Bitcoin (BTC) has viewed its 2nd worst yr to date (YTD) in 2022 considering the fact that its launch – which is predicted to continue to be flat right up until 2023, in accordance to Arcane Exploration (AR).

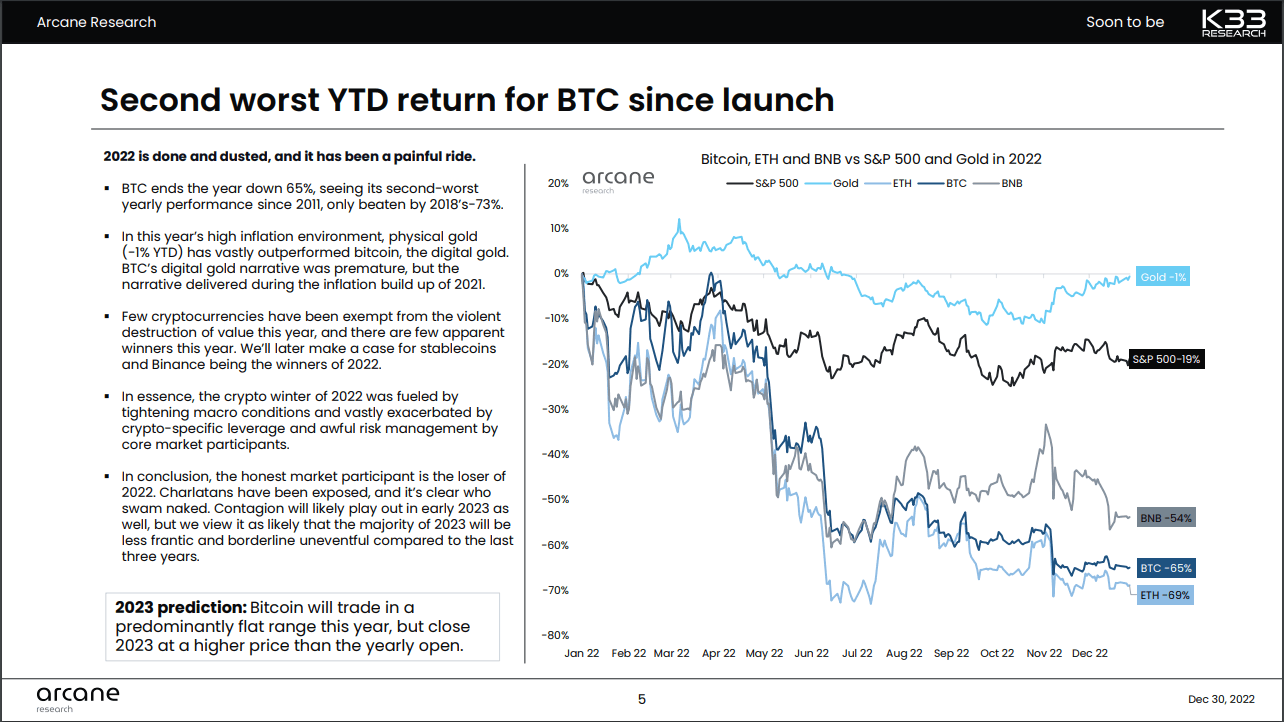

Down 65% at the finish of 2022, BTC underperformed just on one more event — in 2018, down 73% yr-above-yr.

Compared to gold and the S&P 500, cryptocurrencies are the most impacted in terms of worth in 2022 — plummeting in May 2022 and mid-June 2022, in accordance to AR information.

“Crypto winter of 2022 fueled by tightening macro conditions and exacerbated by crypto-specific leverage and poor risk management by market participants core.”

AR says – if reached in 2023 – the next BTC market bottom “will be the longest BTC draw ever.”

“23rd Prediction: Bitcoin will trade in a mostly flat range this year, but close 2023 at a premium above its yearly opening.”

According to AR information, following a yr of central financial institution tightening, 2022 has grow to be “a big dollar deal,” as all assets are revalued though the dollar gets to be costly. than.

“In 2022, the Federal Reserve’s effective funds rate increased from % to 4.25%, leading to a massive re-pricing of risky assets, all of which benefited from easy money making. and low interest rates by the end of 2022 and throughout 2021.”

AR predicts that the Federal Reserve will increase curiosity prices in the initial half of 2023.