Solana (SOL) recently had a significant price breakout, overcoming an eight-month resistance level at $201. Dubbed the “Ethereum killer” thanks to its scalable blockchain technology, Solana has now also become the 4th cryptocurrency to reach a market capitalization of $100 billion.

However, despite this impressive gain, a strong sell signal could pose challenges in maintaining these gains in the coming days.

Investors in Solana are withdrawing

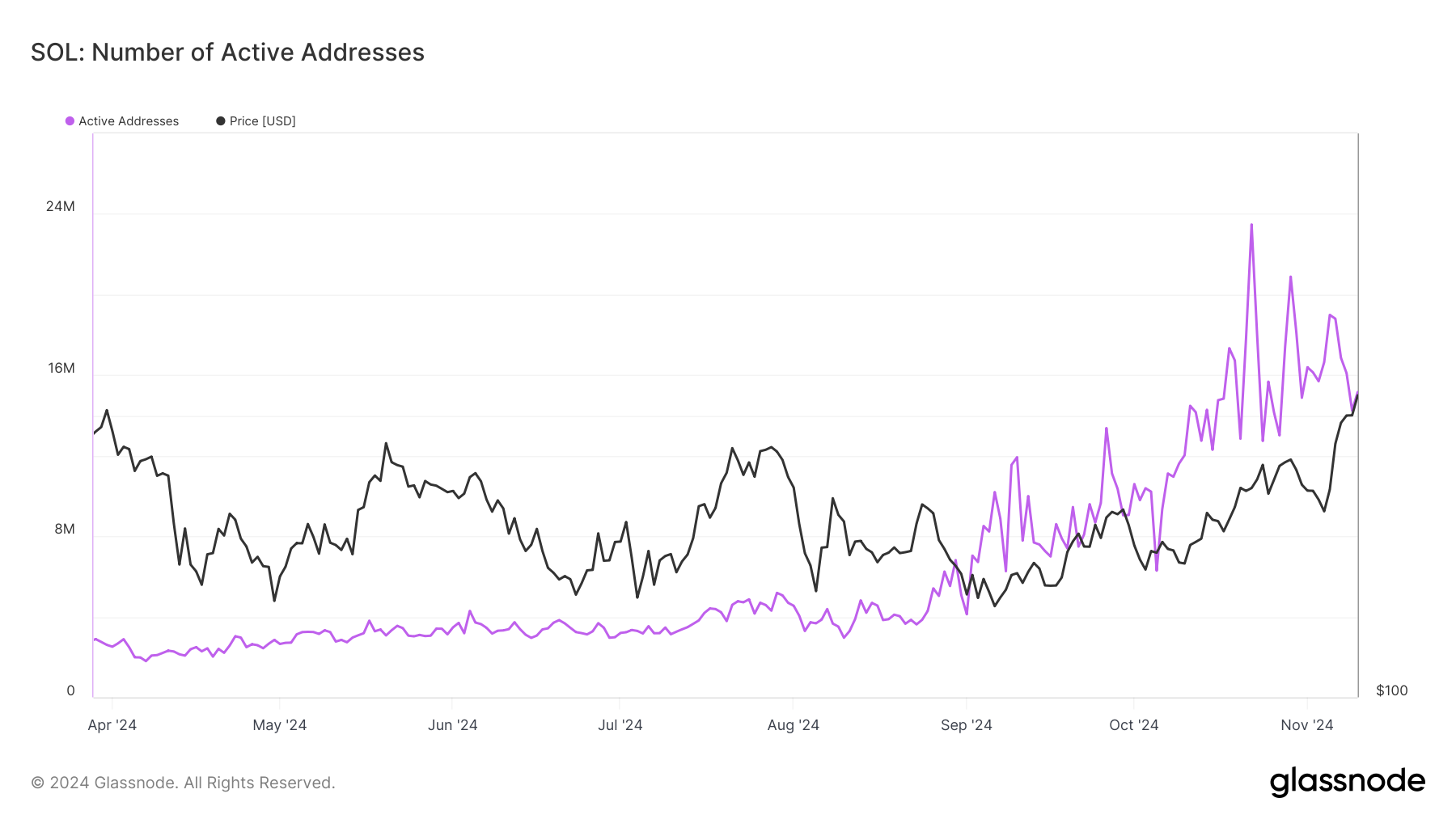

Even though Solana price is increasing, active addresses on the network are decreasing. This decline results in a “DAA Divergence” (Daily Active Address), signaling potential selling pressure. When price increases go hand in hand with a decrease in active addresses, it often signals that fewer investors are participating in the asset, which can lead to a decline in momentum.

This divergence between Solana price and active addresses could signal caution. Sell signals arising from this index reflect uncertainty in the investor community, which may limit further profits. If this trend continues, it could lead to a wave of profit-taking as investors seek to preserve recent gains, affecting SOL’s price stability.

