The Shiba Inu (SHIB) value fell 5.6% over the past seven days, but is up 3% over the past 24 hours, marking an attempt to restore momentum. The Relative Strength Index (RSI) remained neutral at 50.9, suggesting balanced buying and selling pressure, while whale activity has stabilized after a recent decline.

SHIB is trading near key levels, potentially testing key resistance levels if the uptrend strengthens or finding support areas as selling pressure intensifies.

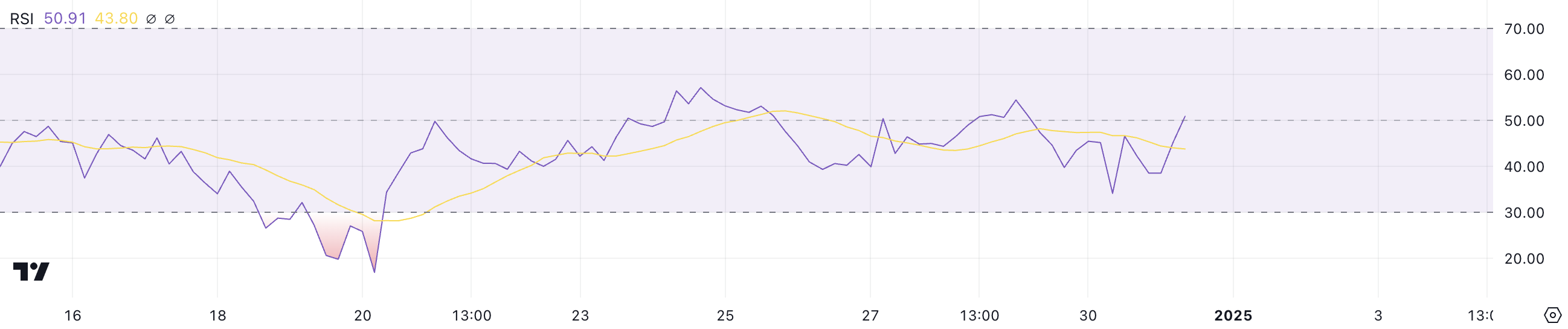

Shiba Inu’s RSI Has Remained Neutral Since December 20th

Currently, the Shiba Inu RSI stands at 50.9, remaining in the neutral zone since December 20. This level indicates there is a balance between buying and selling pressure, with no dominance any clarity from any side. The stability of the RSI shows that SHIB price is in a consolidation phase, as traders are hesitant about the next direction.

This neutral reading reflects a lack of significant momentum, leaving the price susceptible to external factors or changes in market sentiment.

RSI is a momentum indicator that measures the speed and strength of price movement on a scale from 0 to 100. Readings above 70 typically indicate overbought conditions, which can signal the possibility of a price correction, in When indexes are below 30, it suggests oversold conditions and a possible recovery.

With SHIB’s RSI at 50.9, it is near the midpoint, indicating neither overbought nor oversold conditions. In the short term, this neutral RSI suggests SHIB price may continue to trade in a range unless there is a clear increase in buying or selling activity to push the momentum in a clear direction.

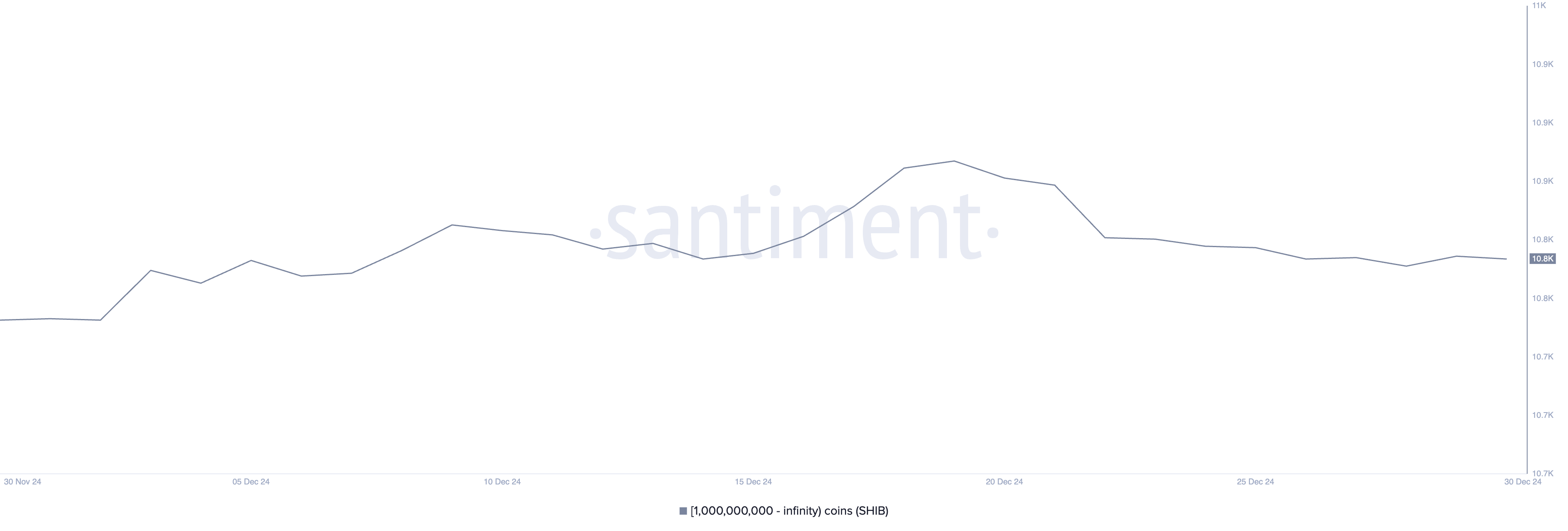

SHIB Whale Activity Stable

Shiba Inu whales, i.e. addresses holding at least 1 billion SHIB, reached a monthly peak of 10,930 on December 19 but have been steadily decreasing since then.

The number of SHIB whale addresses is now 10,861 and has remained below 10,900 since December 20. This stabilization follows a period of decline, suggesting that large investors are neither aggressively accumulating nor decreasing Their position is considerable at the present time.

Tracking the activities of “whales” is important because these large investors often drive market trends because of their ability to make large transactions. Their accumulation can create growth momentum, while distribution can lead to selling pressure.

The current stability in the number of SHIB whales indicates that there is still neutrality in the sentiment of large investors.

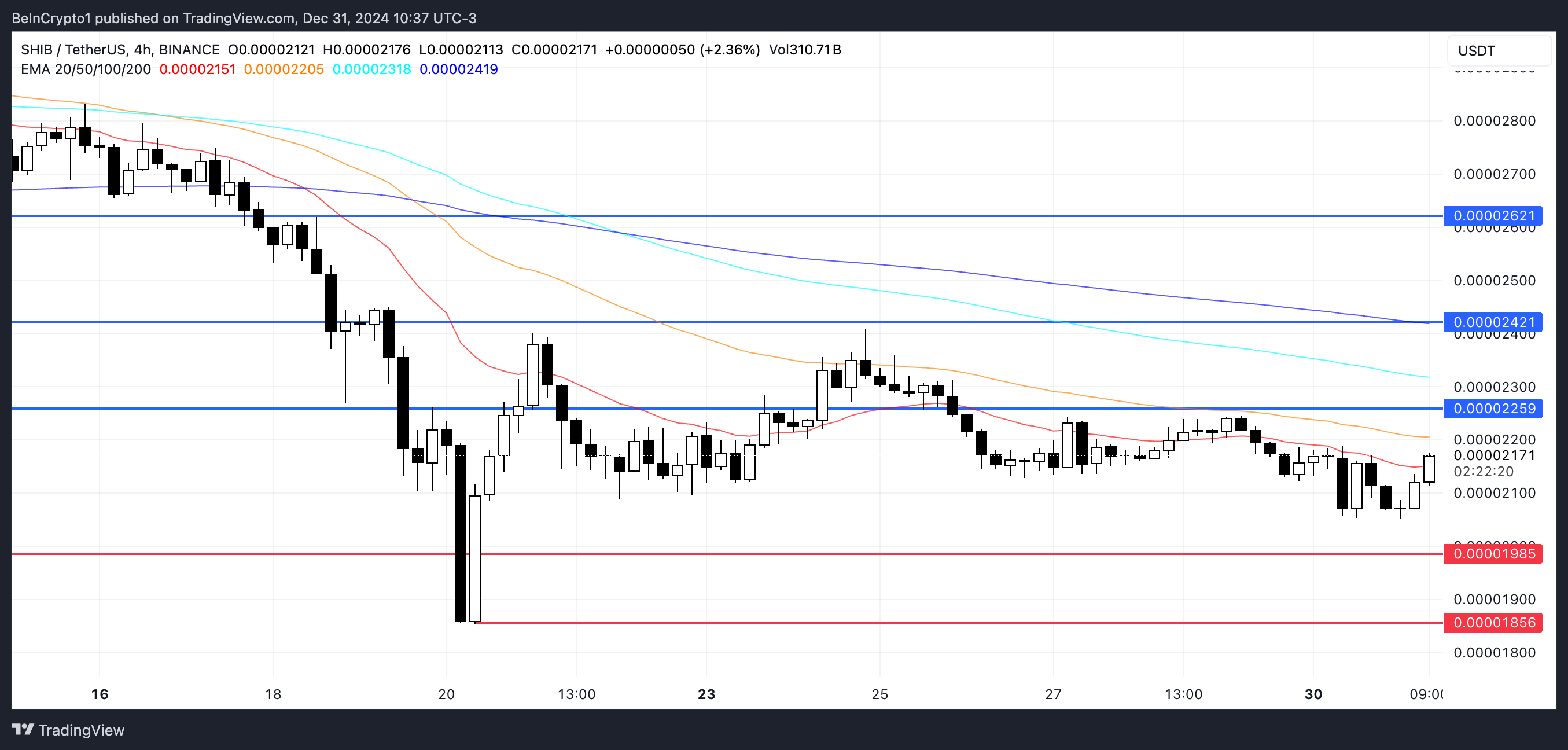

SHIB Price Forecast: Will the Recovery Continue?

If the current uptrend strengthens, Shiba Inu price is likely to test the resistance at $0.0000225. A break above this level could pave the way for further gains, with the next resistance targets at $0.000024 and $0.000026.

A strong uptrend would signal stronger upward momentum, potentially attracting more buying interest and pushing SHIB prices higher.

However, if the uptrend loses momentum and a strong downtrend prevails, SHIB price could test the first level of support at $0.0000198. If this level fails to hold, the price could fall further to $0.0000185, signaling intensifying selling pressure.

These key resistance and support levels will likely determine SHIB’s near-term trajectory, with traders keeping a close eye on whether bullish or bearish dynamics will prevail.