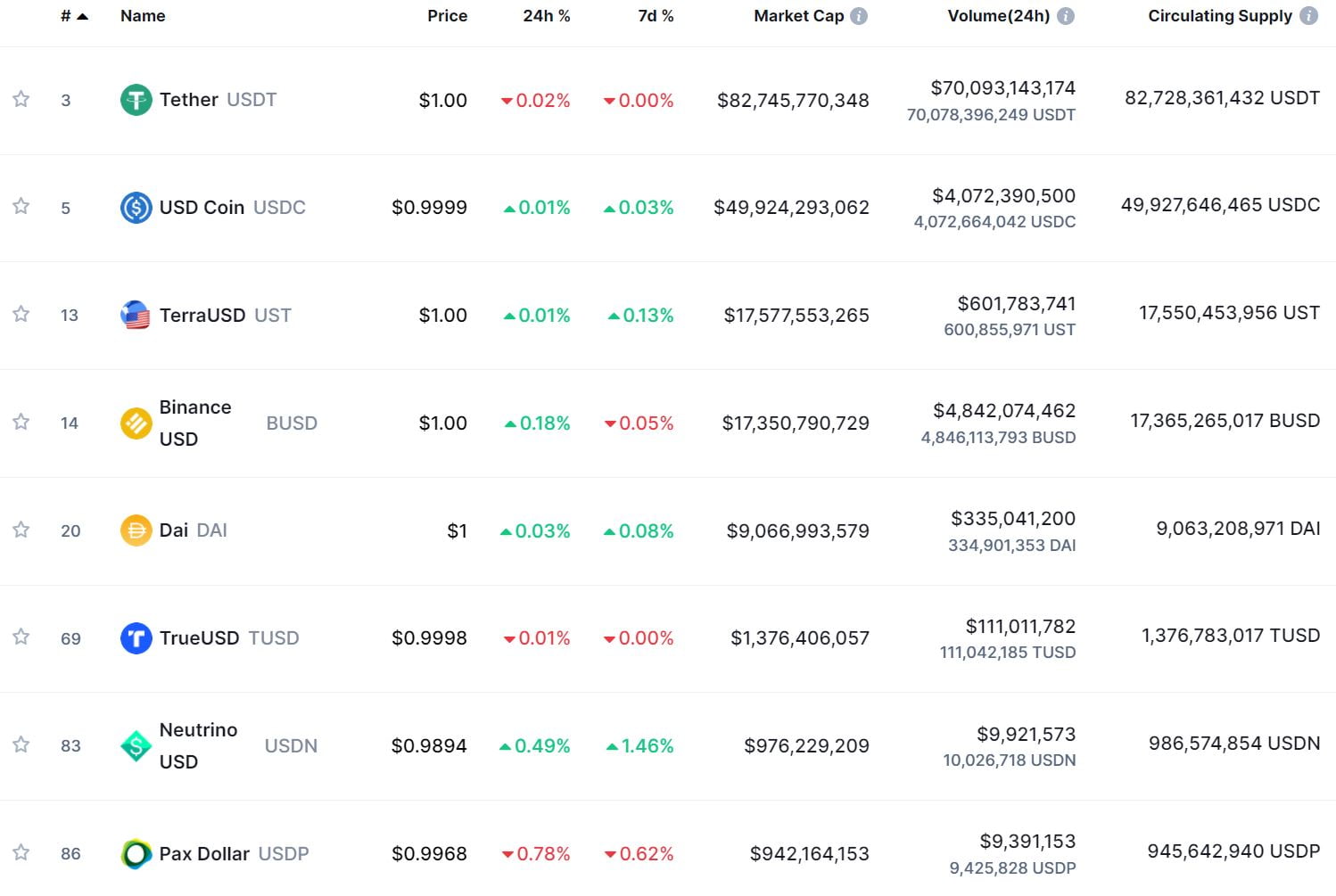

The market place cap of TerraUSD (UST) has surpassed BinanceUSD (BUSD) to come to be the third biggest stablecoin in the cryptocurrency market place.

On April 18, the market place worth of TerraUSD (UST), the stablecoin utilised in the Terra (LUNA) generation, reached $ 17.five billion. With this achievement, UST surpassed BinanceUSD’s $ 17.three billion market place cap (BUSD) to come to be the third biggest stablecoin in the cryptocurrency market place.

Currently, UST is just behind the two dominant stablecoins in the cryptocurrency marketplace, Tether (USDT) and USD Coin (USDC), with market place capitalizations of $ 82.seven billion and $ 49.9 billion, respectively.

As explained by Coinlive, TerraUSD is the stalecoin deemed “the lifeline” and 1 of the major development engines of the Earth ecosystem. In addition to the mint-burning mechanism concerning LUNA and UST to keep the cost of the two coins, UST can also be deposited on the Anchor Protocol with curiosity up to twenty% / 12 months.

Even so, this partnership has lengthy been criticized as an unsustainable “ponzi scheme”, as sooner or later on Terra will run out of cash to keep the twenty% curiosity price for Anchor, main to a slump in UST demand and dragging the cost. of stablecoins and LUNA in decline.

Therefore, the firm behind the Earth ecosystem, Terraform Labs, founded the Luna Foundation Guard (LFG) in February 2022, an organization whose mission is to create a cryptocurrency reserve fund to safe the worth of cryptocurrencies for UST. Terraform then repeatedly “donated” practically $ two billion in the type of LUNA tokens and held a $ one billion funding round for LFG, assisting it fulfill its ambition to make a UST ensure fund well worth $ three billion. bucks.

As of April 19, Luna Foundation Guard’s UST reserve holds $ two.four billion in cryptocurrencies, which includes BTC, LUNA, USDT and USDC, seven.three occasions significantly less than the company’s real capitalization.

The @LFG_org now cease the $ US peg with $ two,486,483,007 USD.

Broken down:

BTC 42.53K (one.74B USD)

MOON two.25M (201.18M USD)

USDC 398.66M (398.66M USD)

USDT 151.28M (USD 151.32M)– Reserve_LFG (@Reserva_LFG) April 19, 2022

LFG also participated in investments in the AVAX token of the Avalanche ecosystem in April, but this asset was not integrated in the UST reserve fund.

Synthetic currency 68

Maybe you are interested: