Canadian businessman and “Shark Tank” star Kevin O’Leary has criticized Binance, claiming it intentionally brought about FTX to crash.

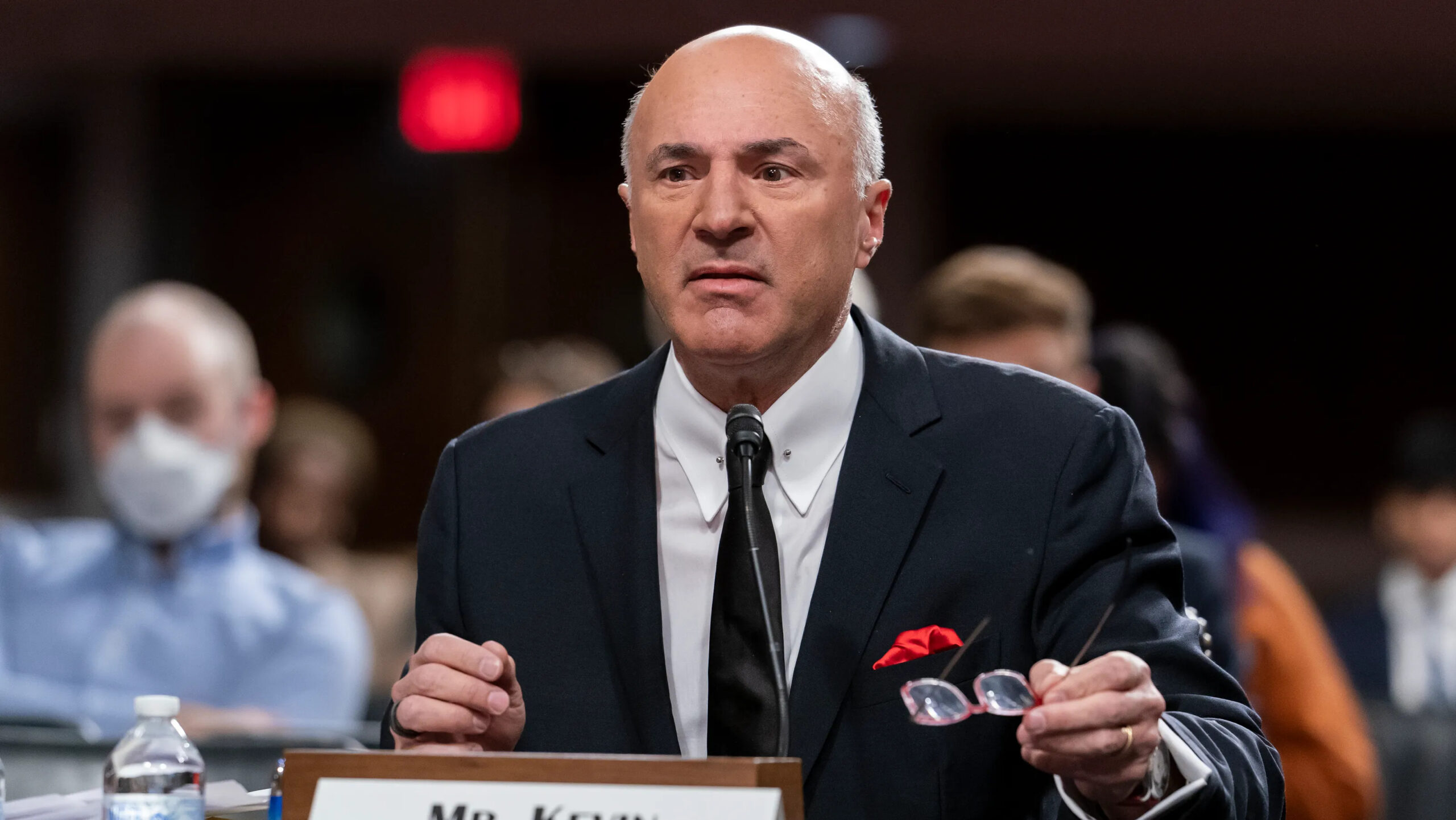

Speaking at a US Senate hearing on December 14, Kevin O’Leary straight criticized Binance for deliberately leading to the collapse of FTX for the reason that the exchange presently holds a monopoly place in the loosely managed crypto-income market place by governments.

