Cryptocurrency investment fund Sino Global Capital has confirmed its publicity to the FTX exchange, revealing seven-figure losses. Additionally, the fund mentioned it will proceed to invest in startups.

The Chinese investment fund posted a letter on its Twitter webpage on November 15. The announcement of the partnership concerning the firm and FTX, claimed to have been immediately impacted by the accident, was “7 figures”, but did not specify the actual volume of the harm.

– Sino Global Capital (@SinoGlobalCap) November 15, 2022

Sino Global expressed “deep regret for the misplaced trust” in FTX, the exchange is at the moment dealing with legal prerequisites concerning the management of consumer money and the “fraudulent” romantic relationship. ties “with the Alameda Research investment fund, which is mentioned to have borrowed billions of bucks in debt from FTX.

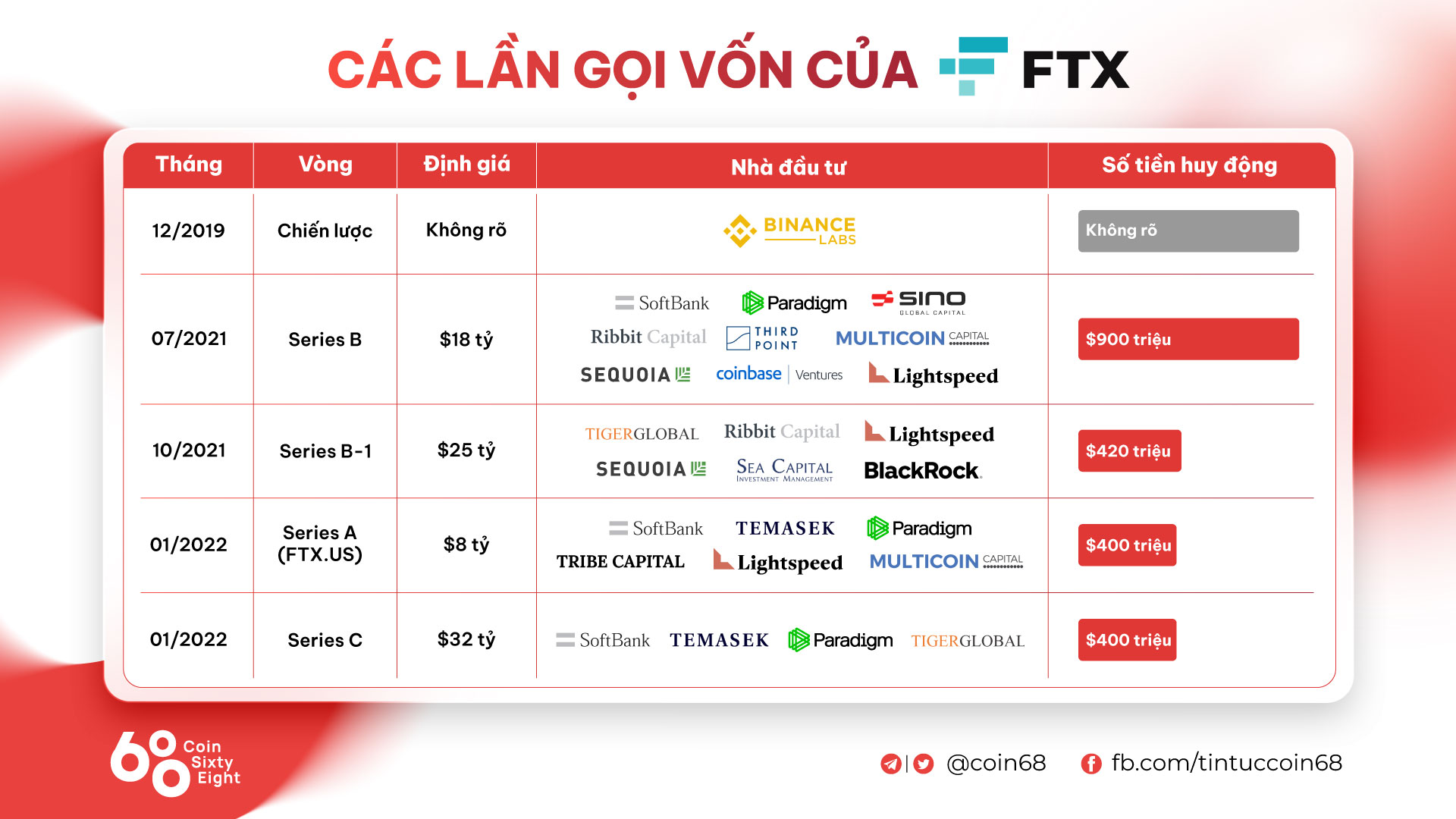

Sino Global was a single of the initially traders in FTX, which in January 2022 recorded assets underneath management for a worth of about 300 million bucks. Sino Global is acknowledged as a “big hand” investor for FTX connected tasks, namely Solana and Serum, There are also hundreds of complications immediately after FTX files for bankruptcy.

Sino mentioned he had invested in FTX equity shortly just before the fund’s launch and has not invested in FTX considering the fact that. To conclude, Sino reassured end users that the industry will recover, this is a challenging time period and the industry will undergo alterations with numerous new technologies, they nevertheless sustain their faith in blockchain technologies.

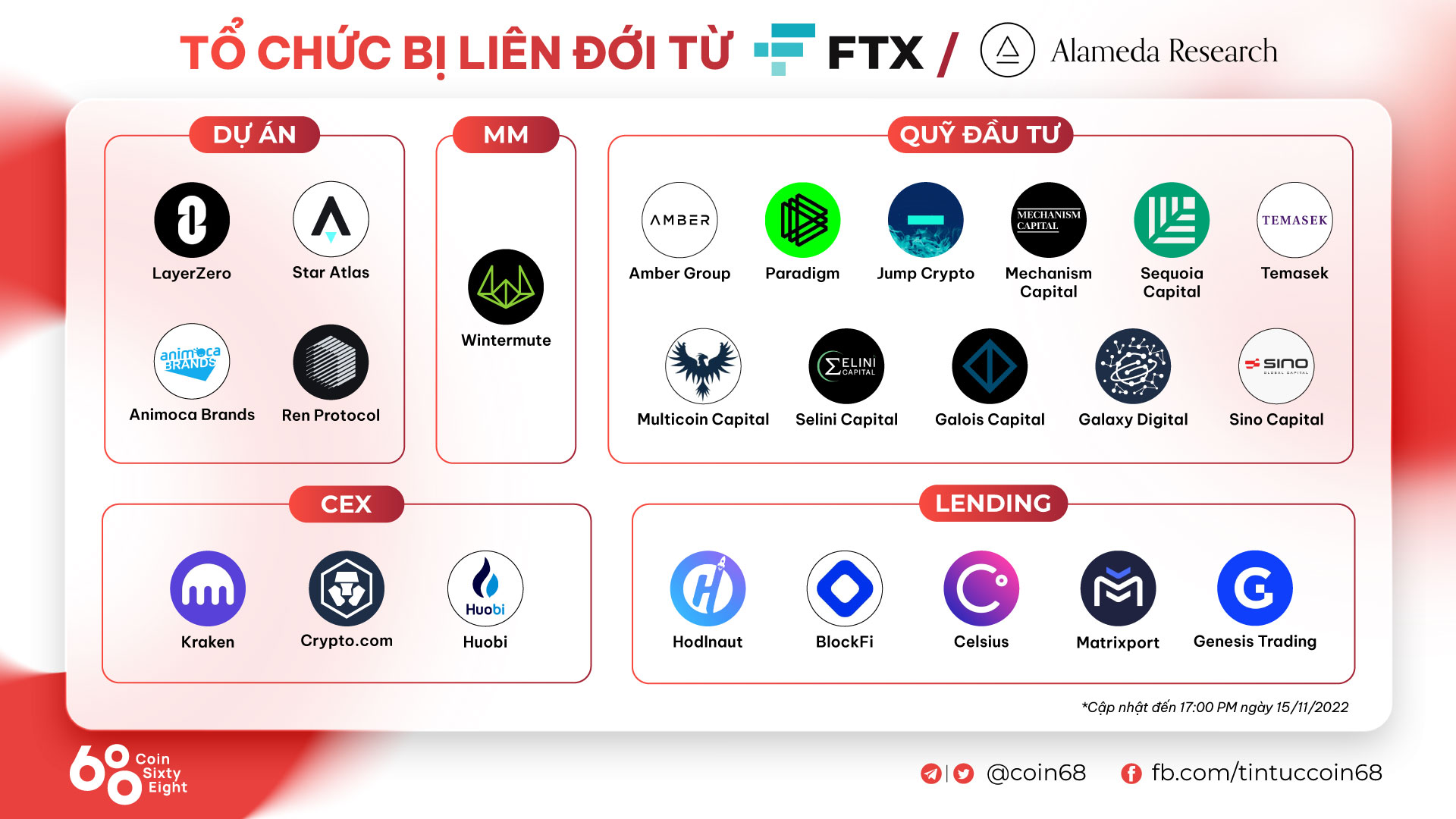

So Sino Global is the subsequent title to verify the effect of FTX threat. Before that, there had been a amount of “joint” tasks that confirmed the degree of harm, normally Huobi is caught at $ 18 million on the FTX exchangeadmitted to becoming the Galois Capital fund locked up to $forty million on FTX… Readers can refer to the short article Summarizes the organizations impacted by the collapse of FTX up to date by Coinlive till eleven/15.

At the identical time, numerous events have taken measures to “take out” FTX as of late Visa terminates cooperation with FTX exchangeBinance removes all spot pairs for FTT, leaving only FTT / BUSD or Kraken exchange blocks accounts connected to FTX and Alameda Research.

Synthetic currency68

Maybe you are interested: