The price of SPX jumped 50% during Friday’s intraday trading session. This unexpected price breakout triggered a wave of liquidation of short positions, leaving many traders with huge losses.

With the SPX Token price expected to continue rising, its short-term traders could face even more liquidations.

SPX short-term traders recorded losses

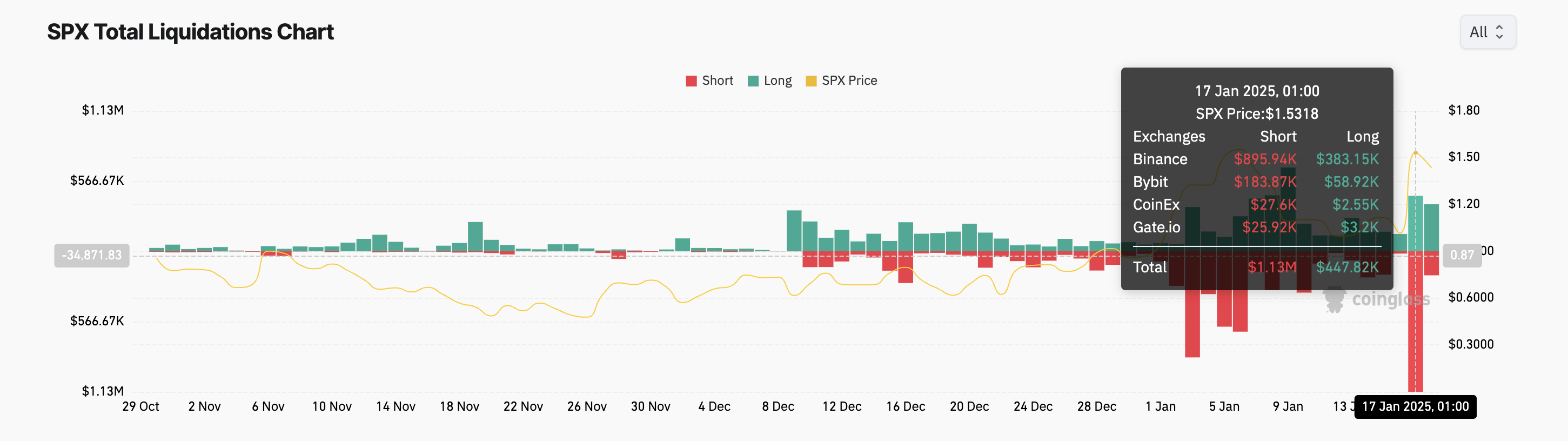

During Friday’s trading session, the value of SPX increased 50%, reaching a nine-day high of $1.55. The rally triggered a massive liquidation of short positions in its futures market, totaling $1 million, according to data from Coinglass.

Liquidation occurs in the derivatives market of an asset when its value moves against the trader’s position. In such cases, the trader’s position is forcibly closed due to insufficient capital to maintain it.

Short position liquidation occurs when traders with short positions are forced to buy back the asset at a higher price to cover losses as its value increases. This occurs when the asset price breaks through a key level, forcing traders who had bet on a decline to exit the market.

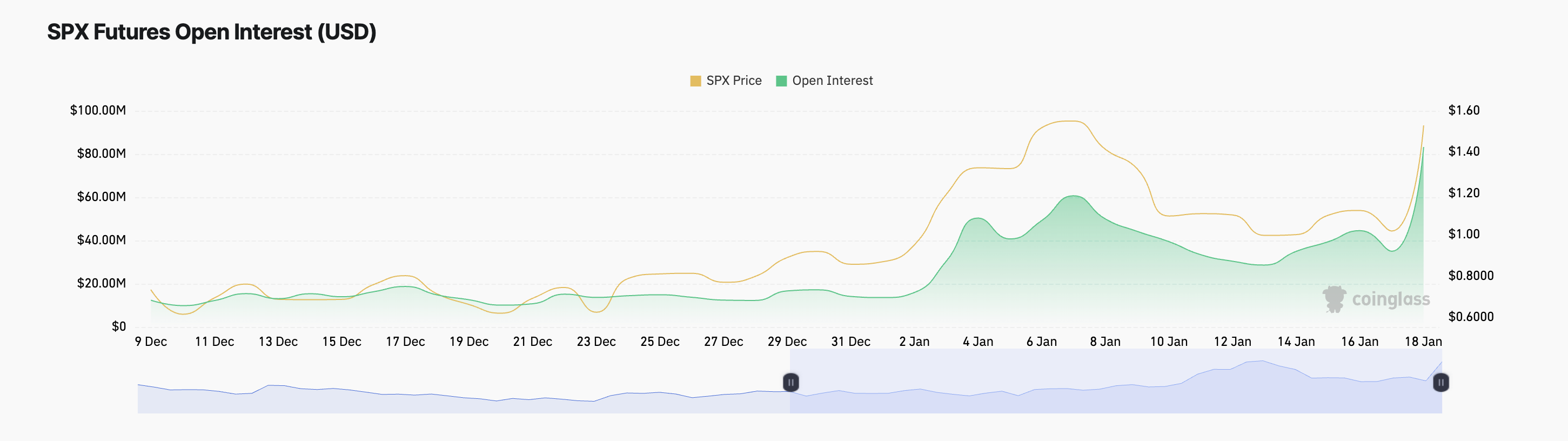

Notably, this may not be the end of the losses for SPX traders as trading activity continues to increase. This is evidenced by a 137% increase in open contracts over the past 24 hours, accompanied by a 32% increase in Token value over the same period.

Open interest tracks the total amount of unsettled derivative contracts, such as futures or options. When it rises during a bull run like this, it shows increased market participation and confidence in the upward price trend.

Therefore, if the uptrend in SPX price continues, its short-term traders will suffer more losses.

SPX Price Prediction: Token aiming for all-time high

SPX’s 50% rally prompted a change in the Super Trend indicator. It is currently a blue line providing dynamic support below the Token price on the daily chart.

This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to indicate the current trend of the market: green for an uptrend and red for a downtrend.

When the price of an asset trades above the Super Trend indicator, it indicates an uptrend. This signals that buying pressure outweighs selling activity among market participants.

If the situation continues, SPX price will break out to return to its all-time high of $1.65. However, if the sell-off begins, the SPX Token price will lose recent gains and could drop to $1.23.