Some on line are speculating that the boost in Canto’s cost could be due to a spike in Notice’s volume — the quasi-steady currency issued by Canto and pegged to USDT/USDC.

Recently, some Twitter customers have begun speculating that a layer one decentralized token could at some point encounter downward strain due to its association with Be conscious, warning traders that a peg mortgaged may perhaps vary only semantically for The stablecoin, the TerraUSD/UST algorithm, crashed in 2022 following its peg fell quick, resulting in the flight of practically $45 billion well worth of assets.

However, members of the Canto discord local community had been brief to downgrade all FUDs:

“UST is not collateralized by anything they have 10% collateral. Here we are 100% in stablecoins. We cannot mint Notes with Canto.”

What is Can Tho?

Canto is a blockchain permissionless Layer one (L1) operating on the Ethereum Virtual Machine, offering Tendermint consensus secured by validator nodes with EVM executions by way of the Cosmos SDK.

Canto’s small business model focuses on what is regarded as Free Public Infrastructure, which is like totally free parking on city streets, with Canto DEX is a totally free DEX for liquidity companies.

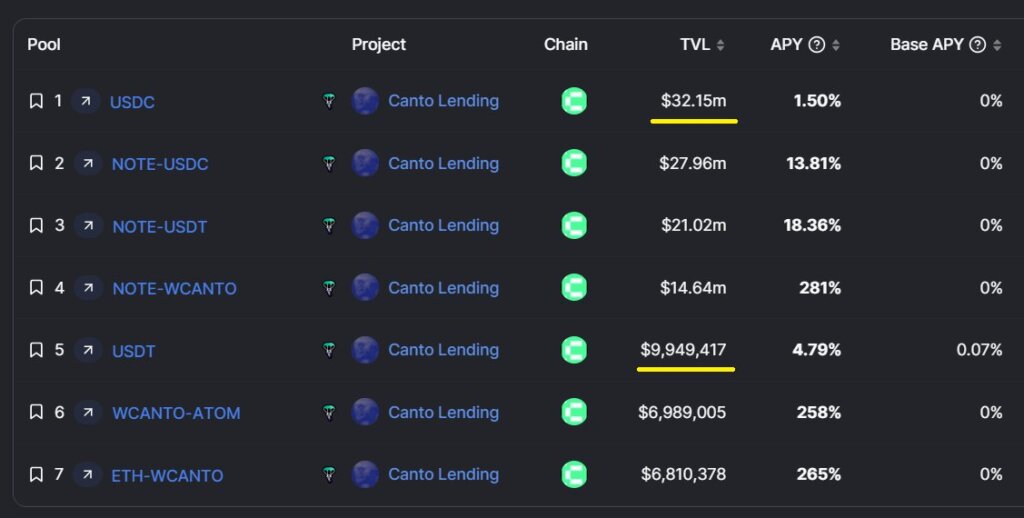

The small business model also incorporates the Canto lending marketplace (CLM), which presents customers with pooled money by way of the v2. Observe completes Canto’s trio of decentralized solutions, described as “a fully collateralized unit of account issued by CLM, while also serving the ecosystem as a pegged stablecoin.” soft cost USDC/USDT.”

Canto’s decentralized utility exists on the Cosmos chain, working with a cross-chain protocol termed Communication in between Blockchains (IBC) to aid blockchains realize interoperability.

As of January 26, Canto has $42 million in USDC and USDT listed on its CLM lending unit, collateral that will allow customers to borrow Notes.

In concept, if the Note fixation falls under $one, the alternative would be to print a lot more Notes, placing inflationary strain on the current provide of Notes.

However, considering that Note is primarily based on an curiosity charge procedure, tokens are not able to be made, but only borrowed. Rates to borrow these are immediately adjusted each six hrs primarily based on time-common cost (TWAP).

With the cost of Canto acquiring greater substantially in the previous thirty days – largely thanks to the information that it has obtained a secured investment from venture capital company Variant – the coin has rallied from a very low of $,075. at the starting of January to $.35 on January one. 26.