[ad_1]

The cryptocurrency market has grown beyond macroeconomics — now, it’s also intertwined with politics. If you’re in doubt, look at the price of assets like Solana (SOL) since Donald Trump won the US presidential election. For example, from Solana’s all-time high, which a few weeks ago was still 40% short, it now only needs a 15% increase to reach the new peak.

However, that’s not the only thing going on with this altcoin. In this analysis, TinTucBitcoin reveals what else is going on and what might happen next for SOL’s price.

Solana Open Benefits Hit New Record High

In November 2021, Solana reached an all-time high of $260. In March this year, the altcoin attempted to break above that level but was met with rejection, leading to a double-digit downside correction.

However, the situation has changed since last week, when the price of SOL has increased by 37% in the past seven days. This rise has brought it closer to its all-time high, and now another 15% is needed to test that area. But that’s not all.

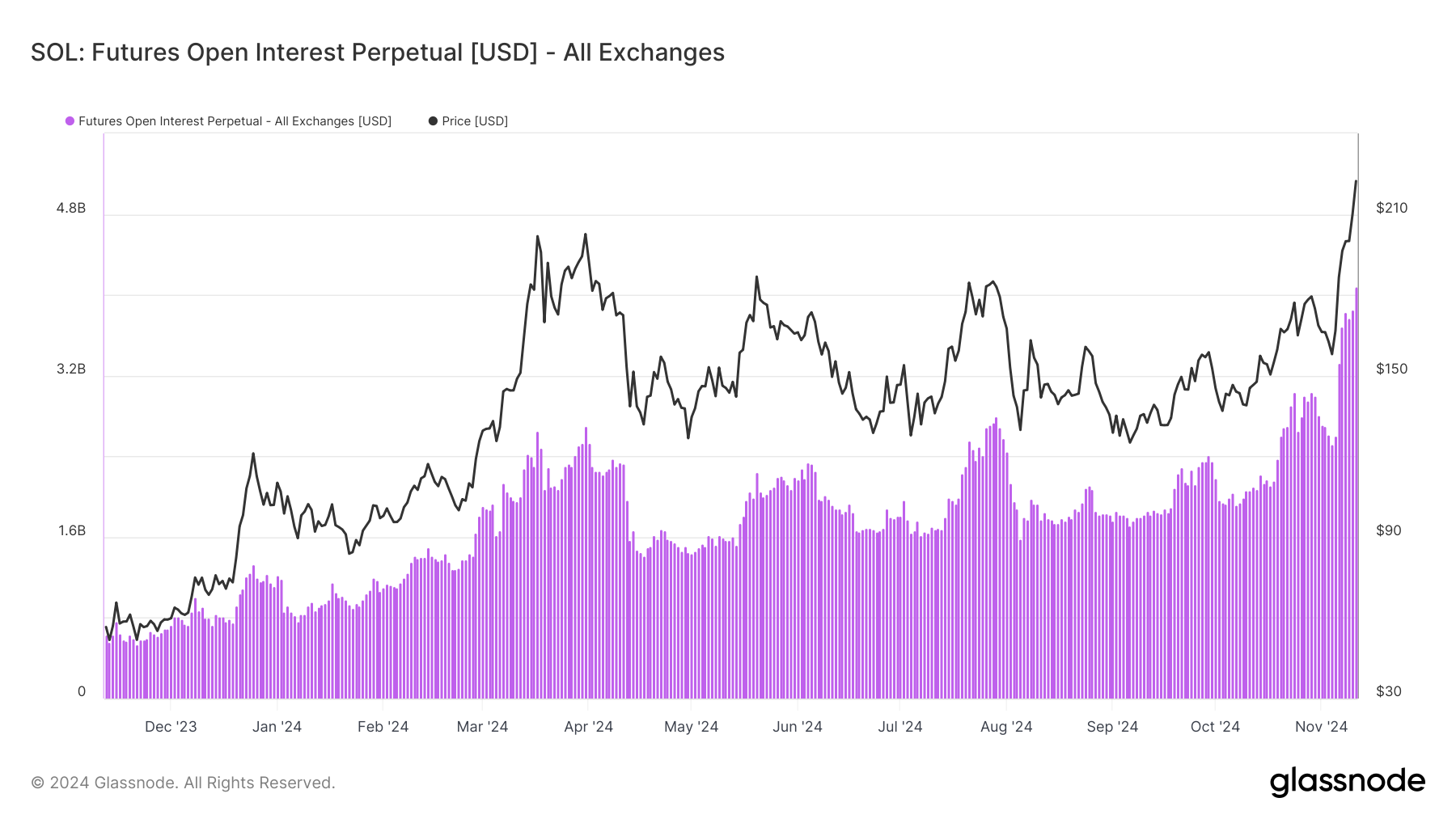

According to Glassnode, SOL Open Interest has reached a record high of $4 billion. OI, as it is often called, is the total value of all open contracts in the market.

Increasing open interest signals new money is flowing into the market and suggests an increase in speculative activity. Conversely, decreasing open interest indicates money is being withdrawn. Therefore, the recent increase in Solana’s open interest suggests that, with new funds flowing into these crypto contracts, the price could continue to rise.

The Sharpe ratio is another indicator that suggests that Solana’s all-time high could become a reality in the short term. To clarify, the Sharpe ratio measures the risk-adjusted return of an asset.

Furthermore, the higher the Sharpe ratio, the higher the return relative to the level of risk taken. Conversely, if the ratio is negative, it means the potential reward may not be worth the risk.

Based on Messari data, the Sharpe ratio for SOL has increased to 0.48. This notable increase shows that buying SOL at its current market value can yield strong returns for investors looking to accumulate.

SOL Price Forecast: Will Exceed $260 Soon

On the daily chart, SOL price has encountered resistance at $222.26. However, the Chaikin Money Flow (CMF) index suggests that this barrier may not stop the altcoin from continuing to advance.

CMF is an oscillator that measures buying and selling pressure, giving scores from -100 to +100. Positive values indicate an increasing trend, while negative values indicate a decreasing trend. A CMF index near zero implies a balance of buying and selling pressure.

According to the current assessment, the CMF index is at 0.23, suggesting that Solana is witnessing an increase in buying pressure. With support at $186.58, a new peak for Solana could be near, and the price could surpass $260.

However, if selling pressure occurs, this prediction may be invalidated. In that case, the price of SOL could drop to $157.89.

General Bitcoin News

[ad_2]