Bitcoin deposits and withdrawals related with exchanges are generally great indicators of market place sentiment.

As the variety of exchange deposits increases, the provide of liquid Bitcoin increases and signifies the market’s willingness to trade. In contrast, as the variety of withdrawals on exchanges increases, traders seem to be to be much less interested in trading and searching to hold their BTC off exchanges.

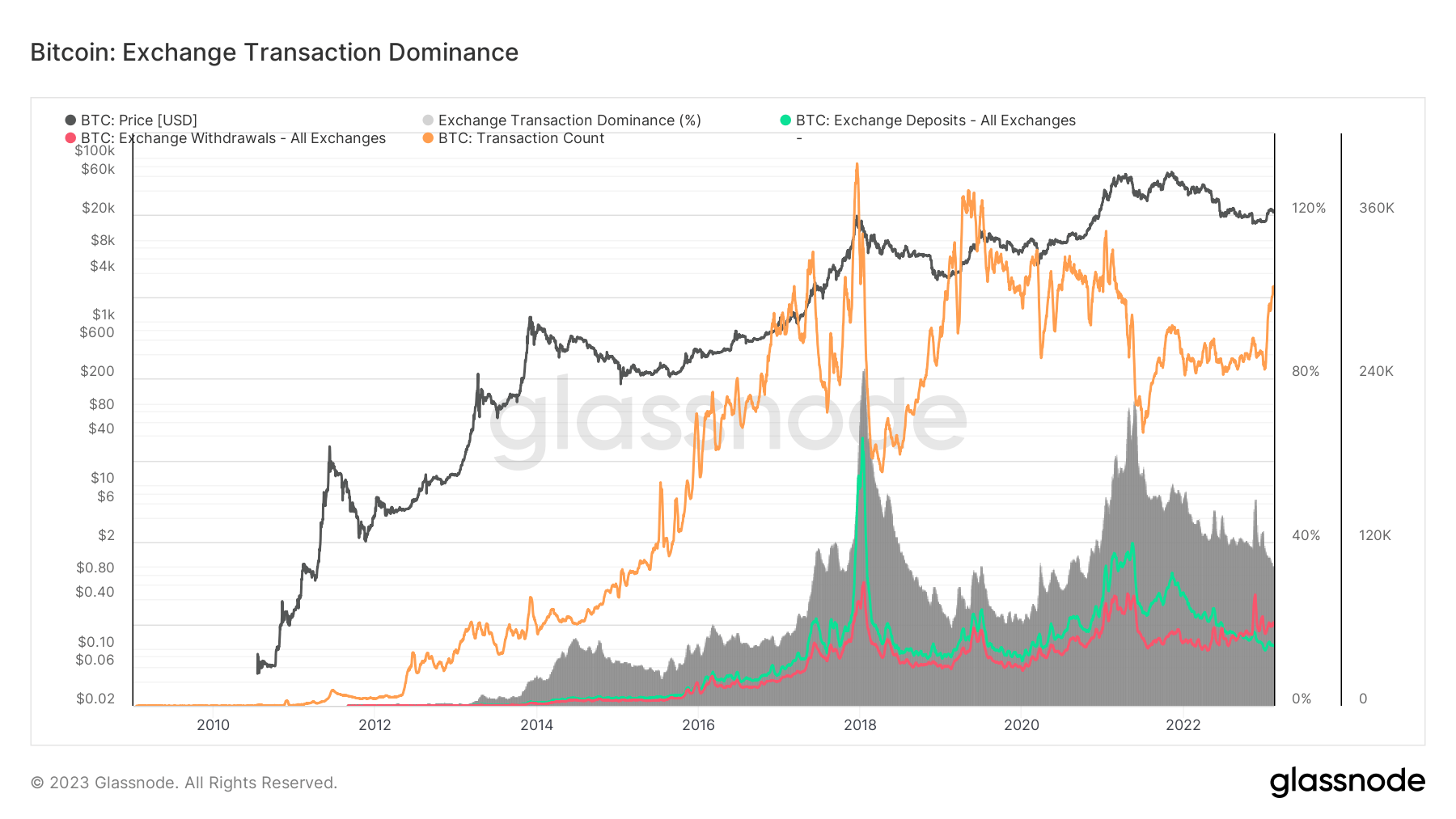

Looking at these exchange-relevant transactions towards the complete variety of Bitcoin transactions can indicate no matter whether the market place is getting ready for a bull run.

In February 2023, the complete variety of Bitcoin transactions passed 307,000, reaching a two-12 months large, information analyzed by CryptoSlate Shows,

Past transaction volume peaks correlate with Bitcoin rallies. The 400,000 transactions recorded at the finish of 2017 assisted fuel the bull run that pushed Bitcoin to an all-time large of $twenty,000. About 80% of all Bitcoin transactions at the time have been exchange-relevant, with the bulk getting exchange deposits.

The subsequent spike in trades followed a equivalent pattern – the rising variety of transactions spurred a bull run that started to right following the variety of transactions peaked. Both deposits and withdrawals on the exchange enhanced appreciably, with deposits exceeding withdrawals.

The prior large variety of transactions recorded in early 2021 echoed this pattern. However, the Bitcoin cost started off to rise even following the variety of transactions peaked, indicating a cost rally all through the 12 months driven by derivatives.

Since 2014, the dominant trend is that deposits on the exchange outstrips withdrawals. This trend was broken in September 2022, when withdrawals have been far more than deposits – September 2022, 53,000 BTC have been withdrawn and 52,000 BTC have been deposited on exchanges.

This trend has only grow to be more powerful considering the fact that the crash of FTX. In November, withdrawals amounted to 81,000 BTC as traders raced to withdraw their money from centralized exchanges. On February eleven, 44,000 BTC have been deposited into exchanges, though 61,000 BTC left exchanges. The distinction amongst withdrawals and deposits exhibits that traders are continuing to consider ownership of the coins they obtained all through the drop.

The declining dominance of exchange transactions more confirms this — much less than 35% of all Bitcoin transactions in February have been exchange-relevant.

With a huge sum of BTC now getting withdrawn from exchanges, Bitcoin’s illiquid provide has noticed major development. Simply place, the liquidity of the Bitcoin provide exhibits how a great deal income is in fact accessible to get and promote. A expanding variety of illiquid Bitcoins (i.e. cold storage and dormant coins) is frequently regarded a solid bullish signal as it signifies solid investor sentiment.

Data analyzed by CryptoSlate exhibits an illiquid provide of Bitcoin commencing to maximize in September 2021.