[ad_1]

Solana’s recent price action shows the continued battle to secure $200 as stable support. The cryptocurrency is fluctuating around this key price threshold, reflecting broader market instability.

However, changing market conditions indicate a possible reversal, paving the way for an uptrend.

Solana Investor’s Profits Fall

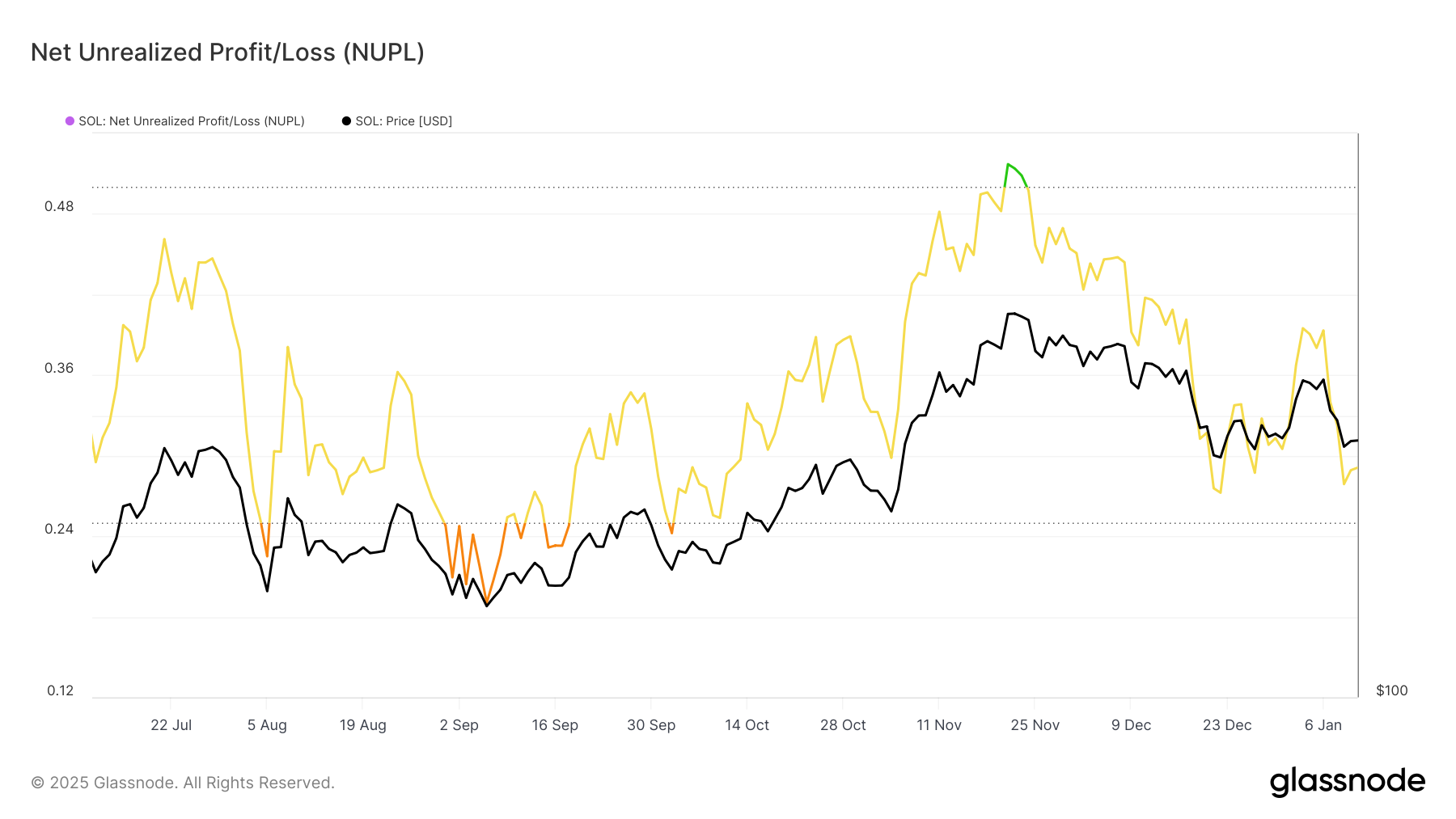

Solana’s Unrealized Profit/Loss Index (NUPL) is approaching the Fear Zone, signaling cautious investor sentiment. Historically, when the index falls into this zone, prices often recover as the market begins to stabilize. This trend suggests that Solana could experience a similar recovery if unrealized profits continue to decline.

Investor sentiment still plays an important role in determining the next stage of Solana price movements. If NUPL enters the Fear Zone, it could create opportunities for fresh buying activity, stimulating optimism. This could be the catalyst needed to push the cryptocurrency back into an upward trend.

