What is the Shade Protocol (SHD)?

Shadow protocol is a linked DeFi application constructed on the secret network. Shade Protocol is designed for the goal of building an ecosystem that consists of algorithmic stablecoins that protect privacy, synthetic assets and indices, lending solutions, leveraged trading abilities, fixed earnings solutions and contract possibilities.

The very first solution of Shade Protocol

SILK is an interoperable and privacy-preserving stablecoin on Shade Protocol. Built on the secret network and implemented by way of the SNIP-twenty privacy token normal, Silk maintains transaction privacy for all token holders. Silk acts as a medium of exchange, i.e. a shop of worth (anchored to the USDT by way of the Band protocol oracle integrated into the Shade protocol).

How does the venture function?

stablecoin

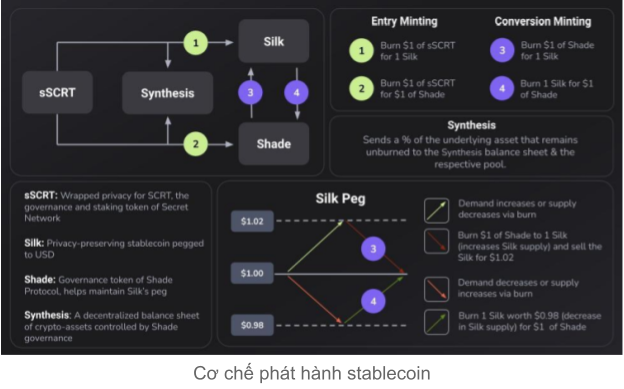

Operating mechanism of the venture for issuing stablecoins:

- Send sSCRT (Secret Network Governance Token) to mint a SILK token

- Send sSCRT (Secret Network Governance Token) to mint SHD tokens

- Burning SILK to launch SHD

- Burn SHD to cast SILK

SILK price tag equalization mechanism

When the price tag of SILK is trading over one USD. To deal with the exchange price differential, it is important to maximize the complete provide of SILK in buy to lower the price tag of SILK to the anticipated target of one USD this maximize in provide is facilitated by the following course of action: SHADE holders will burn up one USD for a worth of SHADE and mint one SILK (Shade conversion mint). This SILK holder will then have the possibility to trade the SILK which the industry values at $ one.02 (when the holder is minted at $ one) towards any readily available asset in the industry. When SILK is traded for significantly less than one USD, the over course of action is carried out in reverse.

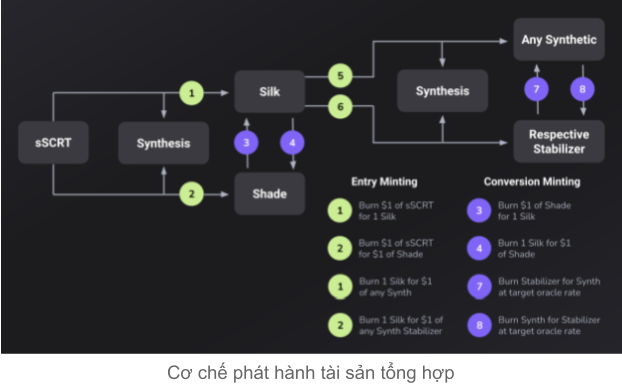

Mechanism of problem of synthetic assets

Shade Synthetic exclusively targets the S & P500, NASDAQ, gold, silver, bitcoin, ethereum, and any single currency claimed by the Shade local community as synthetic assets. Shade Synthetic will also aim to develop a crypto index that displays the best a hundred cryptocurrencies.

In standard, the mechanism of issuing and balancing the charges of synthetic assets on Shade Protocol is very similar to that of SILK. When enabling arbitrage consumers to modify the price tag of aggregated assets.

Basic information and facts about the SHD token

- Token title: Shadow

- Ticker: SHD

- Blockchain: Secret network

- Token variety: Utility, Governance

- Total offer you: Updating

- Circulating provide: Updating

Shadow Protocol Token Allocation

Updating

Token release routine

Updating

What is the SHD token for?

- Administration.

- Stakeout.

- Mining of other tokens.

SHD Token Storage Wallet

Updating

How to earn and very own SHD tokens

Updating

Where to get and promote SHD tokens?

Updating

Roadmap of the Shade Protocol venture

Q4 2021

- Launch token

- SecretSwap integration

- Improved UX / UI

Q1 2022

- Mainnet

- Synthetics

- Government V2

Q2 2022

- Launch of the international return derivation

- Start of activation of the synthesis reward

3rd quarter 2022

- Launch of the Shade Protocol Leverage solution

What is the long term of the Shade Protocol venture, should really I invest in SHD tokens or not?

Shadow protocol is a venture designed to problem stablecoins and synthetic assets. The project’s very first solution is the SILK stablecoin, so the venture will aim to problem a amount of other synthetic assets in the long term. Through this posting, you ought to have by some means grasped the fundamental information and facts about the venture to make your investment selections. Coinlive is not accountable for any of your investment selections. I want you achievement and earn a great deal from this possible industry.