Solana (SOL) price has faced many challenges recently, falling 21% in the past 30 days. Despite this decline, SOL still maintains its position as the sixth largest Cryptocurrency in the market, with a market capitalization of approximately 90.8 billion USD.

Technical indicators such as BBTrend, DMI and EMA show that while the downtrend continues, its strength has diminished, and the price is currently in a consolidation phase. Whether SOL price continues its downtrend or begins to recover depends on key support and resistance levels and changes in market dynamics.

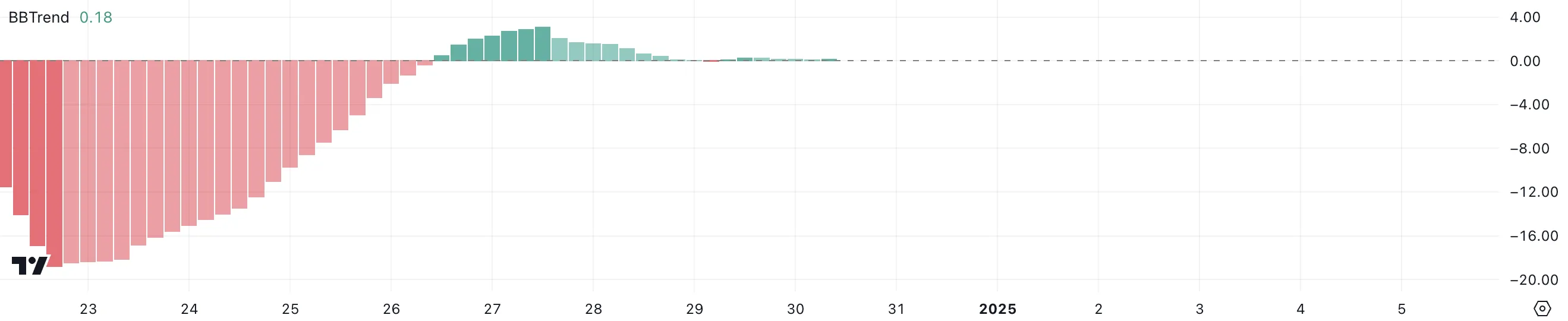

SOL’s BBTrend Is Near Zero

SOL’s BBTrend is currently at 0.18, indicating a neutral state after rebounding from deeply negative levels that began on December 23.

The indicator reached a temporary peak at a positive value of 3.09 on December 27, indicating near-term bullish momentum. However, it has since declined and stabilized around 0.18, suggesting that there is not a clear strong trend in the current price action.

BBTrend is a technical indicator from Bollinger bands, measuring the strength and direction of a trend. A positive BBTrend value typically indicates bullish momentum, while a negative value indicates bearish momentum. When BBTrend is near zero, as it is now for SOL, this reflects a neutral or range-bound market, without strong trend direction dominance.

In the short term, Solana’s BBTrend at 0.18 hints at a potential period of consolidation, where price volatility could decline until a clearer trend emerges.

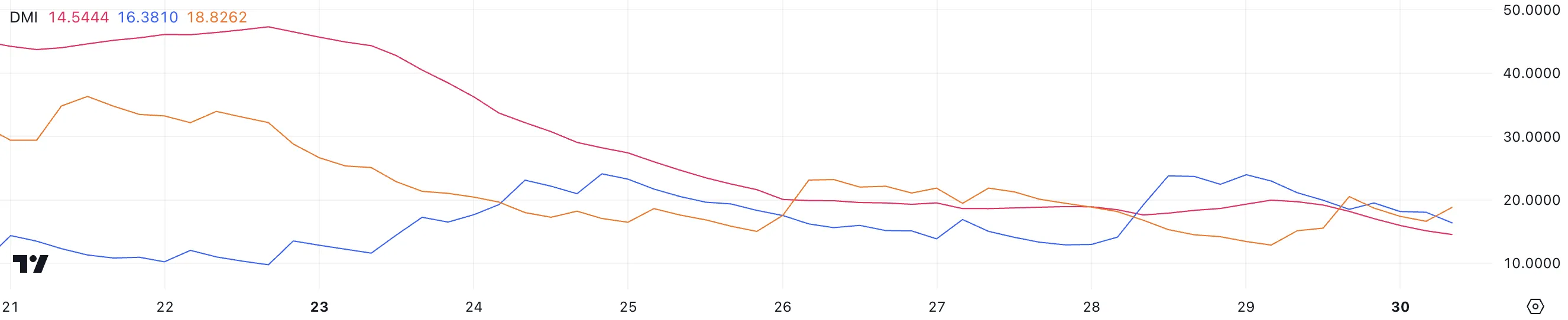

Solana’s Downtrend Remains

Solana’s DMI chart shows ADX currently at 14.5, down from nearly 20 just a day ago. This decline reflects increasingly weak trend strength, indicating that recent market momentum is fading.

Meanwhile, +DI (Positive Directional Index) is at 16.2, and -DI (Negative Directional Index) is at 19.7, suggesting that bearish pressure remains somewhat dominant as -DI higher than +DI. This configuration highlights that SOL price is still struggling to fully reverse its downtrend.

The Average Directional Index (ADX) measures the strength of a trend, regardless of its direction, on a scale from 0 to 100. Values above 25 indicate a strong trend, while values below 20 , like the current level of SOL 14.5, suggests weak or non-existent trend strength. With +DI below -DI, the bearish trend remains firm, but the falling ADX suggests that the trend lacks significant momentum.

In the short term, SOL could continue to consolidate or move sideways unless there is a change in momentum pushing +DI above -DI, along with rising ADX to point to a stronger trend.

SOL Price Prediction: Will the Downtrend Continue?

Solana’s EMAs continue to show a bearish configuration, as the short-term EMAs remain below the long-term EMAs. This arrangement reflects ongoing bearish momentum, with no immediate signs of a bullish reversal.

The bearish EMA configuration suggests that selling pressure is likely to continue, especially if the price approaches the next strong support level at $182. If this support fails to hold, the downtrend could strengthen, potentially pushing Solana price down to $176.

On the other hand, if SOL price manages to reverse the current trend and establish an uptrend, it could test the resistance at $201. If this level is surpassed, it will indicate an increase in bullish momentum and could pave the way for further upside.

However, for such a change to occur, the EMAs need to start converging and eventually move into a bullish configuration, with the short-term EMAs crossing above the long-term EMAs. Until then, the bearish EMA structure continues to signal near-term caution.