Stablecoin USN broadcaster for the Close to protocol has announced that it can no longer keep the venture due to the drop in the value of Close to.

On the evening of October 24, Decentral Bank, the broadcaster of the USN stablecoin on Close to Protocol, abruptly announced that it would completely discontinue the venture.

five. All USN holders are invited to go through the total write-up on this subject and obtain out how to redeem USN right here https://t.co/8n0WP5yFA1

– Decentralized Bank (@DcntrlBank) October 24, 2022

As reported by Coinlive, USN was launched in mid-April 2022, at which time the algorithmic stablecoin “craze” peaked with the LUNA-UST model and the UST deposit curiosity fee of up to twenty% / 12 months on Anchor. . The value of Close to at that time soared thanks to the information that the ecosystem was about to welcome an algorithmic stablecoin capable of attracting a lot more liquidity.

At the time of launch, USN was an algorithmic stablecoin backed by Close to, but it only provided an yearly curiosity fee of ten% / 12 months. However, following the collapse of LUNA-UST, Decentral Bank announced in June 2022 that it would discontinue USN securitization with Close to due to fears that this cryptocurrency could slide, compromising its capacity to hold USN’s USD one value. The stablecoin has because been supported by USDT.

Even so, the remaining five.seven million NEARs in USN’s reserves continued to plummet, resulting in the spread involving the Close to and USN holdings issued now to attain the $ 21 million mark.

It is for the over purpose, in addition to the legal results focusing on the algorithmic array of stablecoins, as effectively as the challenge of the complete provide of USN pushed to ten trillion, Decentral Bank has made a decision to near the venture. At the time of closing, USN’s functionality was as follows:

– Circulating provide: about forty million USN are blocked on Ref.finance, they will be burned by the Decentral Bank.

– Collateral: USDT 38.9 million, Close to five.seven million (really worth $ sixteen.75 million at the time of the update).

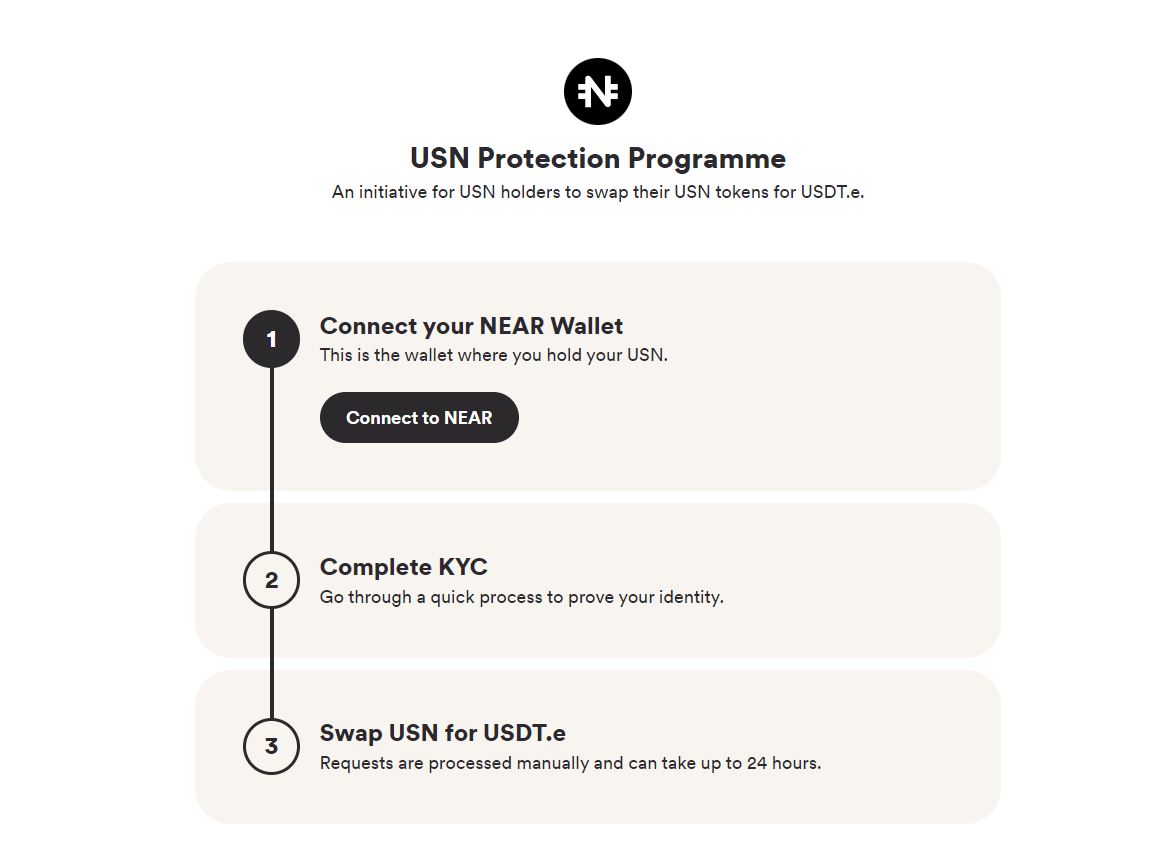

The Decentral Bank claimed to have informed the Close to Foundation and has been accredited by the Close to protocol management organization to invest USDT forty million for Close to holders to convert USN to USDT. This Close to Foundation campaign is named the USD Protection Program, in partnership with Aurora.

In response to a latest difficulty with USN, the @NEAR Foundation is funding a safety system to safeguard USN holders.

More information underhttps://t.co/NDMZUO2Wim

– Close to Protocol | Create with out limits (@Close toProtocol) October 24, 2022

To redeem USN, consumers have to stop by Aurora’s site, hyperlink a wallet containing USN, full KYC, and exchange stablecoin for USDT. Furthermore, consumers can also trade USN straight with USDT on Decentral Bank or Ref.finance.

Meanwhile, the stablecoin battle in the midst of the bearish trend continues with the emergence of a lot of new gamers, regardless of the collapse of the LUNA-UST model in May. New stablecoins that appeared this 12 months consist of TRON’s USDD, Aave’s GHO and CUSD. by Coin98. Furthermore, Curve is explained to be building stablecoins as effectively, when Binance has created the controversial selection to consolidate the stability of all stablecoins except USDT into BUSD, the stablecoin issued by the exchange, and broaden BUSD to a lot more techniques, the new blockchain ecology. .

Synthetic currency 68

Maybe you are interested: