it is growing the training of its electrical power on the cryptocurrency marketplace. Last week, Kraken has agreed to completely halt staking items in the US and shell out a $thirty million fine to the SEC. President Gensler was stationary at the time “discourage” the cryptocurrency industry after the sanction.

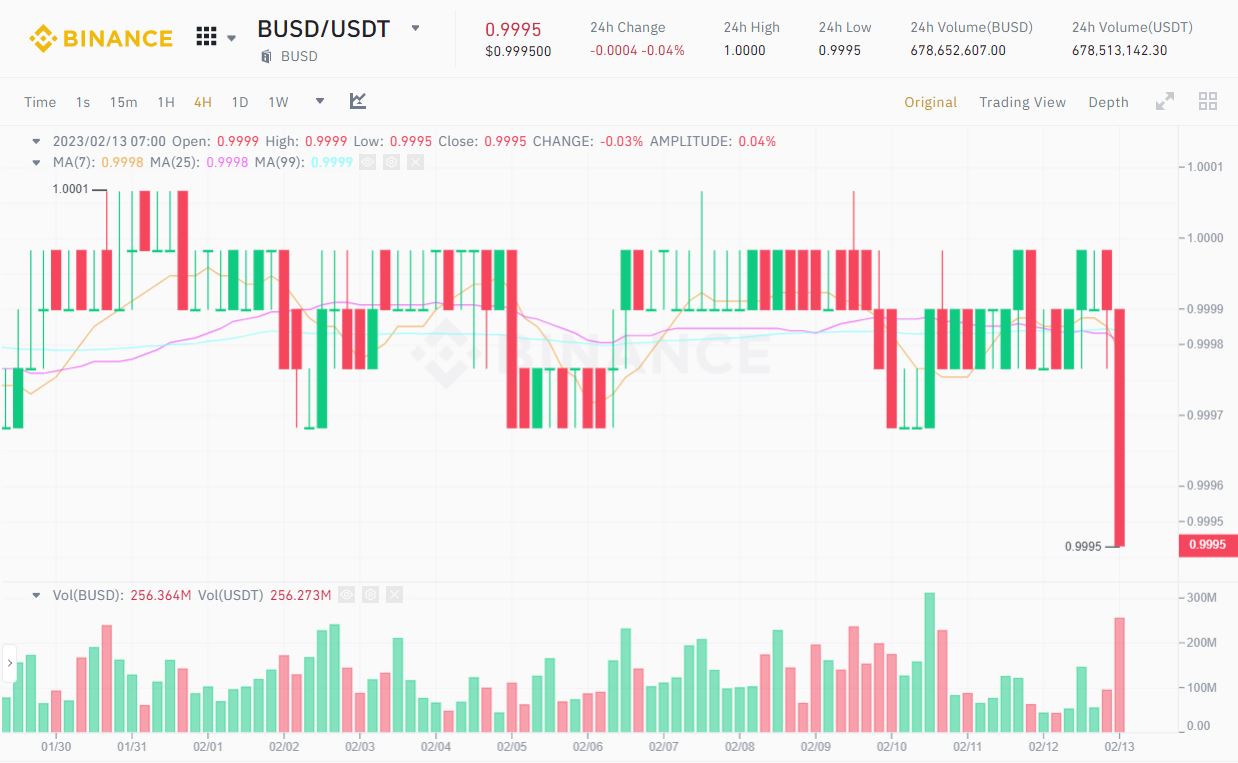

However, prior to the over information, the stablecoin with the third biggest marketplace capitalization was depeg somewhat in the $.9995 location. This response as well uncomplicated to realize as in the previousWhen The FUD series on Binance is peaking.

Meanwhile, BNB has decreased in the final 24 hrs but the response is not sturdy and it would seem that the marketplace is not as well detrimental.

Synthetic currency68

Maybe you are interested: