Shiba Inu (SHIB) prices have fallen 10% over the past seven days, following a December 7 peak when they hit their highest level since January 2024. The recent decline highlights weak bearish momentum, with indexes important as RSI and DMI reflect a negative shift in market sentiment.

Although SHIB’s downtrend currently lacks significant strength, continued selling pressure could push the price towards key support levels. However, a recovery above key resistance could signal a potential reversal and renewed bullish momentum in the short term.

SHIB’s RSI has been neutral since December 20

The Shiba Inu’s Relative Strength Index (RSI) is currently at 40.4, down from around 57 just two days ago. This significant drop indicates a loss of buying momentum, with the market leaning towards bearish sentiment.

Movement towards lower RSI levels shows that sellers have taken control, pushing prices closer to the oversold zone, though not quite there yet.

RSI is a momentum indicator that measures the speed and magnitude of price movements on a scale from 0 to 100. Levels above 70 indicate overbought conditions, often leading to a correction, while levels below 30 indicate sees oversold conditions, which could lead to a recovery.

With SHIB’s RSI at 40.4, it remains within the bearish neutral range, pointing to some selling pressure without reaching oversold levels. In the short term, this could mean SHIB prices could continue to decline or stabilize near current levels unless there is strong interest from buyers to change momentum now.

The current downtrend of the Shiba Inu is not very strong

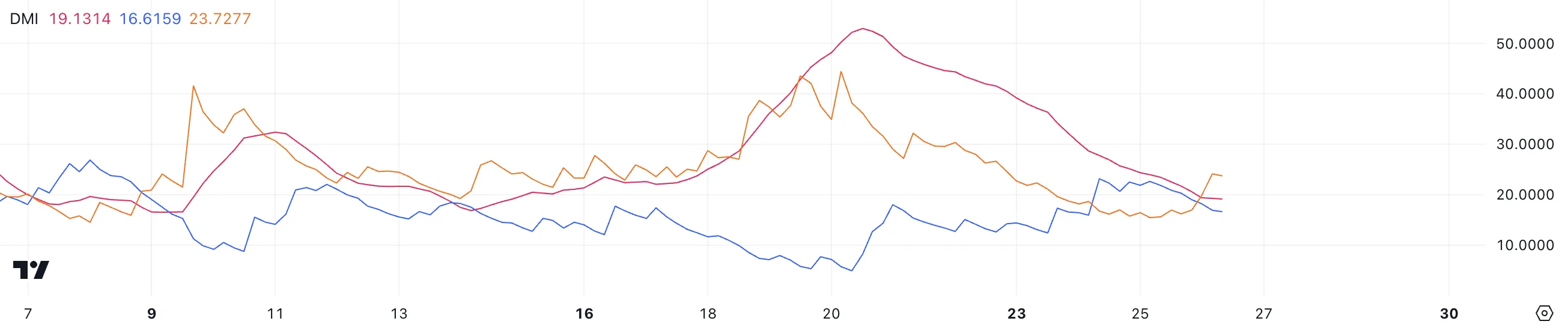

SHIB’s Directional Movement Index (DMI) chart shows its Average Directional Index (ADX) at 19.13, down from a higher level just three days ago. This decline in ADX indicates that the strength of the Shiba Inu’s current downtrend is weakening, although the trend remains.

The D+ index (positive direction indicator) fell to 16.6 from 23 two days ago, signaling a decline in buying momentum, while the D- index (negative direction indicator) rose to 23.7 from 18.6, reflecting increased selling pressure. This combination suggests that sellers currently dominate the market, with buying interest continuing to wane.

ADX is an indicator that measures the strength of a trend on a scale from 0 to 100, without indicating its direction. Values below 20 signal weak trends, while values above 25 represent strong trends. With SHIB’s ADX at 19.13, the downtrend lacks significant strength, although sellers remain in control as indicated by the higher D- index.

In the short term, this could mean SHIB prices could continue to come under downward pressure, although this weakening trend suggests the possibility of stabilization or consolidation if buying momentum begins to recover.

SHIB Price Prediction: Return to 0.000015 USD soon?

