It was identified that the Alameda Research investment fund owes Voyager a big volume of income regardless of owning previously bailed out the organization.

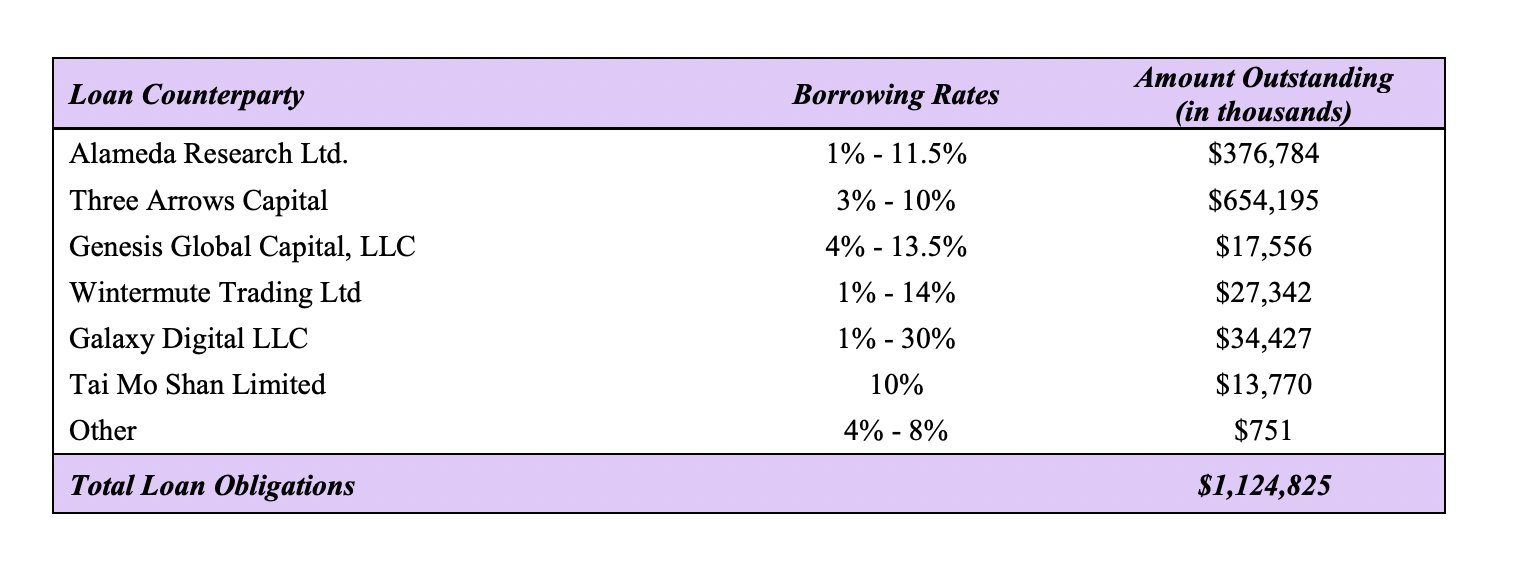

To adhere to bankruptcy documents As announced by Voyager, the Alameda Research investment fund is at present the 2nd biggest borrower of this loan organization, just behind Three Arrows Capital (3AC).

Specifically, Alameda Research owes Voyager $ 376.seven million, with an curiosity fee of one% – eleven.five% / 12 months. Meanwhile, the volume Three Arrows Capital owes Voyager is $ 654.one million, which has been requested by the organization given that late June but has not obtained a response. Voyager later on declared 3AC “insolvent” and confirmed that it would consider legal action to get the income back.

Both Three Arrows Capital and Voyager filed for bankruptcy in a New York (USA) court.

What is perplexing right here is that following encountering liquidity complications, Voyager claims to have sought the assist of Alameda Research and obtained a loan of up to $ 200 million in income / USDC from this investment fund, along with 15,000 Bitcoin. (BTC). – really worth $ 485 million at the time of the loan. In return, the investment fund will hold up to 22.six million Voyager shares, eleven.six% of the company’s shares. However, Alameda later on claimed to have returned four.five million shares.

Additionally, the bankruptcy filing also mentions that Voyager owes Alameda about $ 75 million unsecured, so this volume could be the volume the fund lent to the organization minus the volume owed by the fund organization.

Voyager Digital files for Chapter eleven tonight in New York. (h / t @Chapter 11 Cases)

The biggest unsecured creditor is SBF’s Alameda Research. The up coming 49 listed are all labeled “customer”. pic.twitter.com/DjcNHTYu8D

– Sujeet Indap (@sindap) July 6, 2022

Neither Alameda Research nor Voyager have launched an official statement on the figures published in the bankruptcy filing.

Synthetic currency 68

Maybe you are interested: