USDT stablecoin issuer Tether just announced business enterprise outcomes, which include net revenue of $700 million in Q4 2022.

On Feb. 9, Tether launched its hottest asset attestation report performed by auditing company BDO. This reviewer states:

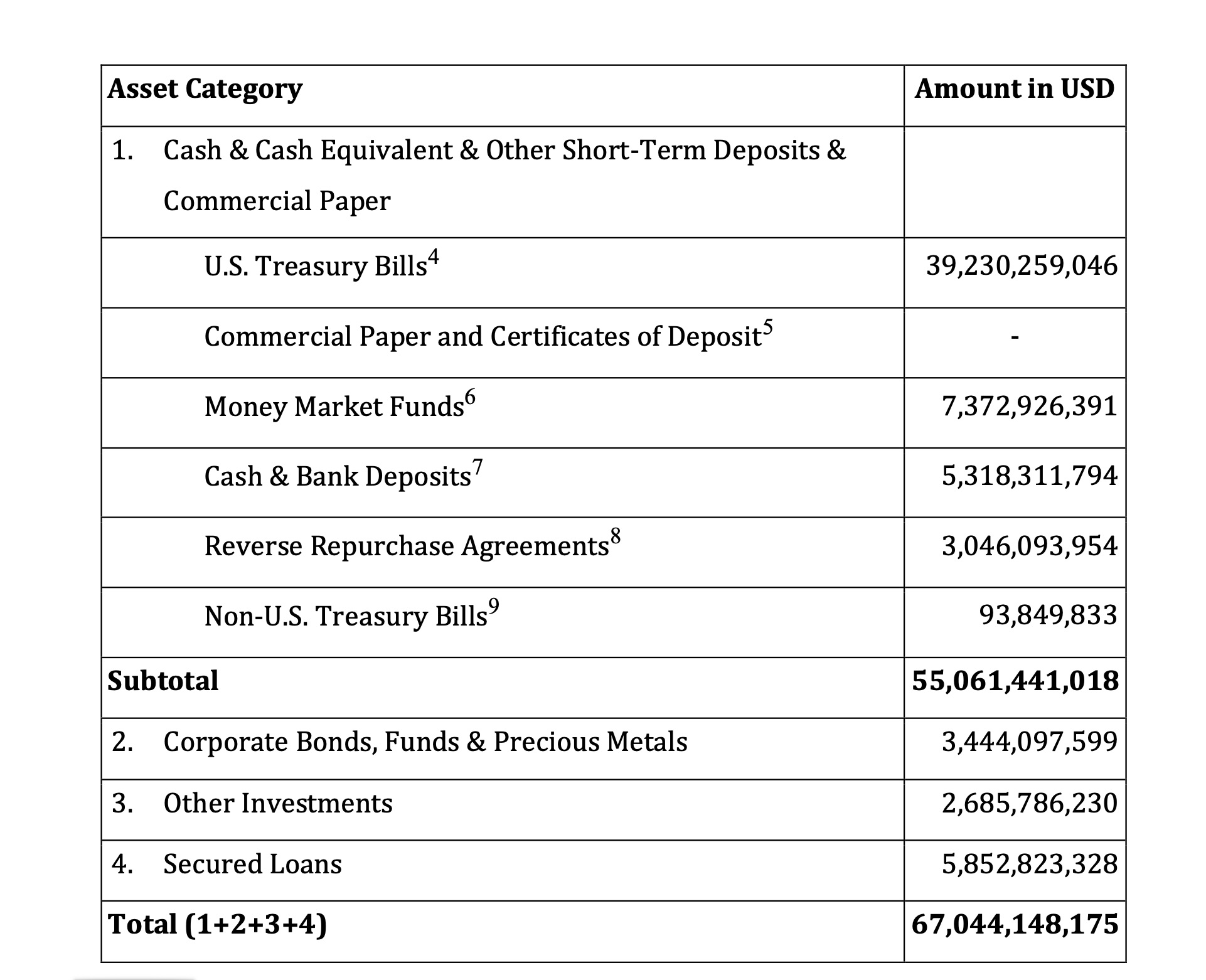

“Tether’s reserves remain highly liquid, with most investments held in cash, cash equivalents and other short-term deposits.”

#Bind Continues to show power of reserves, reveals revenue of $700 million for the fourth quarter of 2022 in the hottest attestation reporthttps://t.co/NlPLC3Qil9

—Tether (@Tether_to) February 9, 2023

After deducting expenditures, the company’s net revenue was $700 million, bringing Tether’s complete assets to at least $67.04 billion by the reporting date is December 31, 2022. Meanwhile, the company’s complete liabilities column is $66.08 billion, displaying that the assured reserve is even now around $960 million.

This is also the 1st time Tether has announced firm revenue in its 9-yr background.

Tether Chief Technology Officer, Paolo Ardoino, proudly shared:

“Once again Tether proves its stability. In the midst of the chaos of 2022, we not only successfully repurchased 21 billion USDT, but also issued over 10 billion USDT, demonstrating the continued growth of Tether.”

Responding to the supply of this $700 million revenue, a Tether rep stated it was basically “part of equity.” And it is only funds in the kind of “additional capital” injected to bolster the buffer for the platform.

In December of final yr, Tether announced it would “settlement” of mortgage loan loans in 2023, following seeing loans swell and possibility default in the occasion of a crisis. However, in accordance to a report launched nowadays, the firm decreased the loan volume to $300 million.

In early October, the stablecoin issuer manufactured its determination absolutely take out business paper as collateral for USDT AND improve in direct publicity to US Treasury expenses. Other corporate assets contain corporate bonds, market place money and treasured metals.

Synthetic currency68

Maybe you are interested: