- South Korea expands Travel Rule to all crypto transfers.

- New regulations target transactions below 1 million won.

- Stricter compliance affects all major cryptocurrencies.

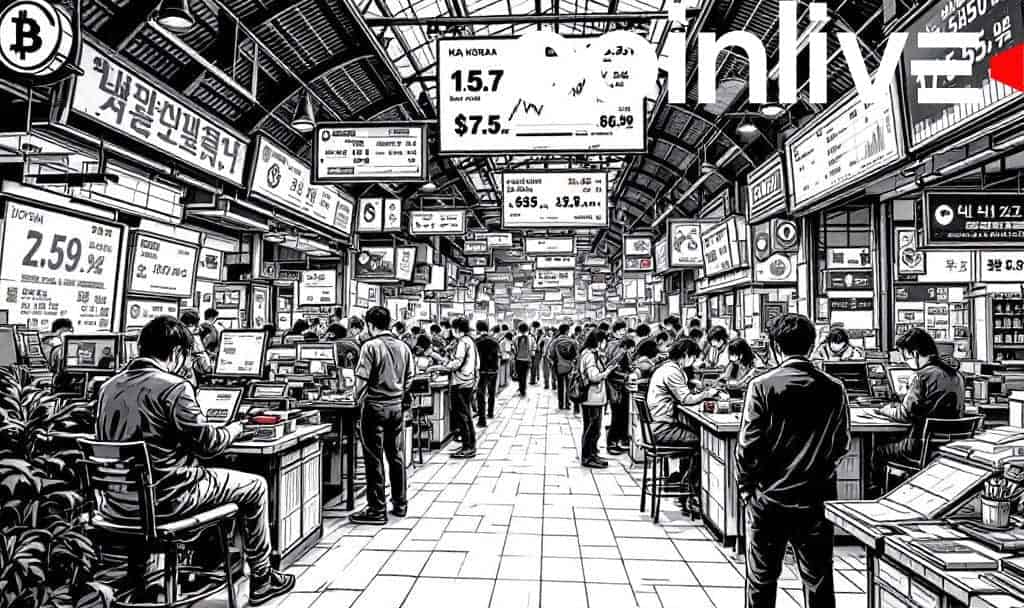

South Korea’s Financial Services Commission announced an AML overhaul, expanding the Travel Rule to all crypto transfers, including those under 1 million won, to enhance compliance by 2026.

The regulatory shift targets preventing money laundering in smaller transactions, impacting VASPs by increasing compliance demands and possibly affecting liquidity and transaction volumes across the crypto market.

South Korea is implementing a significant AML overhaul to strengthen market integrity. The Travel Rule now covers all crypto transfers, including transactions below 1 million won, closing loopholes exploited through smaller transactions.

Chairman Lee Eog-weon of the Financial Services Commission announced these changes at the Anti-Money Laundering Day ceremony. Virtual Asset Service Providers must comply, enhancing transaction tracking and vetting of shareholders’ backgrounds.

The expansion aims to disrupt criminal activities impacting smaller transactions and increase compliance costs for exchanges. Higher reporting obligations may affect liquidity flows and subsequent transaction volumes in the market.

Legislative changes affect popular cryptocurrencies like Bitcoin and Ethereum, as the new rules apply extensively. The government leads the regulatory changes without any additional financial injections reported from institutional funding.

Lee Eog-weon, Chairman, Financial Services Commission (FSC), stated, “The expanded crypto Travel Rule ensures criminals cannot break large transactions into smaller amounts to bypass monitoring systems” emphasizing tighter surveillance and investor protection.

Since 2021, South Korea mandated exchanges to align with AML standards, previously targeting large transactions. The current expansion includes smaller transfers, potentially influencing transaction dynamics.

Regulation may influence financial landscapes by impacting volumes and the operational cost structure of exchanges. Historical data from prior enforcement hints at effective crackdowns, aiming to minimize money laundering activities and strengthening investor confidence.