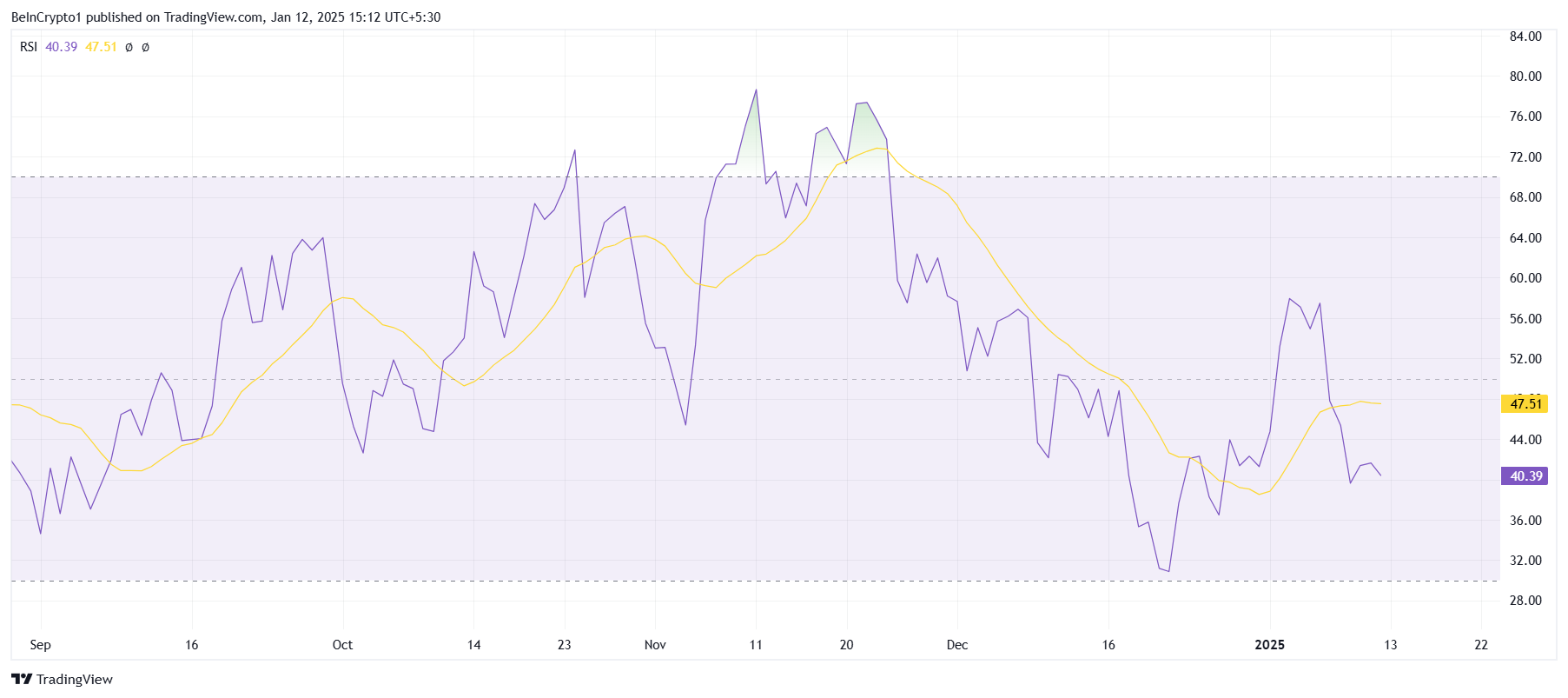

Solana’s macro growth momentum is showing signs of recovery. The Relative Strength Index (RSI) has recently recovered after approaching oversold territory last month. Although the RSI has not yet established support at the 50.0 neutral level, it is trending upward, suggesting that bullish momentum could strengthen in the coming days.

RSI improved in line with market indicators, indicating a possible reversal. If Solana continues to strengthen, this could bolster investor confidence and lay the foundation for a sustained rally beyond key price levels.

SOL Price Prediction: Restoration of Support

Solana price temporarily broke above the $201 resistance level in early January but then fell 15%, returning to the $183 support level. This pullback reflects continued volatility in the market but also lays the groundwork for a recovery if key conditions improve.

If the mentioned factors continue to strengthen, Solana could return to the $200 support level. Sustained momentum could push the price up to $221, correcting recent losses and signaling the start of a stronger uptrend.

However, failure to overcome the $201 resistance could lead to a long-term consolidation above $183. If the cryptocurrency loses this support level, it risks a further decline to $169, weakening its bullish momentum and delaying recovery efforts. This situation will highlight the challenges Solana faces in establishing a steady uptrend.

General Bitcoin News

[ad_2]