Sui token price (SUI), up 30 percent in the past 30 days, just down from $3, threatening newly accumulated gains. Yesterday, November 12, the SUI price increased to 3.30 USD.

However, as of press time, the altcoin’s value has dropped to $2.97. While owners may hope that SUI will weather this decline, this analysis suggests it may take some time to recover.

The Index Becomes Decreasing For SUI

Sui’s price drop is in line with a broader market correction as the cryptocurrency market takes a breather after more than a week of gains.

Based on BeICrypto’s results, this decrease could be related to profit taking by owners. However, there are other reasons for the slide.

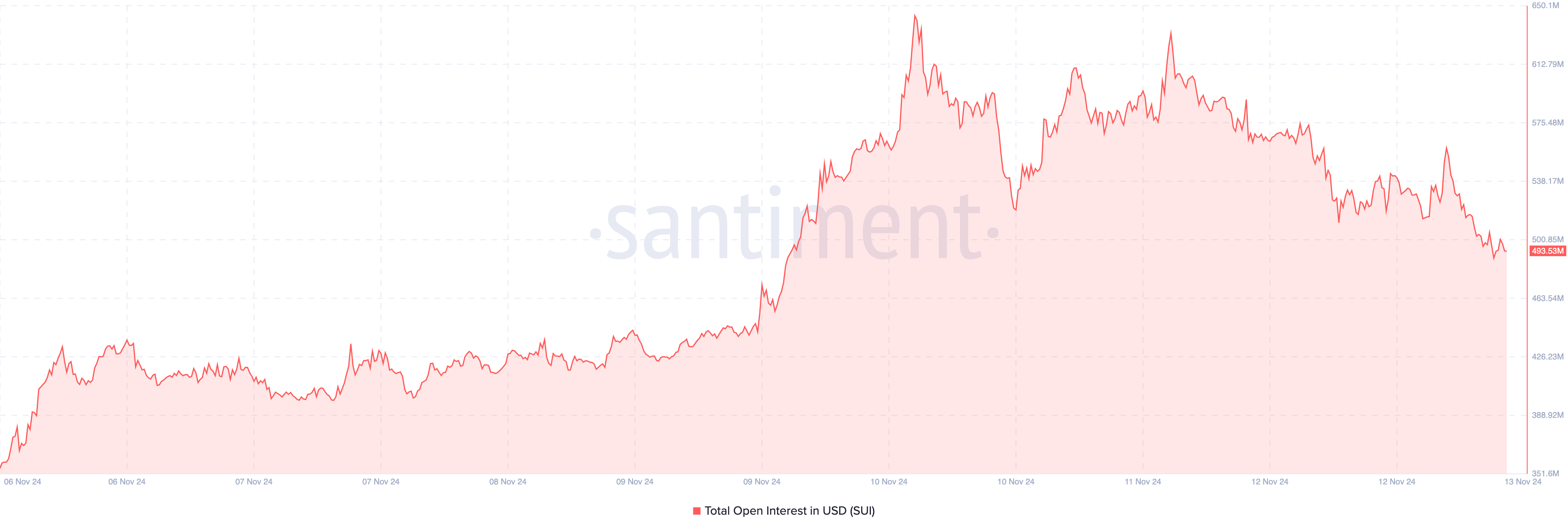

First of all, Open Interest (OI), which measures the level of speculative activity around a cryptocurrency, increased to 644.30 million on November 10. Today, this value has plummeted to 493, 53 million.

Usually, the OI index helps confirm the strength of the trend. To clarify, an increase in open interest usually reinforces a trend, while a decrease in open interest can indicate that the trend is weakening.

Furthermore, the significant decline in OI for Token Sui appears to be the main reason why the recent uptrend lost momentum.

Besides the decrease in OI, Adjusted Sentiment has also decreased to the negative area. This index tracks whether there are many mentions of blockchain or cryptocurrency. When it rises to the positive zone, it means that most of the comments about the Token are positive.

However, in this case, the decline implies that the majority of comments on SUI are pessimistic. If this situation does not change, altcoins may have difficulty increasing demand.

At the same time, reduced demand means the Sui Token price may not make any significant bounce.

SUI Price Forecast: Likely to Fall Further

From a technical perspective, the 4-hour chart shows that the Bull Bear Power Index (BBP) has dropped into negative territory.

BBP is a technical oscillator that measures the strength of buyers and sellers over various time frames.

When the index is positive, it means bulls have stronger buying power, and prices can rise. However, that is not true for the SUI token price. Specifically, the decrease in the index shows that selling pressure by bears is increasing.

If bears continue to sell, the SUI token price could fall further. Using the Fibonacci retracement indicator, the altcoin’s value could drop to $2.26 if selling pressure becomes stronger.

Conversely, if SUI sees a significant increase in buying pressure, the situation could change. In that scenario, the token could bounce to $3.34.