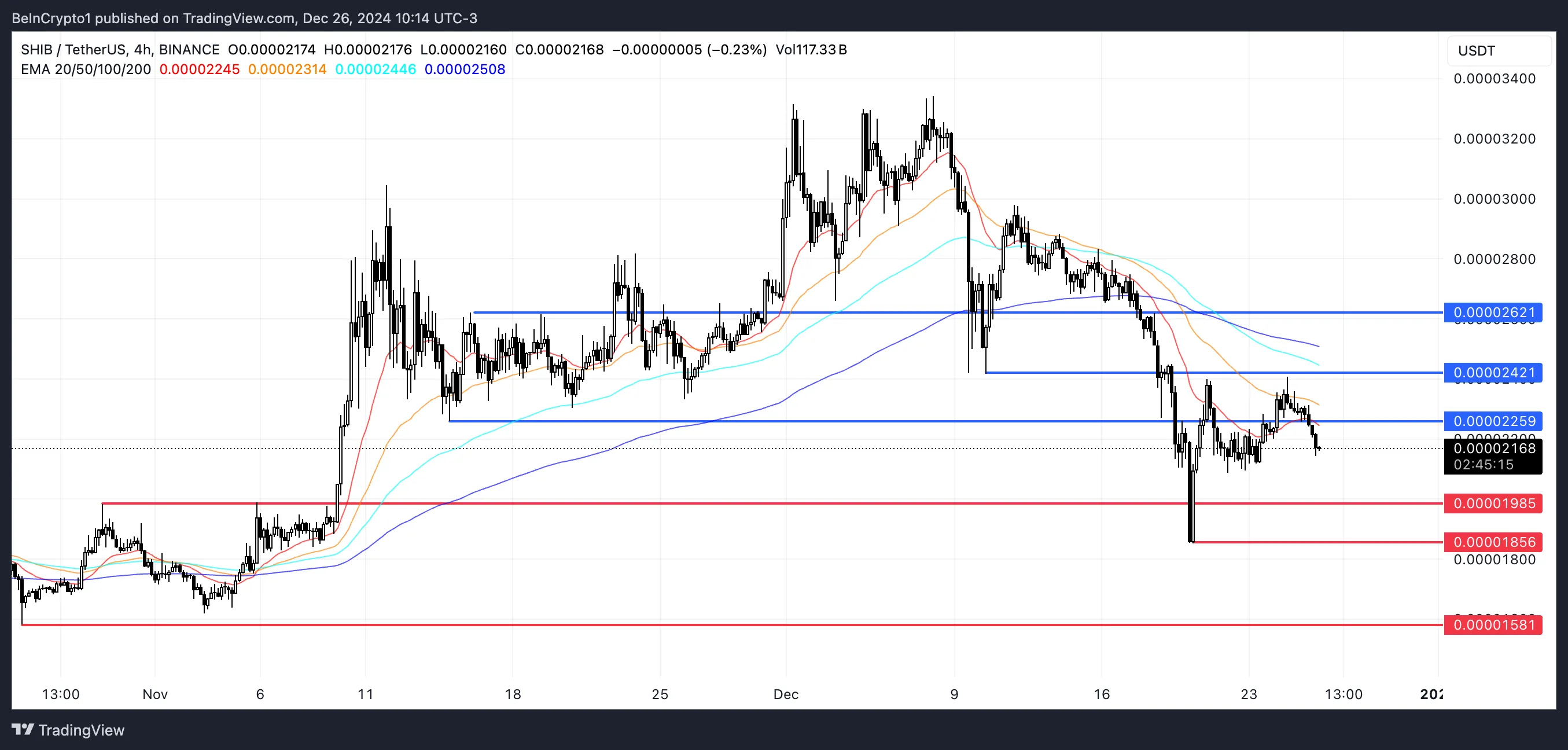

If SHIB’s current downtrend continues, the price could soon test the support at $0.0000198.

If the downtrend regains strength, SHIB price could continue to decline, with potential resistance levels around $0.000018 and $0.0000158 tested next.

Conversely, if SHIB price can resume its uptrend and overcome the resistance at 0.000022 USD, the token could aim for higher levels at 0.000024 USD and even 0.000026 USD.

These levels highlight the importance of the $0.000022 resistance and $0.0000198 support as key thresholds to determine whether SHIB can reverse its bearish trajectory and regain a more positive picture in the near future. short term no.