- Singapore’s Monetary Authority mandates licenses for all blockchain firms.

- Non-compliance leads to fines or imprisonment.

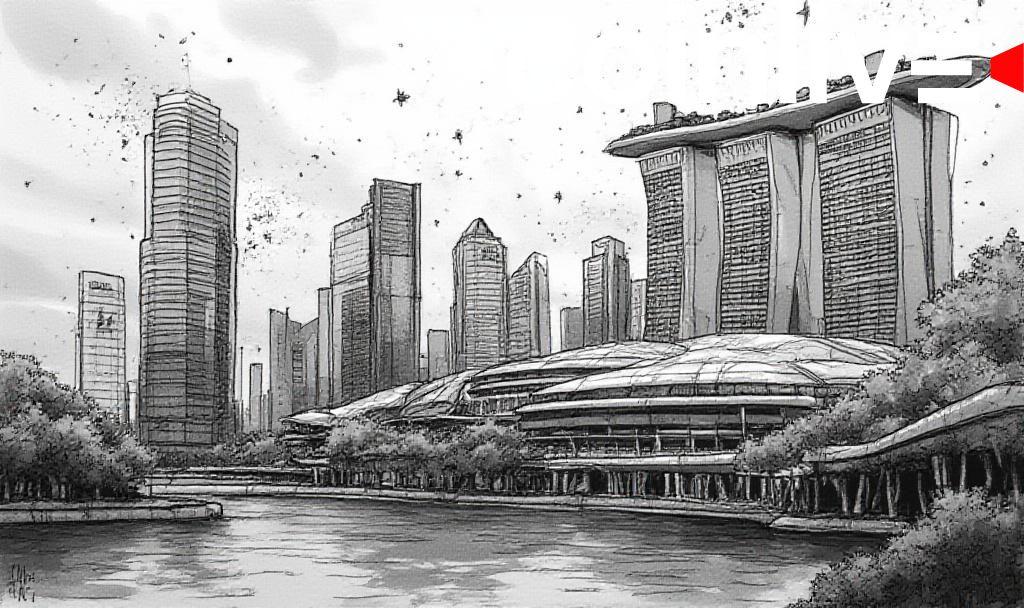

- Major assets face operational disruptions and potential relocations.

Singapore’s Monetary Authority has mandated all blockchain firms to secure a Digital Token Service Provider license by June 30, 2025, significantly changing the regulatory landscape in the sector.

Impact on Blockchain Companies

Blockchain companies in Singapore are facing a new regulatory landscape with the Monetary Authority of Singapore enforcing strict licensing regulations. All Digital Token Service Providers, including exchanges and trading desks, must comply by mid-2025. This affects firms like startups and established entities in the crypto sector.

Market Reaction and Financial Implications

The immediate market reaction involves firms re-evaluating their operational strategies. Compliance costs and risk assessments are rising, prompting some to consider relocating. As firms adapt, there may be disruptions in trade flows and potential liquidity impacts, particularly for ETH and BTC.

Financially, the crypto industry must grapple with increased operational costs due to new licensing and capital reserve requirements. The threat of significant fines or imprisonment adds pressure. The understanding of anti-money laundering in cryptocurrency is crucial, as regulatory emphasis is on closing gaps against money laundering risks, impacting both centralized and decentralized entities.

“All crypto firms, including those operating globally from Singapore, must secure an MAS DTSP License 2025 by June 30, 2025. Unlicensed operations face SGD 250,000 fines or three years’ imprisonment.”

Future Market Dynamics

Historically, regulatory crackdowns have resulted in shifts in trading volumes and asset flows. This action by Singapore could similarly reshape the regional market dynamics.

Firms unable to adapt may face reduced market share or be forced out, echoing past patterns from other major jurisdictions.