Although liquidity is a luxury in the recent DeFi marketplace, numerous tokens are presently exhibiting indicators of depeg. The most current identify to join the depeg checklist this time is not as well unusual, MIM stablecoin from the Abracadabra (SPELL) task.

Stablecoin MIM depeg

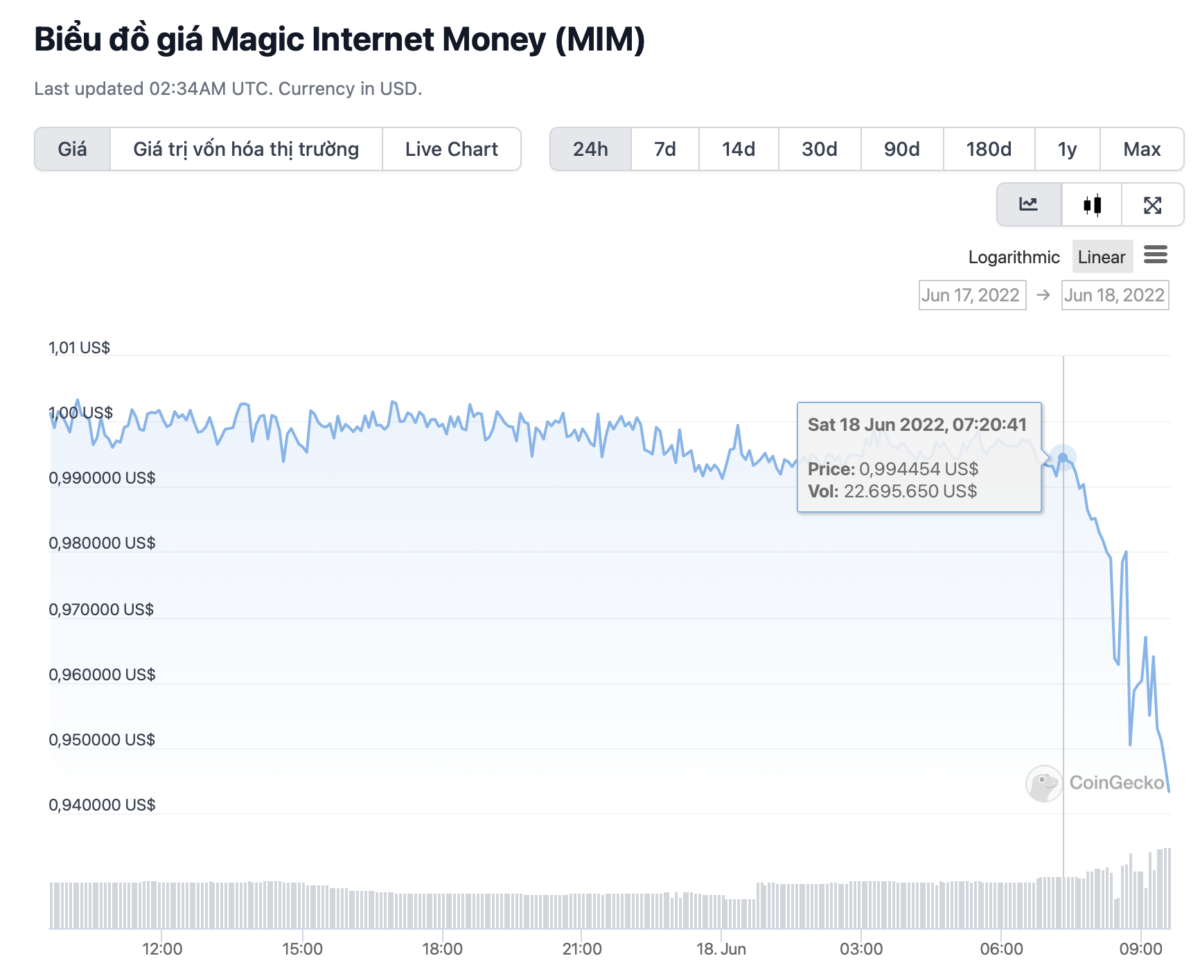

At all-around seven:00 am on July 18, the MIM stablecoin started to move away from the $ one zone. As a end result, at the time of creating, this stablecoin is continuing to plummet to $ .94.

In terms of capitalization, MIM has a marketplace capitalization that fluctuates all-around $ 300 million ahead of depeg time. Currently, this amount has dropped to $ 254 million.

Bad credit score products

Twitter account Autism Capital stated that in the final month when Terra exploded, $ twelve million in negative debt was formed when UST could not rapidly liquidate the chain. However, this information and facts was minor observed by numerous people today, simply just mainly because the primary light was as well centered on the Earth at the time.

Last month, through the Earth explosion, $ twelve million of negative debt was developed by Abracadabra (the protocol behind MIM) mainly because liquidations could not occur quickly sufficient to cover the protocol’s MIM liabilities. This information has been swept underneath the rug.

– Capital of autism (@AutismCapital) June 17, 2022

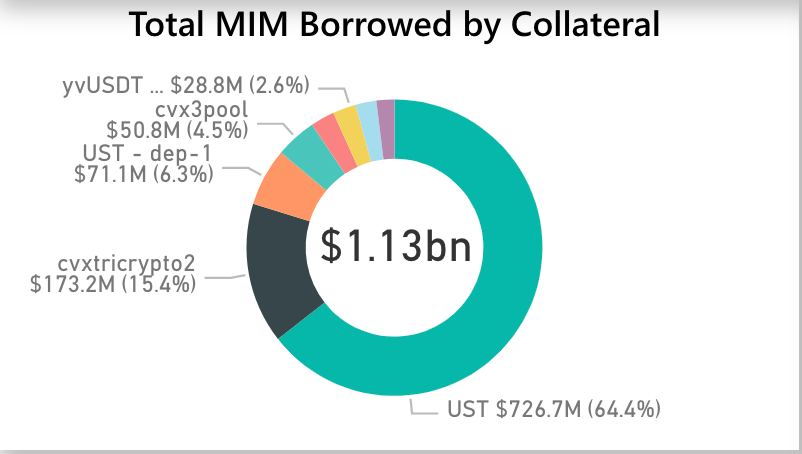

On March 25, 2022, in an picture of MIM’s mortgaged assets – minting dashboard, it is uncomplicated to see that all-around 64% of MIM’s collateral is in UST. However, the SPELL staff claimed that the dashboard was “bad data” and that the staff was “under maintenance”. As a end result, on the task homepage, end users can’t at present accessibility this datasheet.

MIM founder Sesta (who was well-known soon after collaborating “going underground” with 0xSifu) has even mocked the rumors surrounding his negative debt. At the similar time, some photographs recommend that Dani Sesta also mortgaged SPELL and borrowed far more MIM only to be liquidated later on.

More explanations on the trouble of negative debts

Specifically, if the negative debt described over happens, there will be an unsecured sum of MIM stablecoins on the marketplace.

MIM is designed in the kind of a assure to be capable to mint this stablecoin. For ease of comparison, this is the similar model as MakerDAO’s DAI.

> See far more: DeFi discussion ep.seven: Are stablecoins “stable”?

However, to assure that the amount of stablecoins on the marketplace is normally secured, the mechanism will have a liquidation degree. Simply place, when the asset’s worth falls beneath this mark, the liquidation robots will get the user’s loan, return the MIM and get back the place assure. Attached, these clearance robots will also obtain an added bonus.

In the situation of SPELL, mainly because UST fell so rapidly, the liquidation bot did not perform successfully to continue to keep up with the collapse, resulting in a big sum of MIM out of small business with no ensures to be assured.

In the previous, Maker has also encountered this trouble. As a end result, as Ethereum’s infrastructure was as well slow to course of action transactions and the whole marketplace value collapsed at that time, MakerDAO had to bear negative debt.

> See also: MakerDAO is auctioning MKR tokens for the initial time to pay out off $ four million negative debt

To make it uncomplicated to picture, if the over information and facts is confirmed, SPELL’s negative debt (i.e. $ twelve million) will be three instances the debt that Maker has recorded in the previous.

Synthetic currency 68

Maybe you are interested: