Many fiscal gurus estimate that El Salvador’s “Bitcoin bonds” are large chance simply because the nation has a large public debt ratio.

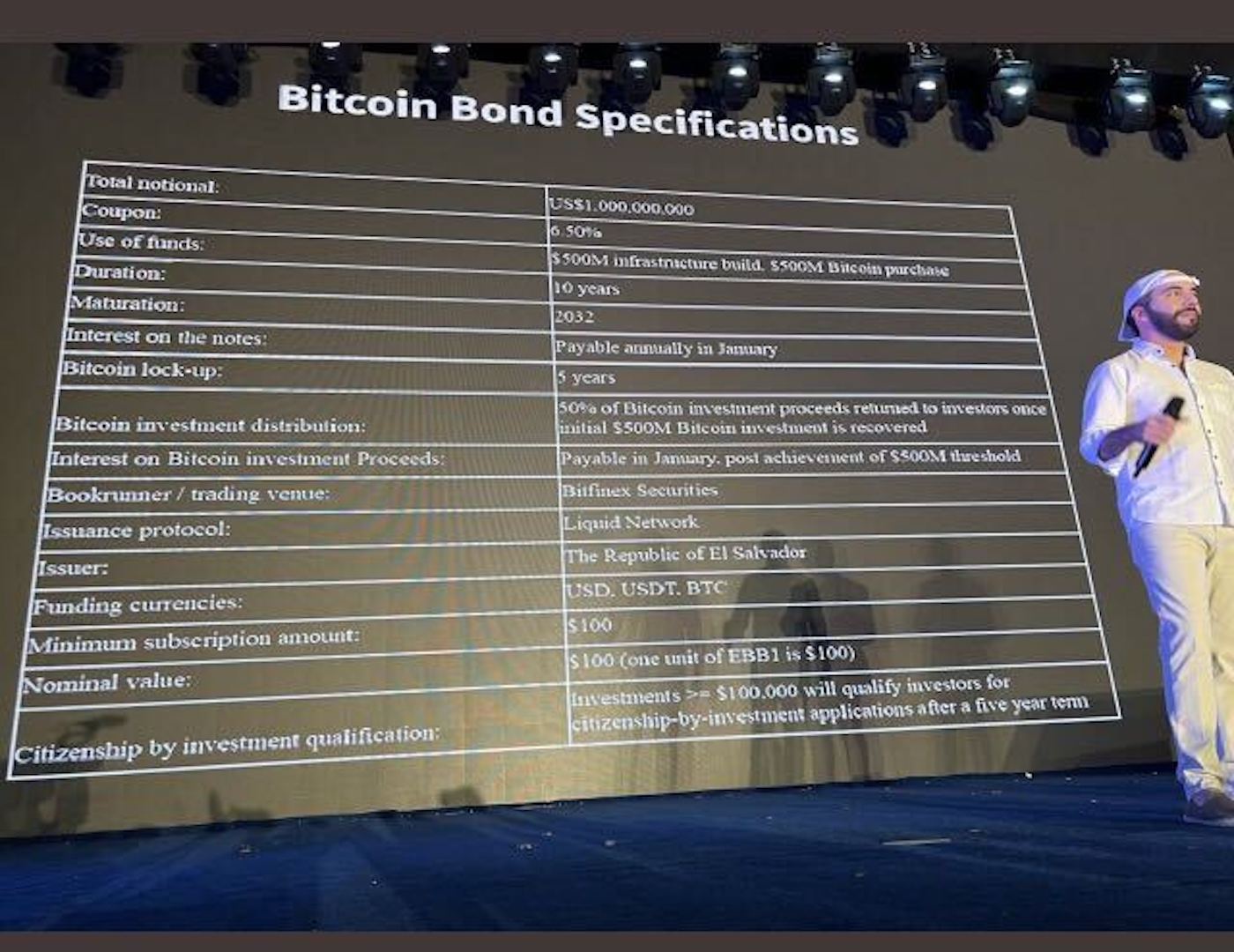

As reported by Coinlive, El Salvador President Nayib Bukele announced on November 21 that his nation will situation $ one billion in Bitcoin bonds, with half of the revenue raised going to be invested in Bitcoin, the rest will be invested in Bitcoin. develop a serious “Bitcoin city” with tons of tax incentives.

As a consequence, El Salvador will spouse with BlockStream and iFinex (Tether’s mother or father organization) to situation the aforementioned bonds in 2022, with a ten-12 months maturity and an yearly curiosity fee of six.five%. Additionally, traders also get dividends from El Salvador’s $ 500 million investment, commencing in 12 months 6.

BlockStream predicts that the curiosity fee on this stock in the tenth 12 months could attain 146%, wholly exceeding 13% of El Salvador’s government bonds or one.six% of US treasury payments. However, their judgment is primarily based on a model that predicts that the cost of BTC will attain $ one million inside of the following 5 many years, a target that would seem far-fetched at the minute.

Even so, Marc Ostwald, an financial analyst at ADM Investor Services International (ADMISI), believes traders in El Salvador’s Bitcoin bonds are betting huge with their revenue. He gave an interview to CoinDesk:

“Those who put their money into Bitcoin bonds are placing a lot of faith in this cryptocurrency, ignoring the credit status of El Salvador, a country in full debt crisis.”

As of 2020, El Salvador’s public debt is $ 21.9 billion, or virtually 90% of the country’s GDP. The detrimental image of the Latin American nationwide economic climate is also reflected in El Salvador government bonds, which fell from $ .13 to $ .073 in the final six months alone. Credit company Moody’s lately downgraded this bond’s rating from B3 to Caa1, equivalent to large-chance bonds.

Marc Chandler, strategist at Bannockburn Global Forex, shares with CoinDesk:

“I think El Salvador’s bonds are quite risky and their addition of Bitcoin is just to blind investors to the truth behind it.”

Furthermore, rather of allocating portfolios to Bitcoin bonds, Mr. Ostwald thinks it would be far better for traders to hold the cryptocurrency immediately rather than expose it by way of a compact country’s debt instrument. Commented:

“Certainly Bitcoin bond customers will be professional-crypto communities, but the query is, would not it be less complicated for them to invest in Bitcoin behind than to hold the debt instrument of a sinking nation? in crisis. Not to mention the “Bitcoin City” which will be constructed following to a volcano, expanding the degree of chance “.

Synthetic currency 68

Maybe you are interested: