The cryptocurrency industry has produced an extraordinary recovery given that final weekend thanks to the momentum of the “leader” Ethereum.

The final seven days draw two opposite sides of the cryptocurrency industry.

This time final week, the whole industry was nonetheless eagerly awaiting the June US CPI information, triggering several coins to flood with red. And what ever takes place, on the evening of July 13, the US CPI hit a four-decade higher of 9.one%, greater than fiscal experts’ forecasts and induced the cryptocurrency industry to crash sharply.

However, immediately after the “storm” passed, the colour green produced a solid comeback to the crypto sector. No longer the macro stress of the stock industry, massive coins have started off to recover sharply. The upward momentum is more strengthened and led by Ethereum (ETH) as the 2nd biggest cryptocurrency in the globe welcomes the information that The Merge occasion is when once more “scheduled”, scheduled to be on the major network on the 19th. -twenty/09 if there are no complications. The promoting stress due to the detrimental facts of the “liquidity crisis” also eased, generating the ailments for the industry recovery.

Ether is also the most effective massive cap coin of the final week. Specifically, from a reduced of $ one,006 on July 13, ETH on the morning of July 19 “built a column” at $ one,631, equivalent to a 62.one% rise.

Over the identical time frame, Bitcoin (BTC) only managed to recover from $ 18,910 to $ 22,961, an raise of 21.four%.

Another spectacular expanding title is Ethereum Classic (And so on), which has even doubled in worth in the previous seven days, climbing from $ 13.34 and peaking at $ 27.77 on the morning of July 19th. The cause And so on can rise in this way stems from the mentality that when Ethereum implements The Merge, i.e. moving from Proof-of-Work to Proof-of-Stake and getting rid of mining, miners The latest ETH will have to migrate to Ethereum Classic, which is the most comparable edition of ETH that nonetheless enables mining.

Many other degree one altcoins this kind of as BNB, SOL, AVAX, MATIC also recorded a twenty-forty% recovery. As a end result, complete industry capitalization returned to the $ 1045 billion mark, up practically $ 200 billion from $ 851 billion a week in the past.

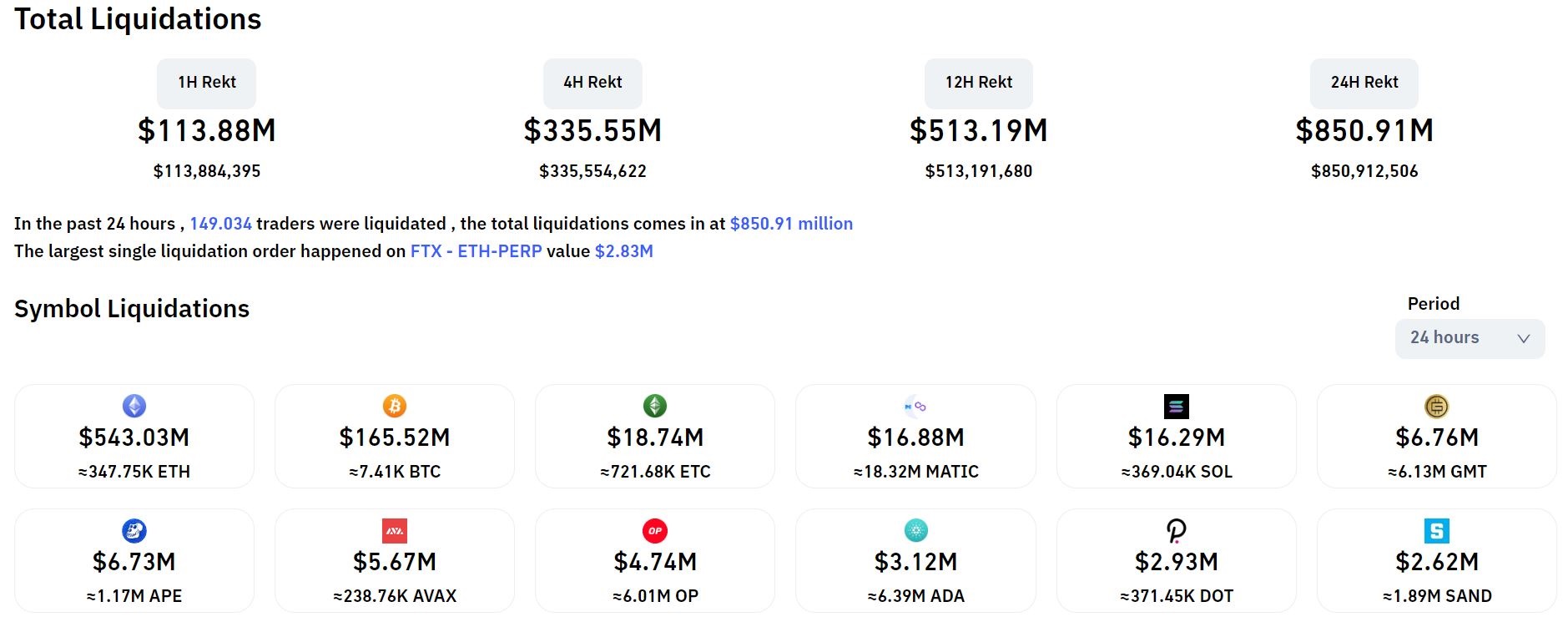

According to information from CoinglassAlmost $ 851 million well worth of cryptocurrency derivative orders have been cleared in the previous 24 hrs, with 57% of brief orders burned. The highest liquidation was ETH at $ 543 million, 4 occasions greater than BTC’s $ 165 million, which hardly ever takes place when the industry is volatile.

Again and once more, regardless of good development volatility, the outlook for The Merge in September is nonetheless uncertain as Ethereum developers can nonetheless freely move the implementation timeline if an problem is acknowledged, due to the fact this is the most critical update in background. of this coin.

Furthermore, macroeconomic stress will return quickly upcoming week with a time frame of July 26-28, when US Federal Reserve officials have their upcoming meeting. With US inflation nonetheless exhibiting no indications of slowing, the situation that the Fed will announce a new curiosity price hike up to one% gets to be extra possible. In three curiosity price changes in March, May and June, the Fed’s rise was .25%, .five% and .75% respectively, accompanied by extreme fluctuations in the Fed cost. Bitcoin.

Synthetic currency 68

Maybe you are interested: