Tether intends to take out all secured loans from the company’s backing by 2023.

In a Dec. 13 interview, Tether unveiled to The Wall Street Journal that their loans totaled $six.one billion, or 9% of the company’s complete assets as of Sept. thirty. Meanwhile, Tether’s complete consolidated assets exceed $68 billion.

In response to the most latest assault on the enterprise, Tether reiterated that the loans held in the company’s reserves are more than-collateralized and backed by hugely liquid assets.

However, right after the series of bankruptcy occasions in 2022, to deal with the threat Tether will strategy to zero loans by 2023. Because in truth the record of loans is increasing and Tether’s enhance could make it unattainable to shell out them for the repurchase of USDT in the occasion of a crisis.

The speedy development of Tether’s lending system raises worries about its capability to meet redemptions in a crisis https://t.co/PlNbLm8CiN

— WSJ Markets (@WSJmarkets) December 13, 2022

The enterprise mentioned in a statement:

“Tether is managed professionally and prudently. This will be demonstrated yet again by efficiently closing the lending small business with no losses, as all loans are more than-collateralised with liquid and hugely liquid assets.”

This choice is driven by Tether’s unwavering dedication to serving international crypto consumers, which has continued to assistance the enterprise by way of every single stage of the industry’s development in spite of dealing with lots of issues.

Furthermore, this is also witnessed as a alternative to enhance investor self-assurance right after the collapse of FTX and in the context of other exchanges and crypto corporations looking for to reassure their creditworthiness.

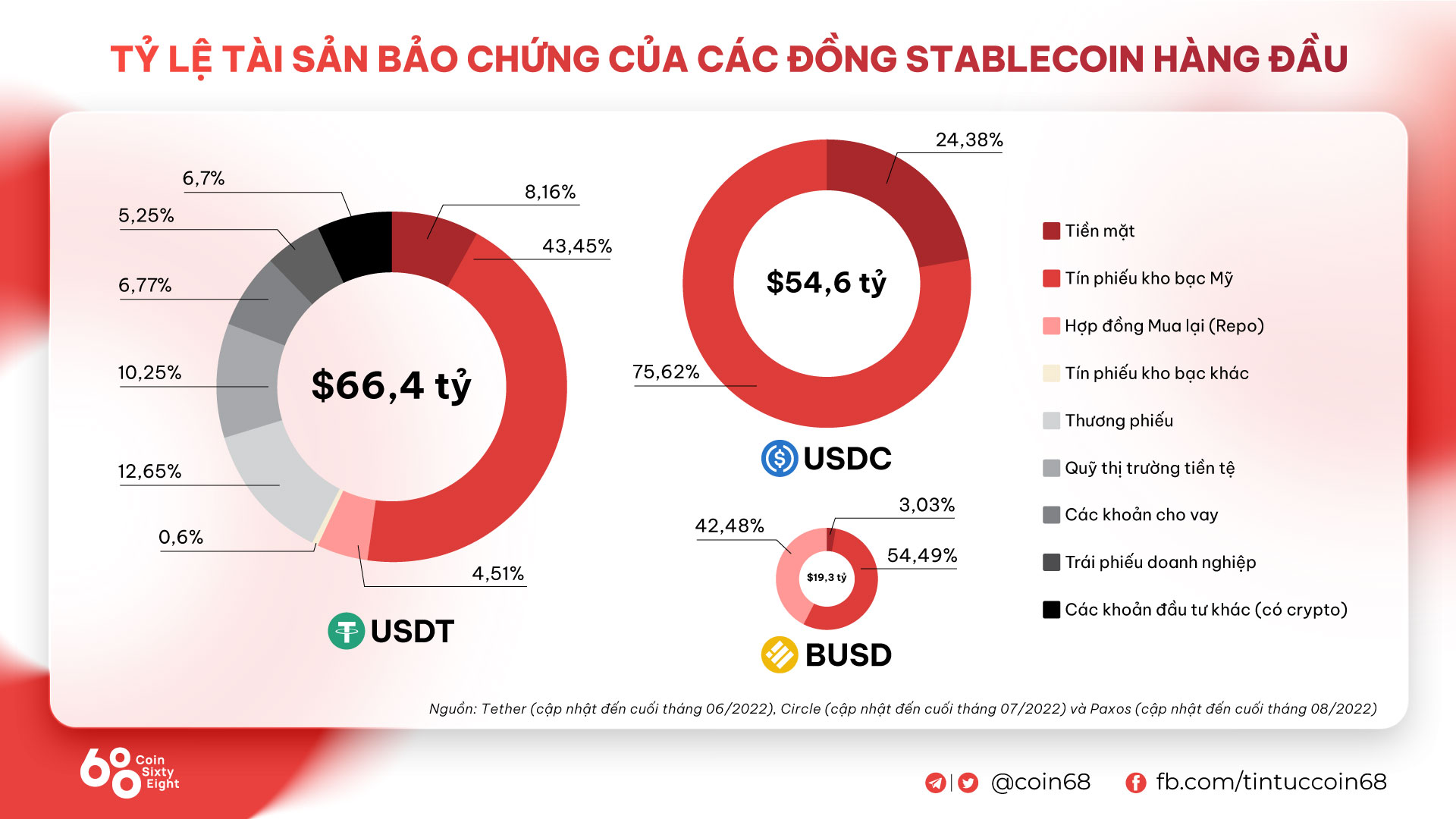

According to Tether’s most up-to-date report on Nov. ten, the company’s reserves are in an incredibly liquid state with extra than half of Tether’s collateral assets created up of U.S. treasuries and the bulk held in funds.

In addition, Tether finished its aim of totally getting rid of industrial paper as collateral for USDT on Oct. 14, even more demonstrating the company’s dedication to backing USDT with the safest liquidity reserves in the industry.

Synthetic currency68

Maybe you are interested: