[ad_1]

Solana (SOL) traders seem confident that the recent decline in altcoin prices is just a short-term pullback rather than a prolonged period of difficulty. This is clearly shown in the positions that Solana investors have chosen since the market went through the liquidation phenomenon, amounting to hundreds of thousands of USD.

But do the indicators agree with this view? Here is a thorough analysis of the potential price fluctuations of SOL.

Solana traders are confident in the altcoin recovery

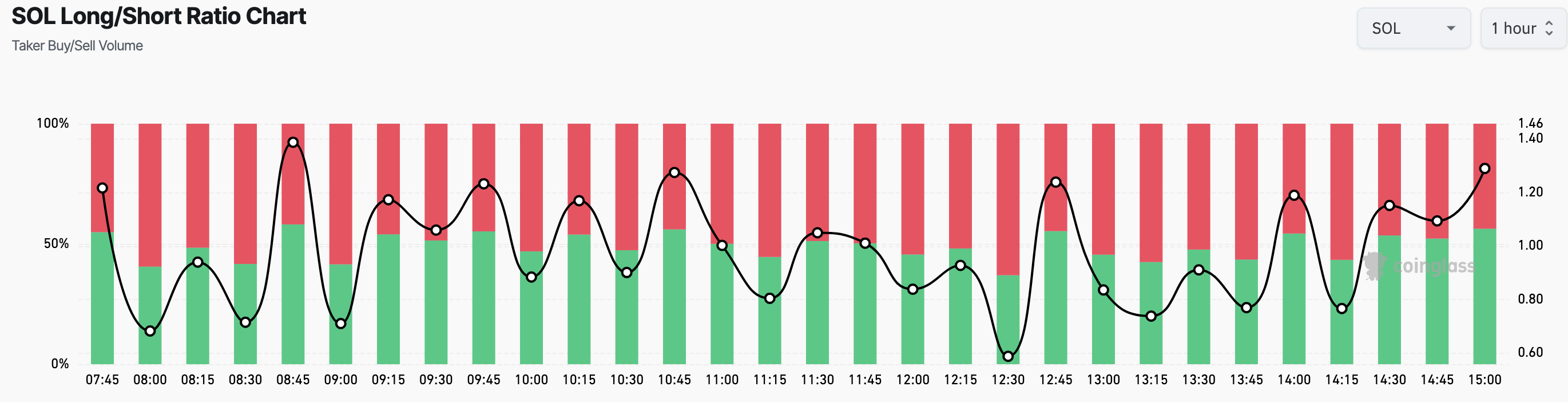

According to data from Coinglass, Solana’s Long/Short ratio is 1.14. As the name itself suggests, this ratio acts as a measure of traders’ expectations in the market. When the ratio is below 1, it means there are more short positions than long positions in the market.

An index above 1, however, indicates that there are more long positions than short positions. To understand better, longs are traders who predict the price will increase. On the contrary, shorts are bearish forecasters.

Therefore, the current ratio shows that long Solana positions are dominant in the market. Therefore, the overall sentiment is bullish and if confirmed, could be profitable for these traders. Interestingly, this comes as the market faced the highest number of liquidations in the past few days.

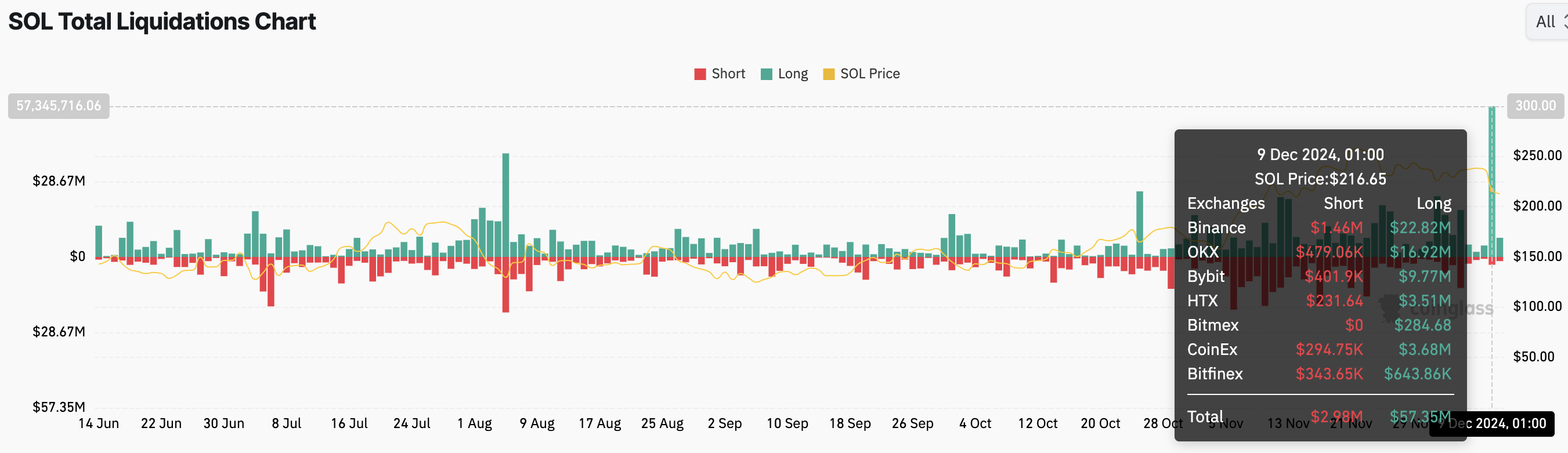

Over the past 24 hours, SOL liquidated positions have amounted to approximately $60 million. Of these, long positions account for over 57 million USD, the remaining are short positions. Liquidation occurs when a trader’s margin level drops low, forcing the exchange to close the position to prevent further losses.

This wave of liquidations was triggered when the price of Solana fell below $215, sparking a series of margin calls and forcing the closure of positions.

SOL price prediction: It’s not time to recover

On the daily chart, SOL price has fallen below the Exponential Moving Average (EMA) 20 and 50, which are technical indicators that measure trend direction.

When price is above EMI, the trend is bullish. Conversely, when price is below the EMA, the trend is bearish, which is currently true for SOL price.

Another notable trend on the chart below is that SOL price is trading below the demand zone at $210. If the altcoin fails to recover above this zone, the correction could continue to increase and the token value could drop to $189.36.

However, if Solana ramps up the buying pressure, the trend could reverse and rise to $264.66.

General Bitcoin News

[ad_2]