Tether just transferred 7,629 BTC, worth approximately $700 million, to its Bitcoin reserve address. This transaction originated from Bitfinex’s hot wallet on the morning of December 30.

This is the largest addition to Tether’s strategic Bitcoin reserve since March 2024, when 8,888.88 BTC were transferred.

Tether’s Bitcoin Reserves Continue to Grow

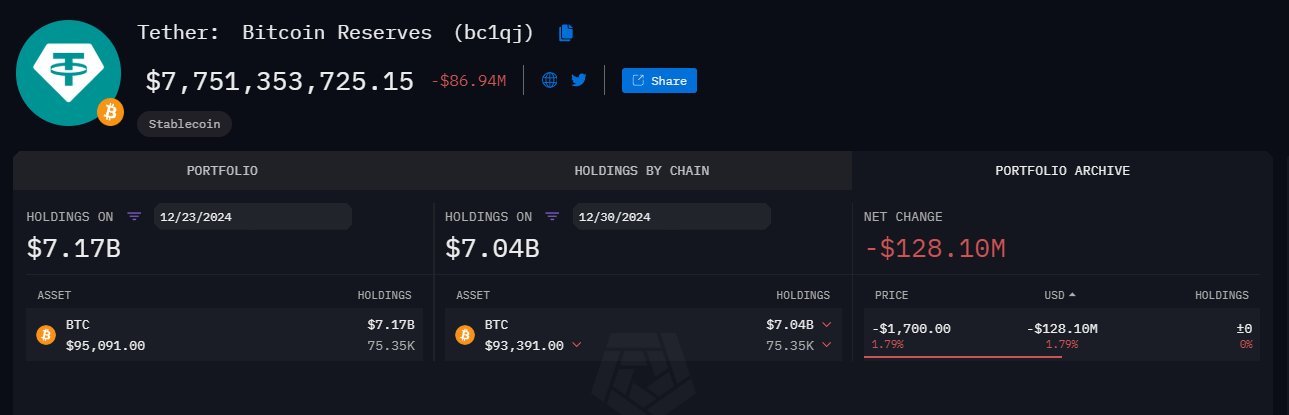

A similar conversion occurred on December 31, 2023, according to data on-chain. According to data from Arkham provideTether’s reserves currently hold 82,983 BTC, purchased for $2.99 billion at an average cost of about $36,125 per coin.

The move is in line with Tether’s decision in 2023 to allocate up to 15% of profits to buying Bitcoin. The company currently holds over $7.6 billion in BTC, and these Bitcoin purchases serve as part of a diversification strategy amid increased USDT issuance.

Tether’s signature stablecoin, USDT, is primarily backed by US government bonds and cash equivalents. The returns generated from these have increased investments in emerging fields such as artificial intelligence, Bitcoin mining and decentralized communications.

In 2024, the company also expanded into renewable energy and telecommunications, demonstrating a broad focus on its investments.

A Strong Financial Year Despite Overcoming Regulatory Barriers

Tether experienced a year of significant financial success in 2024, supported by a strong cryptocurrency market. The company’s total assets reached $134.4 billion in the third quarter, with $120 billion in circulation in USDT.

Furthermore, on December 6, Tether issued an additional 2 billion USDT, bringing the total issued to 19 billion since November. This reflects the increase in USDT demand throughout the bull market.

However, Tether is facing challenges in the European Union as MiCA regulations come into effect. EU exchanges have delisted USDT in recent weeks in preparation for this regulation.

“Remember, Tether holds $102 billion in US government bonds – by not recognizing this asset, the EU has sent a strong signal of its lack of trust in US public debt. The EU has explicitly required stablecoin issuers to guarantee a 60% fiat ratio in EU banks to regulated stablecoins. In my opinion, there are political motives behind this farce. Not a good ending for the EU,” said influencer Martin Folb write on X (formerly Twitter).

Additionally, the company also stopped issuing the euro-backed stablecoin EURT, giving Holder a year to redeem the asset. Increased competition further tests Tether’s dominance.

Most recently, Ripple launched stablecoin RLUSD on the global market, while Circle – the issuer of USDC – announced a number of partners to take advantage of the regulatory difficulties facing Tether.

Despite facing many challenges, Tether remains focused on consolidating its reserves and exploring new areas, maintaining its position as a key player in the stablecoin market.