Accordingly, Mr. Kevin O’Leary stated the following:

“This is my view, not the registered one particular. They want to purposely get the opponent out of the game.”

JUST IN: Kevin O’Leary testifies at Senate hearing and says #Binance reluctantly place FTX out of organization. pic.twitter.com/90pYPYrU5J

— Watcher.Guru (@WatcherGuru) December 14, 2022

It is achievable that Kevin O’Leary relied on Binance’s sudden hefty chain of “impact” occasions on FTX. Notably, on November seven, Binance announced its selection to promote FTT soon after a lengthy investment time period given that 2019. Afterwards, Binance promptly announced that the exchange had signed a non-binding agreement to purchase back FTX with the non-income amount disclosed.

However, Binance eventually canceled the deal, FTX went bankrupt, and Sam Bankman-Fried stepped down as CEO quickly soon after. On the other hand, a great deal of info has appeared that in advance of FTX, Binance had “cancelled” with numerous other cryptocurrency providers. Therefore, this action by Binance is believed by a aspect of the local community that the exchange is “deliberately” enjoying badly with FTX. Notably, trading volume on Binance greater by thirty% soon after the FTX crisis.

Indeed, Kevin O’Leary grew to become a scorching subject of discussion in the cryptocurrency local community soon after the FTX crash due to his defense of Sam Bankman-Fried.

Kevin O’Leary was paid $15 million to act as a spokesperson for FTX.

Meanwhile he explained this:

“I’m a bit of a fan of Sam. He has two mothers and fathers who are compliance attorneys.

“If there’s ever a place I could be, that I won’t get in trouble, it’s going to be at FTX.” pic.twitter.com/FSyvTQ6HXS

— uncommon_whales (@uncommon_whales) December 8, 2022

According to numerous viral sources, Kevin O’Leary’s bias for FTX is for the reason that he has been paid up to $15 million by FTX as a brand ambassador for the exchange in advance of. Furthermore, in spite of obtaining this kind of a higher salary, the shark even now turned out to be a significant “loss” for FTX, which produced the local community “outraged” which includes Binance CEO Changpeng Zhao’s comment.

It looks that $15 million has not just modified @kevinolearytvHis mastermind on cryptocurrencies, has also aligned him with a scammer. Is he significantly defending SBF?https://t.co/JoKapOcMXr (baseless attacks get started close to four:20am).

A wire. one/eleven

—CZ Binance (@cz_binance) December 9, 2022

“It seems that $15 million not only changed Kevin O’Leary’s mind about cryptocurrencies, but the money also linked him to a fraudster. Does Kevin O’Leary seriously defend SBF?”

eleven/eleven If @kevinolearytv he is on the lookout for an individual to blame for the FTX implosion, he should really get started by wagging his finger at his investment companion, Sam, and then possibly at the guy in the mirror.

—CZ Binance (@cz_binance) December 9, 2022

“If Kevin O’Leary is looking for someone to blame for the FTX crash, he should start by saying goodbye to his investment partner SBF and then perhaps himself.”

As for Kevin O’Leary, he himself verified on his individual web page in response to public view that his multi-million dollar investment in FTX was not genuine, though the public was just on the lookout at the connection with his behind the scenes association with FTX for mockery.

I have misplaced hundreds of thousands as an investor in @FTX and i was blasted as paid for the enterprise but soon after hearing that interview i am in the enterprise @billAckman camp on the boy! https://t.co/5lWzTT7JEv

— Kevin O’Leary aka Mr. Wonderful (@kevinolearytv) December 1, 2022

In a relevant advancement, former FTX CEO Sam Bankman-Fried was arrested in the Bahamas earlier this week and held in custody in the Bahamas until finally February 2023. To make issues worse, he is presently below investigation and faces dozens of criminal expenses by the Department of Justice, the United States Securities and Exchange Commission (SEC) and the Commodity Exchange Commission Commodity Futures (CFTC).

Synthetic currency68

Maybe you are interested: