- The shift from extraction economy to RWA.

- BlackRock’s role in significant market shifts.

- Institutional momentum boosts tokenization trends.

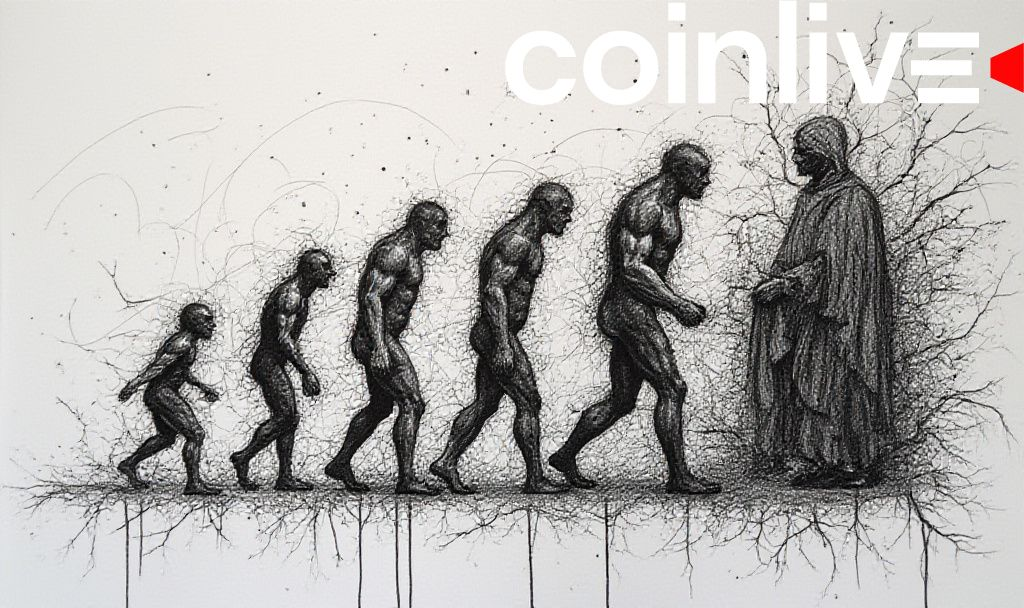

The Shift to Tokenization of Real-World Assets

The transition from the extraction economy, dominated by memecoins, to the tokenization of real-world assets (RWA) is reshaping the cryptocurrency landscape. Major players like BlackRock are spearheading these changes, fostering a more stable market environment.

Larry Fink of BlackRock emphasizes, “Tokenizing real-world assets isn’t about eliminating speculation but improving how productive assets operate and who can access them.” source

The tokenization trend involves various groups, from developers to institutional investors. Players like BlackRock are involved in developing RWA products, significantly impacting market dynamics.

Fractional ownership of productive assets through RWA is changing traditional finance, lowering investment minimums, and increasing global investors’ participation. Institutional involvement is expected to stabilize markets.

The tokenization movement offers insights into future financial frameworks, potentially leading to more regulated and transparent models. Historical trends suggest a transition from volatile to consistent growth, influenced by strategic institutional actions.

Anticipated outcomes include regulatory adaptations and technological advancements favoring RWA platforms. The tokenization model, supported by historical trends and current analyses, underscores a shift toward long-term investment viability. Strong returns are expected as more capital flows into these assets.