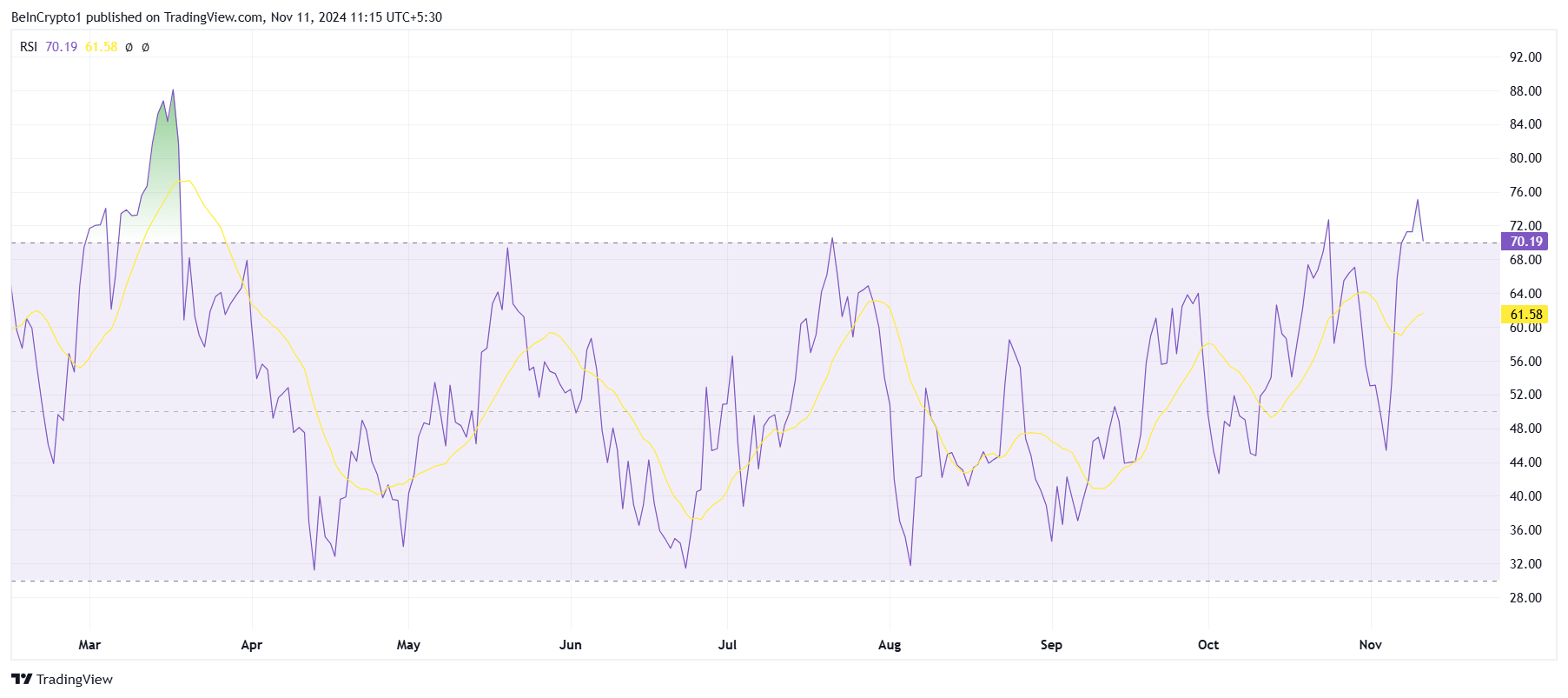

Solana’s macro growth momentum is showing signs of overshoot. The Relative Strength Index (RSI), an important technical indicator, is currently showing Solana in overbought territory.

Historically, this often leads to short-term corrections when prices become overvalued. If RSI remains high, it could signal a potential reversal, leading to a temporary price drop.

This overbought state on the RSI suggests that Solana’s bullish momentum could run into trouble if investor excitement cools. The risk of a reversal is heightened, as previous high RSI readings were frequently accompanied by profit-taking. Traders are advised to monitor RSI closely, as further price increases may depend on RSI exiting the overbought zone.

SOL price prediction: Prevent reversal

Solana’s rally took it to a three-year high of $215, with SOL now trading at $205. However, with reduced address activity and an overbought RSI, Solana price is getting closer and closer to likely support at $201. If this level cannot be maintained, the price may continue to decline sharply.

If investors start taking profits, Solana could fall to $186, an important support level for this altcoin. Holding above $186 is crucial to sustain the recent uptrend, as a break below this level could signal a deeper correction.

Conversely, if Solana bounces off the $201 support, it could aim to clear the next key resistance at $221. Surpassing this level could push Solana’s market capitalization back above $100 billion, restoring bullish momentum and countering the current bearish stance.